- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Morning Note

presented by - |  |

Invest with us here: https://www.river1.us/invest.php

Trading Observations

Market starting in sell the news mode as the government shutdown is over.

Trump administration trying to rectify the problem of why they lost NYC with “transferable mortgages”. The bigger issue here is -

Transferable mortgages just push duration out from current 10 years (because people move) to the full 30.

Nobody wants to buy paper for 30 years that yields 4% because why?

Because that yield stinks, and because we print money at a clip that creates inflation, which is why that yield stinks.

If this is going to work, you need a forced buyer of this paper, like the Fed or banks. Investors will want at least 6%.

Also balancing the budget for the next 30 years would work, but that’s a lot harder.

Current Market Opinion– Risk in the buy at any price AI names remains very high in our opinion. Be careful what you own.

Futures

DOW -105

S&P -20

Nasdaq -105

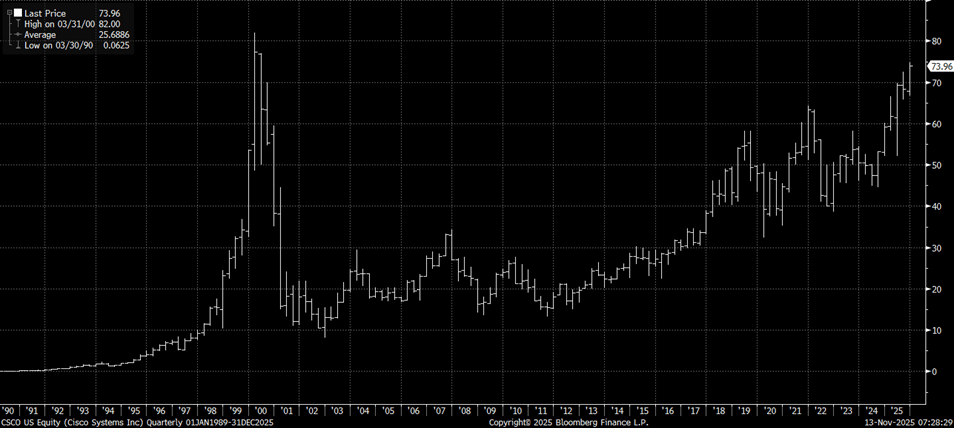

CSCO – Remember when you paid 40x revenue for CSCO in 2000? Well, you’re about to get to break even finally (PLTR is currently 100x).

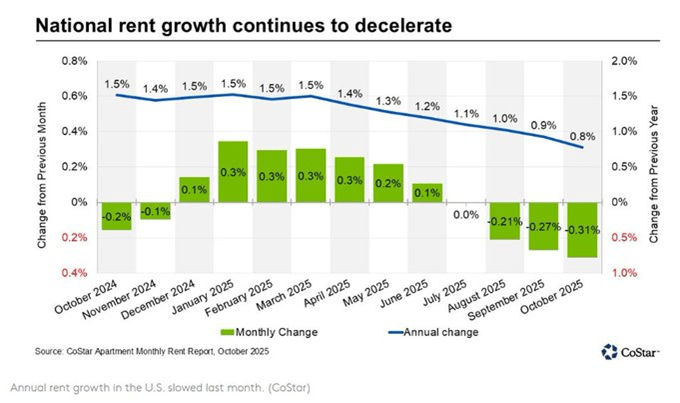

You want 2% inflation and lower rates? I give you apartment rent deceleration helping your cause.

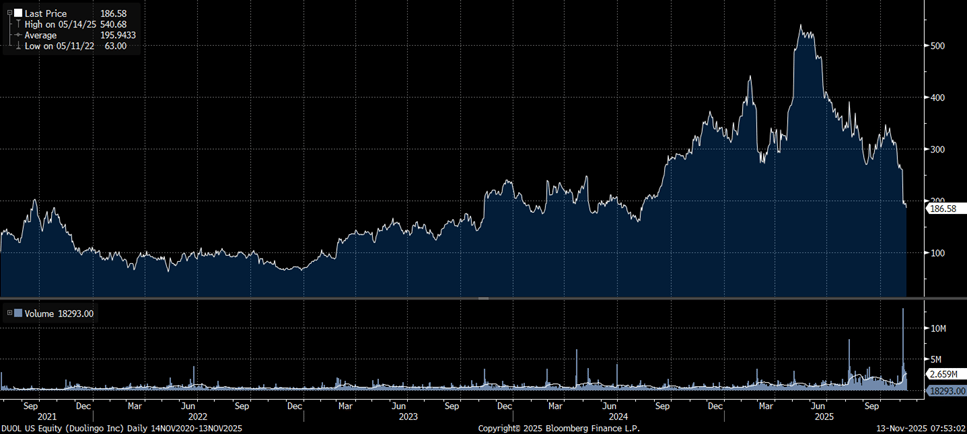

Today’s “What were you thinking?” Chart – Language Training Software DUOL/Duolingo

Financials / Consumer / Healthcare

CRCL – JPM Upgrading to overweight from underweight on better fundamentals. They think USDC stablecoins continue to enter the economic landscape at a pace that warrants CRCL ownership.

DIS – Down 5% - Direct to Consumer spending remains high, and Parks demand remains meh. Attendance expected to be 4% lower y/y in Q4, down 1% FY.

HD, LOW – Baird preview calls the quarters likely “lackluster”.

NKE – Up 3% on a WFC upgrade on “better visibility”.

SG – Up 5% on upside from government shutdown end.

SBUX – Workers in 40 cities out on strike. It really is the hardest job in food service.

DDS – Dillard’s up 8% on solid earnings. Bad industry, but very well-run company. Warren Buffet would tell you the industry eventually wins that battle.

Technology

CART, ABNB – Piloting a JV where you show up to your AirBNB with a “stocked kitchen”. Love it.

CSCO – Up 6% - They successfully attached themselves to AI for the first time. IBM has had a good run after it did the same.

Baird lowering PTs in DUOL, DV, MTCH and OMDA in Internet.

SNAP – Down 1% on an $8MM insider sale.

FLUT – FanDuel owner down 4% on earnings. This gambling/prediction market has officially become overly competitive.

AAPL, Tencent – Agree to a 15% cut of all in app purchases in WeChat.

META (RVER Holding) – Named to Best Ideas List at Wedbush. We obviously agree as it’s the cheapest Mag7.

Industrials

ONDS – Up 16% on solid numbers from this defense contractor. Think Walkie Talkies.

FLY – Fly Aerospace up 22% on rocket launch resumption.

Latest Media

Rob Haugen, CIO at River1 Asset Management, joins Schwab Network to discuss where the market is headed next