- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Morning Note

presented by - |  |

Invest with us here: https://www.river1.us/invest.php

Trading Observations

CPI excluding food and energy +0.2% m/m vs estimate of 0.3%, BLS data show.

Earnings kick-off with JPM higher, DAL and BK lower

Still in the 6920-7000 range

While Trump bashing Powell, the slow cutting cycle best for markets https://tinyurl.com/ydpx8a7m [tinyurl.com]

Time for a rotation back to tech? https://tinyurl.com/385reyay [tinyurl.com]

Doesn't 'feel' like it, but value relative at a key level https://tinyurl.com/y7mz455x [tinyurl.com]

Greenland: military experts dismiss claims that the US needs to outright own Greenland in order to defend its national security – WSJ

Futures

DOW -43

S&P +3

Nasdaq +13

Charts/Sentiment

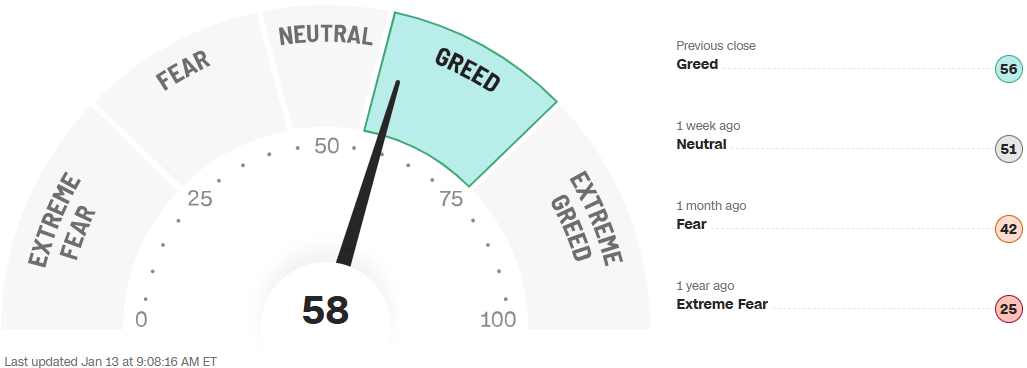

CNN Fear/Greed Index | U.S. 10 Year Treasury |

Gold | Bitcoin |

Financials / Consumer / Healthcare

The Biggest Conference of the Year in Retail, ICR, has started with some company updates – Reactions are largely lower. Teen retail getting the worst of the Christmas season.

US banks and financial firms warn Trump's proposed 10% credit-card rate cap could cut access to credit for millions – Reuters

JPM – Flat – Numbers look good as always, but more EPS beat than revenue. They are blaming investment banking fees for the drop. They also took a charge on Apple Card movement. Dimon made sure to mention the 10% credit card cap was a non-starter.

BK – Down slightly. Low quality beat. NII was solid, fee revenues +5%. Guidance right in-line with what I would call boring.

USB – Announced it will buy brokerage house BTIG for $725M-$1B in a push to do more trading. Market cap is $84B, so not a big deal.

WH – Wyndham upgraded to outperform at Mizuho.

JPM out on C and BAC in front of earnings saying C has 23% exposure to credit cards, BAC just 9%, and C has a mess to clean up in Russia and Banamex.

TVTX – Today’s drug whiff, down 32%.

MSTR sees its first insider stock purchase since 2022 – WSJ

ABBV - latest pharma name to announce pricing deal with Trump administration to avoid tariffs.

IBRX - Announces Positive Results Demonstrating ANKTIVA® as a Lymphocyte Stimulating Agent in Combination With Checkpoint Inhibitors in Non-Small Cell Lung Cancer

Technology

Alphabet (GOOGL) +1.1%, Amazon (AMZN) +0.5%, Nvidia (NVDA) +0.4%, Tesla (TSLA) +0.4%, Meta Platforms (META) +0.3%, Microsoft (MSFT) -0.1%, Apple (AAPL) -0.1%

Apple leads global smartphone market in 2025, with 20% share; strong iPhone 17 sales https://www.rte.ie/news/business/2026/0112/1552622-apple-lead-smartphone-market/ [rte.ie]

ADBE - shares are down 0.9% in premarket trading, after Oppenheimer downgraded the software company to market perform from outperform.

CLSK - Northland Securities Inc initiated coverage of Cleanspark Inc. with a recommendation of outperform.

Trump said MSFT will make major changes to ensure consumers don't get hit with big utility bills related to AI buildout.

Digitimes noted MU warned AI memory crunch could last until 2028.

Google to develop and make high end phones in Vietnam this year – Nikkei

Oklo and TerraPower will need to invest more than $14B in new reactors to support Meta's data centers - Bloomey

NTAP are up 0.8% after Goldman Sachs started coverage on the storage and data-management company with a buy rating and $128 price target.

SNPS fall 1.4% as Piper Sandler downgrades the chip design software firm to neutral from overweight as the company could see prolonged headwinds to growth.

CRWD - will acquire Seraphic Security, a browser runtime security company, to turn any browser into a secure enterprise browser.

Industrials

Airlines in focus….DAL – Mixed report …. Q4 revs beat, FY profit guidance fell short of estimates

Albemarle (ALB) upgraded to buy from hold at Deutsche Bank

Aptiv Plc (APTV) upgraded to outperform from equal-weight at Fox Advisors

FedEx (FDX) downgraded to neutral from outperform at BNP Paribas

Hub Group (HUBG) upgraded to outperform from in line at Evercore ISI

Kennametal (KMT) upgraded to buy from hold at Jefferies

Installed Building Products (IBP) downgraded to underweight from neutral at JPMorgan

L3Harris Technologies (LHX) announces proposed partnership with Department of War to increase capacity to build solid rocket motors - L3Harris and the DoW have agreed to the terms of a proposed DoW investment in L3Harris' Missile Solutions business through a $1B convertible preferred security, which would automatically convert into common equity upon an initial public offering (IPO).

Primoris Services (PRIM) upgraded to buy from neutral at Guggenheim Securities

Saia Inc (SAIA) downgraded to in line from outperform at Evercore ISI

United Parcel Service (UPS) downgraded to underperform from neutral at BNP Paribas

XPO, Inc. (XPO) downgraded to in line from outperform at Evercore ISI

Latest Media

River1’s CIO on Schwab Network

Levered ETFs, market perspectives, etc.