- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Morning Note

presented by - |  |

Invest with us here: https://www.river1.us/invest.php

Trading Observations

Jobs.... numbers were light, unemployment highest since 2021. 10 year 4.06%

Does this open the door for a 50bp cut? Doesn't feel like that priced in yet)

Jobs cuts rising though not yet concerning https://tinyurl.com/bdcne445 [tinyurl.com]

AVGO higher on AI chip customer (believed to be OpenAI), watch NVDA / AMD as companies want less reliance on NVDA

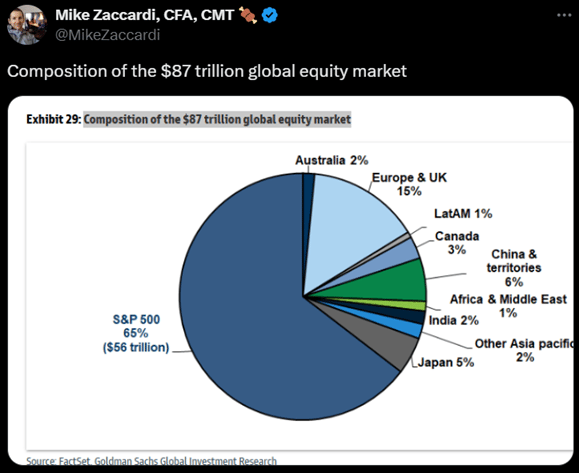

For now, path of least resistance clearly higher with 6550 in sight

Despite the mess that is LULU, discretionary winning https://tinyurl.com/3wyj5j7h [tinyurl.com]

Breadth strong yday at 3/1 positive though oddly Nasdaq saw most new lows since late July

AI adoption, for perspective https://tinyurl.com/5n7xzd2n [tinyurl.com]

Construction spending falling, something to monitor https://tinyurl.com/nhnaym9d [tinyurl.com]

Treasury buybacks rising https://tinyurl.com/mrykwr7p [tinyurl.com]

Futures

DOW +32

S&P +27

Nasdaq +221

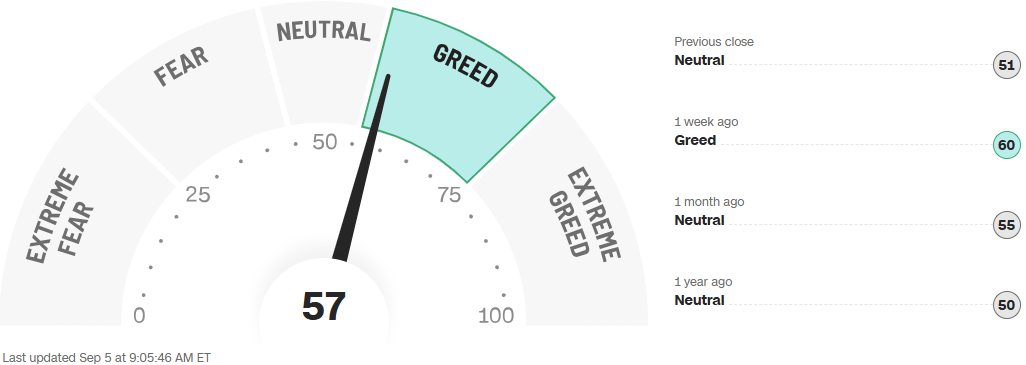

Charts/Sentiment

CNN Fear/Greed Index | U.S. 10 Year Treasury |

VIX | Bitcoin |

Financials / Consumer / Healthcare

Crypto-linked stocks (MSTR +2.6%, COIN +1.4%, RIOT +1.8%) rose with Bitcoin and Ether prices in premarket trading Friday as broader markets gain on hopes that US jobs data on Friday will increase the chances of a Federal Reserve interest rate cut later this month.

