- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Morning Note

presented by - |  |

Invest with us here: https://www.river1.us/invest.php

Trading Observations

China approving ANSS/SNPS and NVDA being allowed to resume selling H20 chips to China should give semis a bid, and perhaps suggest a meaningful announcement on the trade side coming?

CPI came in as expected

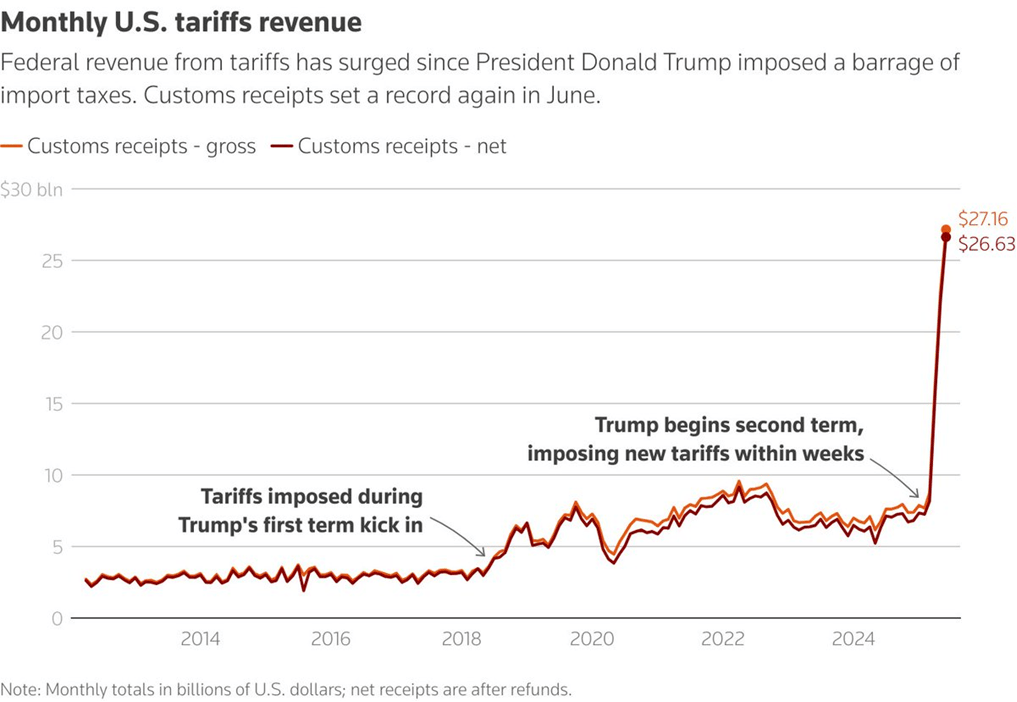

Some tariff context https://tinyurl.com/yenjjkpw [tinyurl.com]

Bank earnings start in earnest with JPM higher on first blush

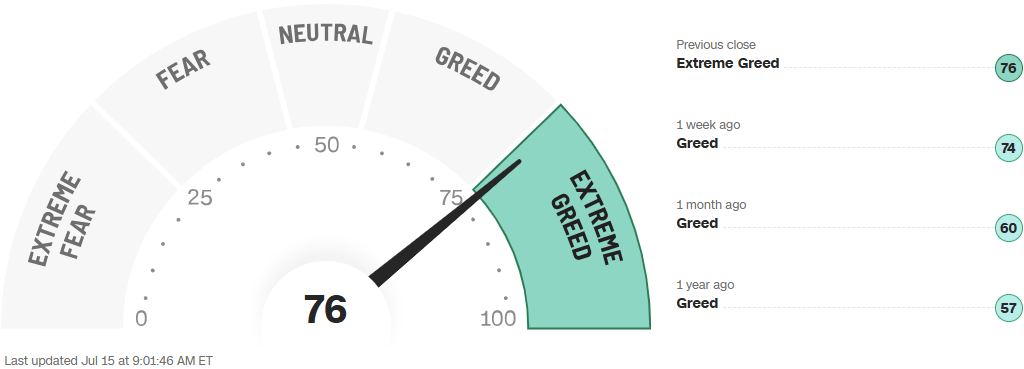

Still overbought, but being worked off

6285 resistance vs. 6230/6180 support

Low bar heading into earnings https://tinyurl.com/u6uphwck [tinyurl.com]

Cash allocations at lows https://tinyurl.com/y3xd8m3s [tinyurl.com]

Futures

DOW -49

S&P +24

Nasdaq +161

Charts/Sentiment

CNN Fear/Greed Index | U.S. 10 Year Treasury |

Oil | Bitcoin |

Financials / Consumer / Healthcare

Bank Earnings – Moves – BK down 50 bps, JPM down 40 bps, WFC – Down 3.3%, C up 1%.

