- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Morning Note

presented by - |  |

Invest with us here: https://www.river1.us/invest.php

Calendar

This Week – Retail earnings to start, with all eyes on Powell to finish the week.

Wednesday – FOMC Minutes, TGT, LOW, TJX earnings

Thursday – Jobless Claims, WMT, ROST, WDAY earnings

Friday – Powell speaks at 10am Est.

Trading Observations

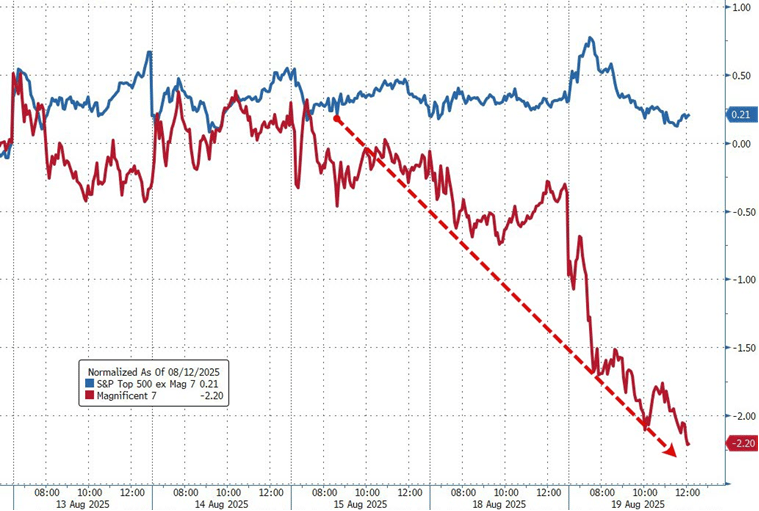

Rotation day yesterday out of high beta tech. Whether this rotation trade continues for more than a few sessions will come down to Powell and Nvidia.

The reaction in HD shares stands in sharp contrast to CRWV, underscoring how positioning in certain parts of the market had become quite stretched – HD missed on EPS/comps and left guidance unchanged and yet the stock rallied (while CRWV beat and raised guidance, only to plunge).

NVDA earnings report is just around the corner (on 8/27) and while results/guidance are likely to be strong on an absolute basis, there’s growing concern about whether the bar is impossibly high.

PLTR - Shares slip 2.8% in premarket trading Wednesday, on track for its sixth consecutive day of declines, as Citron Research says the stock is worth $40

Broadly still 6500 resistance vs. 6400 support

A sizeable rotation trade occurred Tues, with a fairly aggressive shift out of momentum/growth (i.e. tech) and into value/cyclical sectors (housing, staples, utilities, materials, real estate, healthcare, etc.). Rather than a single catalyst, an accumulation of factors, including fundamental news, macro developments, catalyst anticipation, technical trends, & AI bubble talk are spurring the shift.

Futures

DOW -1

S&P -9

Nasdaq -59

Charts/Sentiment

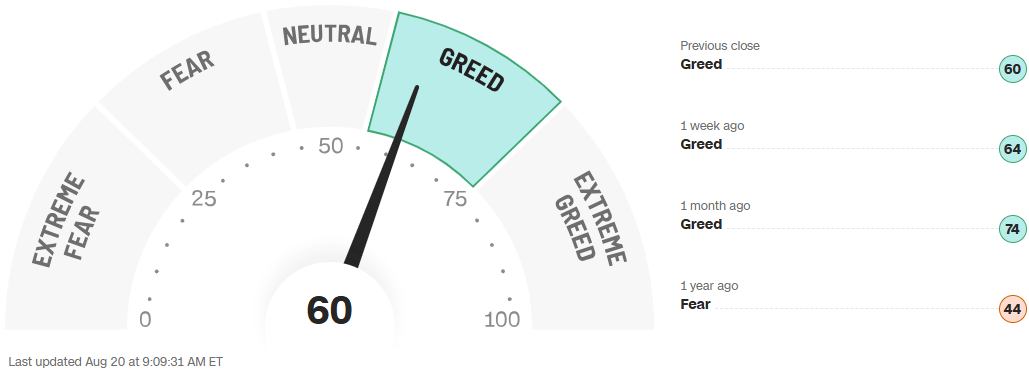

CNN Fear/Greed Index | U.S. 10 Year Treasury |

VIX | Bitcoin |

Financials / Consumer / Healthcare

SOFI – (Yesterday) SoFi to add a blockchain-powered international money transfer service to its app.

