- River1 Morning Note

- Posts

- Market Shapshot

Market Shapshot

Aug - 23

Torrent Trading Observations

BOJ benign - vowed to continue normalizing policy, but only if justified by the data, suggesting any further tightening measures would be done in such a way to avoid the type of disruption witnessed earlier in the month

Japan’s CPI dropped below 2% taking pressure off to raise

Powell is on deck. People will parse, but minutes show some ready to go in July

Question will be 25 or 50 in Sept and sure he will say data-dependent, so likely a nothing burger, but we will see

Still need to work off the overbought and some more consolidation would be constructive

NAAIM up to 74% from 56% - decent jump but still plenty of room to rise before a headwind naaim.org [naaim.org]

Closed below 5585 so quick reclaim needs to hold or 5490-5500 (more significant support) comes into play. 5670 resistance

Notable - Mag 7 is on track for first quarterly underperformance in almost two years - broadening is finally happening....

Upgrades – BILI, BJ, CHWY, GLPI, ROKU, SNOW, WRBY, WLK

Downgrades – BILL, CYTH, EQT, LVS, PTON, MODG

What to watch during the week of Mon 8/26 – there’s a lot of economic data on this week’s calendar, but the main number will be the US PCE for Jul on Friday. For earnings, the main reports include: Tues night (JWN, PVH); Wed morning (ANF, BBWI, CHWY, KSS, SJM); Wed night (CRM, CRWD, FIVE, HPQ, NTAP, NVDA); Thurs morning (AEO, BBY, BURL, CPB, DG); and Thurs night (ADSK, DELL, GPS, LULU, MRVL, ULTA).

Wave Watch

Futures

DOW +177

S&P +32

Nasdaq +168

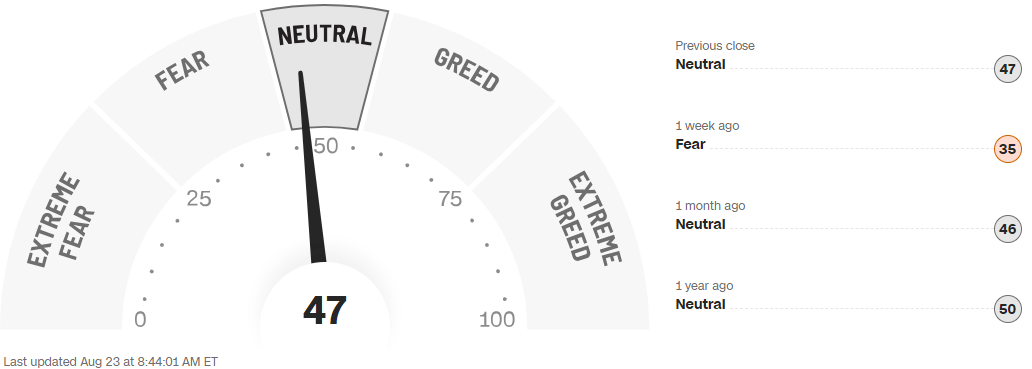

CNN Fear/Greed Index

Mainstream Metrics

10-Year Yield

GOLD - Bar of Bullion Top $1 Million

BITCOIN

Streaming Sectors

Consumer/Financial Healthcare

Retailers Winning – ROST +6% and CAVA +7%. CAVA is probably not the new Chipotle, but it is a restaurant concept rolling down hill very quickly with a massive +14% comp. ROST comps beat by 1% as lower end consumers trade down.

ULTA – Baird earnings preview sees results near expectations. They are reducing 2H estimates on promotions but like the name at 14x P/E vs 18x average and 21x S&P. Citi opened a negative catalyst watch as well.

LVS – Downgraded at UBS on slow Macau recovery.

SOFI – VP Keough sold 25k shares. Stock still higher today with beta financials.

SCHW falls 4% after Toronto-Dominion Bank has raised $2.5 billion in pricing the sale of Schwab shares at $61.65 each, according to a term sheet seen by Bloomberg News

LVS shares fall 2.0% after UBS cut the recommendation on the casino operator to neutral from buy, noting that the recovery in the company’s Macau business is getting more protracted.

Technology

WDAY – PT $285 from $265 at Baird. up big with lowered FY27 revenue growth target more than offset by increased operating margin guidance. Macro consistent with last qtr (continued deal scrutiny and moderating headcount growth). Good momentum in healthcare, higher education, and state and local gov’t. Federal perking up. Financial salesforce showing better productivity ..Board has authorized a new $1B share repurchase program

LYFT – Upgraded to Neutral at Nomura PT $13

AMZN is the subject of a somewhat critical Reuters article detailing how Chinese entities are accessing restricted AI chips/capabilities by renting them from AWS (this is not a violation of US law technically, but it could become so as a result of this media attention)

UBER and GM announced a multiyear strategic partnership to bring Cruise autonomous vehicles to the Uber platform

INTU fiscal Q4 ahead though company lowered LT Consumer and Credit Karma growth guidance.

QCOM to buy Sequans 4G IoT tech (French company)

NVDA - Nvidia CEO Jensen Huang has sold roughly $580 million NVDA shares over the last 2 months. I mean can you blame him?!

ROKU shares rise 4.1% after the stock was raised to buy from neutral at Guggenheim Securities.

Industrials

Canada’s gov’t intervened and ended the country’s rail strike, ordering employees back to work and mandating arbitration to settle the dispute - NYT

HAL - Halliburton says it took some systems offline and notified law enforcement after becoming aware on Aug. 21 that an unauthorized third party gained access to certain of its systems.

Tidal Tweets

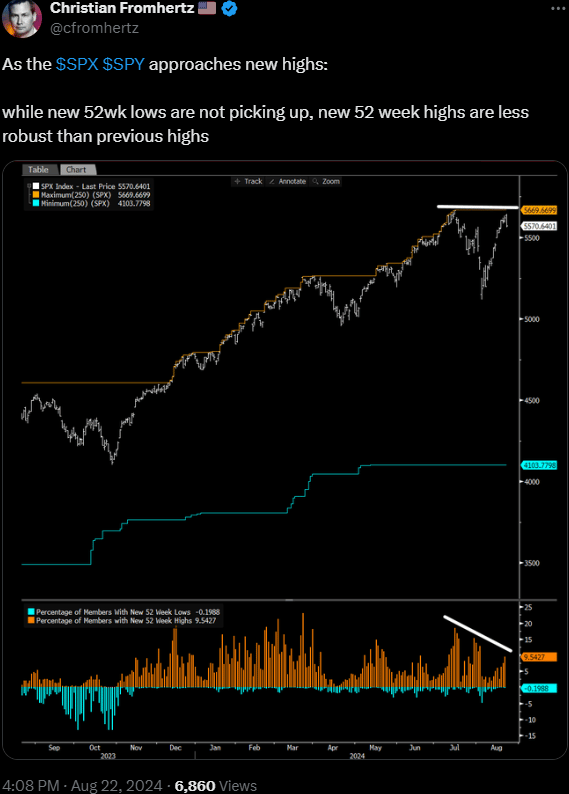

S&P reversed at long trendline

And new highs not expanding and Sept on the horizon

Rapid Review

Openwater Opinion