LULU – Down 20% - P/E was cheap because E was wrong. Competition and tariffs. Deminimus rule killed them. The stock looks like it will open around 12-13x the new number, which is astonishing for something still growing internationally. That said the 0% US comp gives power to the bears. Look for new management or a big Sydney Sweeny like deal from here to re-energize.

DLTH – +8% - Upgraded to outperform at Baird on encouraging profit improvement.

Baird’s top picks in payment stocks – CNX, CPAY, GPN, VRRM, WEX. Zero are household names.

COST – Core comps +6.9% in August vs +7% July. Net sales up 8%. Zero fear of a slowdown here.

OPEN – Up 7% - Feels like the next GameStop.

RKT – Up 5% on lower rates, also a socials darling.

Technology

AAPL: annual sales in India hit a record of nearly $9bn in the last fiscal year, signalling growing consumer demand for its flagship devices

ALAB: +6% any Shorts getting squeezed ... sounded good @ Citi - broadening from PCIe retimers into Ethernet and rack level systems to become a connectivity platform for AI datacenters

AMZN: biggest move Thursday since May post bullish SemiAnalysis article - saying ‘25 exit growth rate could be 20%+ vs street at mid 18s driven by Anthropic multi GW campuses. Got a lot of attention early

AVGO BULLISH CALL: said that FY2026 AI-rev outlook will improve significantly as a result of one of its engagements beyond the major tech companies. Co has secured >$10B of AI-related orders from one of those customers ... BACKLOG hit a record of over $110B ... importantly visibilty on CEO tenure thru 'at least 2030' .... AI sales acceleration in FY26 to be 'fairly material') ... Next Catalyst: speaking at Goldman next week (so he may be saving some fireworks)

AVGO (Hock + Altman): OpenAI set to start mass production of its own AI chips with Broadcom .... ChatGPT maker attempts to address insatiable demand for computing power and reduce its reliance on chip giant Nvidia … clear positive for Broadcom, which is already set to benefit into 2026 from Google's continued success with TPUs, Meta's ramp of its new custom ASICs, and the increase in networking requirements necessary to support AI efforts (with custom ASICs more likely to tie to standard Ethernet deployments, a result that also benefits AVGO

DOCU: +7.5% solid upside on EPS w/the beat driven by higher sales / billings (+13% to $818M vs St $764M) and better margins (200bps above). FY26 guidance was raised across the board, with all metrics coming in above consensus at the midpoint. Co saw strong performance across the eSignature, CLM, and IAM businesses”

GWRE: +15% blowout upside in FQ4 on EPS, w/the beat driven by a combination of higher sales and better op. margins, and the F26 guide is decent ... “We were thrilled to close the year with an outstanding fourth quarter executing 19 cloud deals and surpassing $1 billion in ARR. The fourth quarter was highlighted by a significant 10-year agreement with a major Tier-1 insurer that exemplifies the platform maturity and referenceability driving increased deal sizes and deeper customer commitments”.

MSTR: Strategy Inc. has surfaced as a potential S&P 500 entrant after delivering a $14 billion unrealized gain last quarter, meeting the profitability required for index eligibility ... If admitted to the S&P 500, passive funds tracking the index would be forced to buy nearly 50 million shares, worth around $16 billion at current prices, according to an analysis by Stephens (Bberg)

NVDA/AMD: early laggards as ASIC > GPU debate gaining momentum post AVGO call

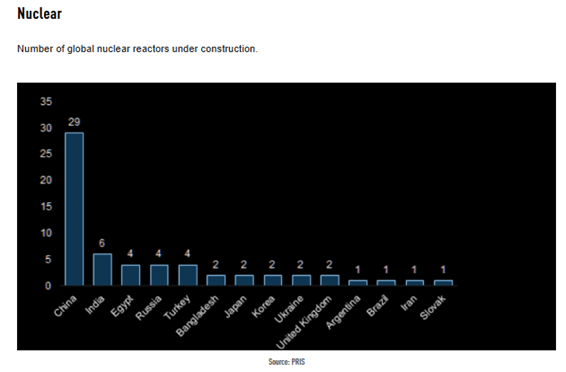

OKLO: +1% announces fuel recycling facility as 1st phase of up to $1.68B advanced fuel center in Tennessee