TGT – Down 11% - Our video earnings preview from this week said, “not cheap enough”. Comp sales negative, down 2% (was expected). We thought that was a low enough bar. The bar we wanted to be lower was margins, which missed slightly as gross margins of 29% vs 30% expected was the disappointment. New CEO might help, but the stock isn’t cheap until near $80.

Shares of Abercrombie & Fitch Co. (ANF -2.1%), Gap Inc. (GAP -2.3%) and Urban Outfitters Inc. (URBN -1.5%) are trading lower on Wednesday after Citi analyst Paul Lejuez cut his recommendation on the specialty retailers to neutral from buy.

HTZ – Up 10% on a pact with AMZN to sell their used vehicles. Probably a short-lived short cover. CVNA down 4%, KMX 2%.

CAR – Avis down 5% on a downgrade to underperform at BAC.

GES – Guess Brands up 25% on take private offer at $16.75 per share. Looks about 13x EBITDA to us and it was already leveraged.

JHX – James Hardie, as in Hardie Plank for your house, down 29% on a dramatic miss in sales.

EL – Down 6% on rough guidance.

TJX – Up 4% on solid numbers. Bargain hunters still shopping.

LZB – Lazy-Boy down 21% as expenses weigh on profits (tariffs).

UPST – Up 3% on a JPM upgrade.

McDonald's to reduce prices for eight combo meals by 15% - Reuters

EL falls 13% to $78 after FY26 profit outlook misses estimates

LOW in line 2Q results - updated FY25 outlook to include ADG (core guide unchanged) - announced acquisition of FBM for $8.8B (13.4x EBITDA)

TOL beat on key metrics such as closings and homebuilding GM, though ASP light and FY volume guidance at lower end of prior range.

Technology

Magnificent Seven stocks: Microsoft (MSFT) +0.1%, Nvidia (NVDA) 0%, Tesla (TSLA) -0.4%, Amazon (AMZN) -0.5%, Apple (AAPL) -0.6%, Alphabet (GOOGL) -0.7%, Meta Platforms (META) -0.7%

Reuters reported Commerce Secretary Lutnick wants US to take stakes in all companies that received CHIPS Act funding, including MU [streetaccount.com], TSM [streetaccount.com] and Samsung. https://www.reuters.com/business/media-telecom/us-examines-equity-stake-chip-makers-chips-act-cash-grants-sources-say-2025-08-20/ [reuters.com]

ADI - Analog Devices shares are up 3.3% in premarket trading after the analog chipmaker reported third-quarter results that beat expectations and gave an outlook that is seen as strong.

ADBE - Adobe announced the introduction of Acrobat Studio. This offering brings together Acrobat, Express, and AI agents to help improve work collaboration. It also includes PDF Spaces, turning static PDFs into a dynamic work environment. Now available globally with early access pricing starting at $24.99/month for individuals and $29.99/month for teams.

Made by Google Event is today https://www.techradar.com/news/live/google-pixel-10-launch-made-by-google-event [techradar.com]

PLTR - Shares slip 2.8% in premarket trading Wednesday, on track for its sixth consecutive day of declines, as Citron Research says the stock is worth $40 in a post on X.

Industrials

Alaska Airlines launches $395 credit card in premium travel race, combines loyalty program with Hawaiian – CNBC

Also, ALK to offer Starlink Wi-Fi starting in 2026

Atmus Filtration Technologies (ATMU) downgraded to neutral from overweight at JPMorgan; $46 P

Custom Truck One Source (CTOS) downgraded to underweight from neutral at JPMorgan; $5.50 PT

Eaton Corp. (ETN) initiated neutral at Rothschild & Co Redburn; $336 PT

Goodyear Tire & Rubber (GT) downgraded to hold from buy at HSBC; $9.50 PT

Oklo, Inc. (OKLO) initiated neutral at UBS; $65 PT

USA Rare Earth (USAR) - Rare Earths Webcast w CEO hosted by Ben Kallo – 11:00 ET- Here to Register [goto.webcasts.com].

Vertiv Holdings (VRT) initiated neutral at Rothschild & Co Redburn; $135 PT