- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Morning Note

presented by - |  |

Invest with us here: https://www.river1.us/invest.php

Trading Observations

Futures down 35 bps, Nasdaq's down 60 bps recovering from overnight lows

Gold and Silver in flux but off their lows and back to flat

Crude down as Iran did not escalate over the weekend

Follow through in the markets, still worries around Warsh it seems but bonds are flat and the dollar is only moderately from Friday

Feels more like a reason for a pullback from overbought than anything

Worries really seem to emanate from Open AI and NVDA relationship... NVDA being forced to keep this circular financing as is AMZN

In the same vein, ORCL said they’d not need capital but they are looking for $50B

ISM coming at 10ET

About 30 S&P companies reporting this week with AMD, GOOGL, AMZN, LLY, and MRK notable while PLTR most notable after the close

S&P was up in January, so goes the rest of the year https://tinyurl.com/vu5t3m8u [tinyurl.com]

Buybacks important, especially at AAPL https://tinyurl.com/atxpppwa [tinyurl.com]

ORCL higher pre-open after all the negativity but cashflow negative til 2030 https://tinyurl.com/bdd9nrzc [tinyurl.com]

Futures

DOW +11

S&P -22

Nasdaq -143

Charts/Sentiment

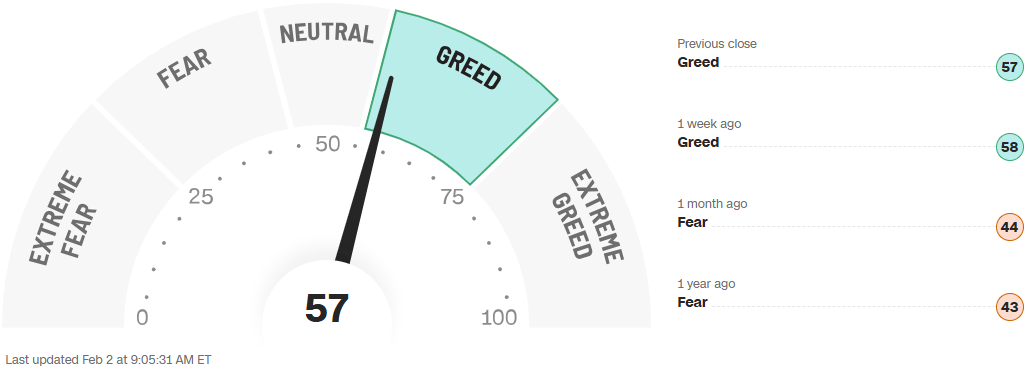

CNN Fear/Greed Index | Natural Gas -down as storm passing over US |

Gold | Silver |

Financials / Consumer / Healthcare

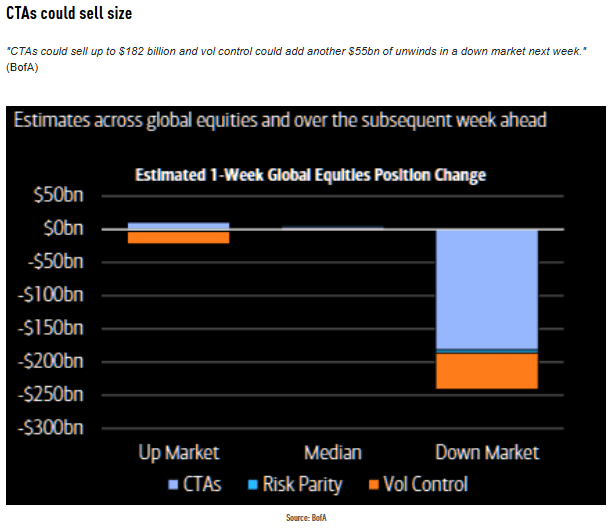

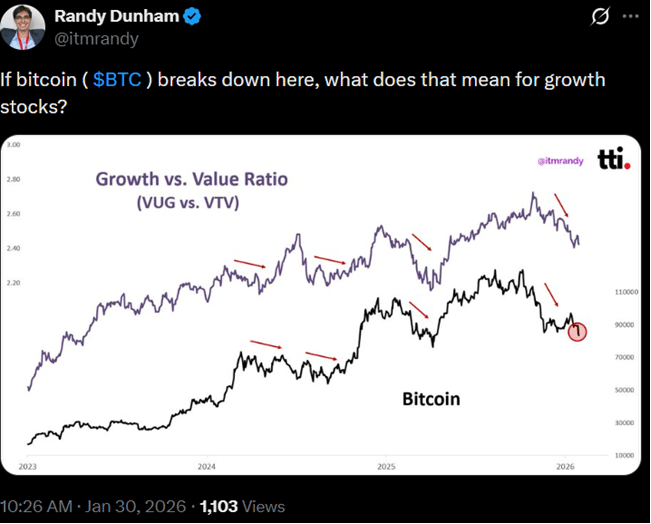

Crypto Related – All deeply red, down ~3%. BMNR is down 9%, MSTR 7%. 2nd tier crypto plays are currently a widow maker trade. MSTR trading near where it bought its bitcoin, which we don’t think is a big deal, but some think it could trigger a spiral lower.