PATH: +3.8% solid top/bottom line beat. Better margins; ARR was above plan too as the company benefited from healthy demand and improved operational execution, and the full-year guide is increased

TARIFF ROULETTE/SEMIS: Trump said he would be imposing tariffs on semiconductor imports “very shortly” but spare goods from companies that have pledged to boost their US investments

ASML: +2% upgraded @ UBS - views the overhang from the Chinese market as well understood by the market"; in 2027 the firm sees the return of ASML as a quality compounder delivering a 20% EPS compound annual growth rate from 2026-2030

China Solar: CSI Solar +14%, Sungrow Power +15%, Xinjiang Daqo New Energy +13% driven by an increase in polysilicon prices

Industrials

TESLA/MUSK: Tesla Inc proposed a new compensation agreement for Musk potentially valued at about $1 tril .... The proposal sets a series of ambitious benchmarks Musk must meet to earn the full payout, incl expanding Tesla’s robotaxi business and growing the co’s market value to at least $8.5 Tril ... plan aims to keep Musk’s focus on Tesla while it pursues growth in newer markets incl robotics/AI

Crown Holdings (CCK) upgraded to buy from hold at Truist; $118 PT

Enerpac Tool Group (EPAC) initiated buy at Roth Capital; $48 PT

ESAB Corp. (ESAB) initiated buy at Roth Capital; $150 PT

Fastenal (FAST) reports August Average Daily Sales (ADS) +11.8%, below our expectations of +15.6%.

J.B. Hunt Transport Services (JBHT) downgraded to neutral from buy at UBS; $157 PT

Karman Holdings (KRMN) initiated strong buy at Raymond James; $100 PT

Knight-Swift Transportation (KNX) downgraded to neutral from buy at UBS; $51 PT

Lincoln Electric Holdings (LECO) initiated buy at Roth Capital; $279 PT

Mirion Technologies Inc. (MIR) will replace GMS Inc. (GMS) in the S&P SmallCap 600 effective prior to the opening of trading on Tuesday, 9-Sep. MIR +6% pre-mkt.

NIO Inc (NIO) downgraded to hold from buy at Freedom Broker; $6.50 PT

Quanex (NX) trading down 15% reporting Q3 EBITDA/EPS below consensus and lowering FY outlook.

QXO, Inc. (QXO) initiated outperform at Raymond James; $28 PT

Schneider National (SNDR) downgraded to neutral from buy at UBS; $26 PT

Latest Media

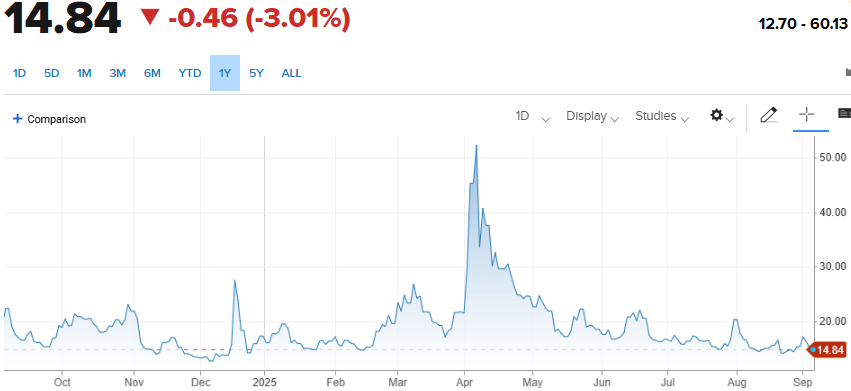

$AFRM - From $50 to $160 to $9 to 78 (current)

Affirm’s (BNPL) business is working. (Is that really a good thing?)

We’re still out.