- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Morning Note

presented by - |  |

Invest with us here: https://www.river1.us/invest.php

Trading Observations

Lot of talk of three black crows (down days) signaling a change in short-term trend

And while certainly possible, how comfortable are you really if a bear? After the run we've had, only 1.5% off the highs, have more tariff announcements after the close and futures flat, and weight of rebalance into quarter end

Could have (should have?) been more carnage and dips got bought yday

Notable QQQ highest volume since mid-August, so the bull/bear battle seems to be at these levels

I do think given the short-term headwinds a test of 6475-6500 support zone more likely than not, but we see

PCE was inline

6650 first resistance if they try and run them

More equity demand than supply (need A LOT of IPOs) https://tinyurl.com/yc52mskh [tinyurl.com]

Tech bond issuance up massively over last few years https://tinyurl.com/kh8z8fpb [tinyurl.com]

Get back in the Office (please?) https://tinyurl.com/4a4tpmtw [tinyurl.com]

Futures

DOW +206

S&P +23

Nasdaq +81

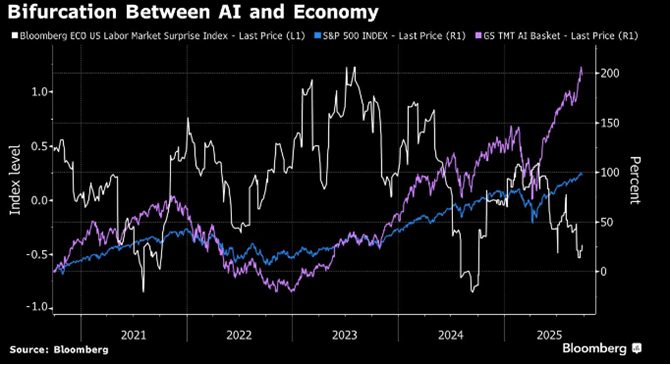

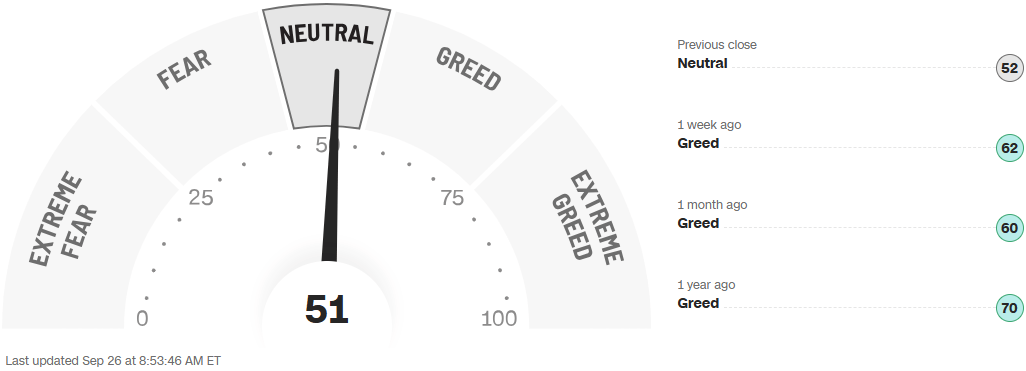

Charts/Sentiment

CNN Fear/Greed Index | U.S. 10 Year Treasury |

Gold | Bitcoin |

Financials / Consumer / Healthcare

COST – Down 1% on same store sales +5.7% vs 5.9% expected. The stock also carries a 47x P/E, which is most of the problem in our opinion. COST up just 2% this year, underperforming the SPX.

JPM on retail – They scraped beautiful bill for winners and losers and came up with top picks BBY, HD and W with a second tier of AZO, ULTA and WMT.

Baird Marine Checks – Retail down 9% y/y in Powerboat segment. Expectations for softness continue.

LLY – Rated new buy at NYKREDIT (not sure what that is).

Shares of US drugmakers (LLY +1.3%, ABBV +1.1%, MRK +1.2%, PFE +1.1%) are inching higher in premarket trading Friday after President Donald Trump announced a plan to impose a 100% tariff on branded and patented drug imports and included exemptions for companies with US manufacturing.

TARIFF ROULLETE – W/Wayfair (-3.5%), RH (-4%), WSM (-2.5%) furniture tariffs

CART – MSci saying GTV tracking below street by weaker orders and share losses

Technology

INTC – +4% and GlobalFoundries (GFS +7.2%) rally in premarket trading after the Wall Street Journal reported that the Trump administration is weighing a new plan to reduce US reliance on chips made overseas

AAPL – Evercore bullish - "annual survey of nearly 4,000 U.S. consumers around iPhone purchase intentions points to the start of a better-than-expected iPhone refresh cycle, led by a strong lineup of products; thinks Apple's core strength remains concentrated in the Pro tiers, but adds that the iPhone 17 appears to have exceeded initial expectations, noting reports of strong first week sales"

AMZN – some ?s on weakness Thurs; data remains mixed / many want stronger evidence for AWS accel

APP – Piper PT hike to $740 ... excited about the Axon Ads Manager soft launch on October 1st. UBS sees bull case raised to $1,000

CIEN – +1.7% upgraded @ Rosenblatt - "Co has an oppty to network multiple AI data centers into clusters. Ciena has won one such deal with a hyperscaler thus far, an est $200M rev opportunity; also a "call option" on Ciena's move inside the Data Center and into components"

INTC – +3% extending gains .... Lip taking advantage of US stake; will cont to shake cup to get investors. for the WH, domestic chip manufacturing #1 priority, and they wont leave it just to TSMC / dont UNDERESTIMATE sovereign support ... TXN +1% decent US footprint

MSFT – MS elevates to top pick in software - " understands the concerns around Microsoft from OpenAI's contract with Oracle, but says the deal contract likely points to Microsoft's capacity constraints and its preference to serve a higher margin enterprise customer. Azure's growth acceleration is not only driven by OpenAI, as its AI strength is backed by broader products and customers"

TIKTOK – US ops are valued at ~$14B, JD Vance said, as Trump signed an exec order bringing American investors closer to control of the app. The low-ball price tag stunned investors after previous projections that scaled closer to $40B

Industrials

KTOS - Baird - The Wins Keep Coming Domestic and Abroad, Raising PT to $87

• We are raising our price target to $87 on higher growth assumptions for the Unmanned segment, which now reflects new developments with the Mighty Hornet drone for Taiwan.

• We reiterate our bullish stance on KTOS, with franchise program wins stacking up, coupled with 3-4 growth drivers set to emerge in 2026+, with the current Administration focused on highly capable, low-cost weapon platforms.

BA ticking up 1% after Turkish Airlines announced orders of up to 75 787 Dreamliners and intentions to purchase up to 150 more 737 MAX airplanes

Building Products - MBC/AMWD both trading up 6% after the Trump administration announced a 50% levy on kitchen cabinets, bathroom vanities and associated products

Commercial Vehicles – PACCAR (PCAR) trading up 6% after the Trump administration announced a 25% tariff on heavy truck imports

FUL – upgraded to buy from neutral at Seaport Research Partners; $80 PT

MTRN – initiated buy at Freedom Capital; $136 PT

MIR – initiated overweight at JPMorgan; $28 PT

ROL – initiated overweight at JPMorgan; $70 PT

VMI – initiated overweight at JPMorgan; $480 PT

Latest Media

$SNAP - We think there could be value!

P/S: 30x to 3x, why?

Stock based comp = 27% of rev since IPO!