DIS – Down 2% - GS thinks it trades higher on F26 guidance reiteration. EBIT was just in line, and with margins the focus for years now, investors are likely meh to this. Park attendance +1% but WDW bookings +5%. GS reiterates it as attractive price.

TPR – Baird preview is positive on Coach momentum.

YUM – Baird preview positive on KFC and Taco Bell comps. Pizza Hut remains a mess.

Baird negative on hotel brands due to a strong divergence of valuation from top to bottom end hotel names.

TSLA – Down 2% on sales slumping to three year low in France, plunging in Norway.

SOFI – Lots of sell side defense notes, but it was expensive into a print and growth is slowing, usually a bad combination.

AVs: Waymo finalizes $16B funding round at $110B valuation .... aiming to raise ~$16B in a financing round that would value the unit at ~$110B. The parent company would provide ~$13B to the robotaxi firm, while the rest would come from others, including new investors Sequoia Capital, DST Global and Dragoneer Investment Group. Coudl close the funding round in Feb

HUM are 3.1% lower after Morgan Stanley downgraded the health insurer to underweight from equal-weight, citing vulnerability in its Medicare Advantage (MA) business.

MCD upgraded to buy from neutral at BTIG

Metals: despite the CARNAGE seen on Friday ... Silver had its fifth consecutive up month despite Friday’s collapse, gold posted its best month in 15 years

Technology

Software vs Semis: depressing pair – down 7consecutive weeks (down 10 out of 11 weeks)

AAPL - More scrutiny in press on AAPL profit margins due to surging memory and component costs.

NVDA: -2% Jensen has reportedly downplayed likelihood of finalizing $100B investment in OpenAI though Jensen said not unhappy with OpenAI and still plans substantial investment in the company.

ADSK: upgraded @ JPM - positioned to capture "outsized share in high-growth verticals" such as data centers and infrastructure

FTNT are down 0.8% after Scotiabank downgraded the security software company to sector perform from sector outperform.

MSTR: -7% drawdown/puke accelerating

ORCL: +2% impressive rally off lows (was -4%) as Co details on its capital raising plans for C2026. To start, plans to raise $45-50B of gross cash proceeds this year to fund its aggressive AI infrastructure buildout. Most NOTABLE part of the announcement is that approx half this amount will come via the issuance of equity-linked securities, including a $20B ATM (at-the-market) common equity program

PLTR are up 2% after William Blair upgraded the software company to outperform from market perform.: #s tonight / conf call at 5pm ET

STM – BULLISH FRESH PICK at Baird-- STMicro is entering 2026 with improved visibility and normalizing channel inventory, and it is our view the 1Q outlook has improved versus company visibility a quarter ago.

TSLA/Musk and his Empire: SPACEX IS SAID TO BE IN ADVANCED TALKS TO COMBINE WITH XAI (Reuters reported last week) .... From Musk’s perspective, the deal makes a lot of sense – xAI is a cash cauldron and needs more capital, and SpaceX is on the cusp of a blockbuster IPO (that could raise as much as $50B at a $1-1.5T valuation), so why not have the former piggyback on the latter? “Data centers in space” will undoubtably be talked about a lot by xAI and SpaceX to justify a combination, but whether investors are really prepared to buy into that narrative remains to be seen

TTWO added to best ideas list at Wedbush

Industrials

US energy stocks (XOM -1.5%, CVX, 1.8%, COP -2.6%) drop alongside oil prices as geopolitical risks faded after US President Donald Trump said Washington is talking with Iran.

US rare-earths stocks (USAR +6.6%, MP +3.5%, UAMY +4.6%) are rising as President Donald Trump is set to launch a strategic critical-minerals stockpile with $12 billion in seed money to lower reliance on China.

AUTO PARTS: Aptiv (APTV) -1.5% 4Q beat but 1Q guided EPS 1.55-1.75 (est 1.94) with revs seen 4.95-5.15bn (Est 4.99bn)... Follows recent weakness from Mobileye, PonyAI. INFINEON one of their biggest suppliers

Ford (F) - reportedly held talks with Xiaomi about forming JV to manufacture EVs in US.

Devon Energy shares (DVN) fall 3% and Coterra Energy shares (CTRA) drop 4.6% after the firms said they will merge in an all-stock transaction with a combined enterprise value of around $58 billion.

Darling Ingredients (DAR) – Upgrading to Outperform from Neutral at Baird

BrightView Holdings (BV) – New Bullish Fresh Pick at Baird

Autoliv (ALV) downgraded to hold from buy at Handelsbanken; $130 PT

ESAB Corporation (ESAB) to acquire Eddyfi Technologies for $1.45B. Eddyfi Technologies is a global provider of advanced inspection and monitoring technologies.

International Paper (IP) downgraded to neutral from buy at UBS; $44 PT

Teradyne (TER) initiated buy at Aletheia Capital; $400 PT

Thermon Group Holdings (THR) initiated buy at Craig-Hallum Capital

Latest Media

River1’s CIO on Schwab Network

Levered ETFs, market perspectives, etc.