WFC negativity is a miss on NII guidance (flat for the year). Loan growth and Capital Markets are fine. Nothing too scary here.

JPM – Worse NII, better loan growth as money is being lent out, but cash balances missed.

COIN related – All down ~2%. Cramer’s new acronym is PARC, Palantir (255x PE), Applovin (44x PE), Robinhood (75x PE), and Coinbase (77x PE). I’m calling top.

BLK – Blackrock Down 3% - Inflows were 20% lower than expectations as new money post the April swoon turned out to go elsewhere (meme stocks and coins). Expenses were high as well. They have $12.5T in assets, so they will be fine.

Baird Fintech Picks – They like MA, CPAY and PAY to beat and raise. They like valuation in FI and VRRM.

Restaurant Trends – Last week comp survey work at Baird was negative. Not a trend yet but concerning.

HBAN – Notes on VBTX acquisition are largely positive as the TBV earn back is about a year.

ACI – Albertsons raised guidance, trades 10x p/e, and is down 2% on earnings because investors do not care about value stocks or supermarket stocks.

TTD +15% after the company was added to the S&P 500 index. Trade Desk will replace Ansys. Two companies that investors had hoped would be added to the benchmark index, Robinhood Markets and AppLovin, fell 0.8% and 1.6%, respectively

Technology

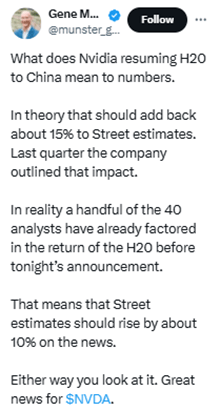

NVDA MASSIVE WIN: +5% plans to resume sales of its H20 AI chip in China after securing Washington's assurances that such shipments would get approved ... last Q company outlined the impact + comes after extensive lobbying efforts by Jensen who is speaking at Beijing later in wk

NVDA: Chinese firms are “scrambling” to buy Nvidia’s H20 chips after the US said sales of the product could resume - ByteDance and Tencent are submitting applications

Trump to announce $70B AI, energy investments – Reuters

AI SEMIS: Nvidia headlines will only fuel AI enthusiasm further + also signaling a further stabilization/improvement in the Washington-Beijing relationship ... CRWV +8%, AMD +4.2%, SMCI+3.6%, ALAB+3.3%, COHR+3%, MRVL/CRDO +2.7%, TSM+2.3%, SMH+2.3%, AVGO/MU+1.5%

ASML: #s Wed am / 5.2% implied move ... positioning light / leans short. Hearing ppl expect bookings of >€4.5B w/ decent TSMC mix. Chip restrictions / China have remained overhang

AV Wars: TSLA doubled Robotaxi Austin service area, now larger than Waymo’s (from Monday)

CRWV: +8% AI frenzy contd ... CoreWeave plans to invest as much as $6 billion to set up a data center in Lancaster, Pennsylvania, as the firm expands its capacity across the US. Expects to develop an initial 100 megawatts of capacity and may expand to 300 megawatts in the future

DASH: Jefferies downgrading - expects Co to post upside to consensus ests and peer-leading EBITDA growth, but says this is not enough to drive contd share outperformance without assigning "optimistic multiples" to DoorDash's non-core businesses. Also, recent ramp in affordability initiatives could limit upside to take rate

GOOGL/Power Up: Google agreed to spend >$3 billion to buy power for its data centers from Brookfield Asset Management hydroelectric plants. The power will come from the Holtwood and Safe Harbor plants with 670 megawatts of generating capacity for 20 years + the deal will support its data centers

GOOGL/AMZN: Google Cloud business is becoming increasingly competitive and winning business from AWS (The Information) ... comes after reports last wk that Google is cutting prices to win govt biz as well

META: Citi bullish - online advertising environment is strengthening. Meta invests billions in AI data centers, pursuing superintelligence to boost ad business – Reuters

MSFT: named top AI winner at Jefferies (survey of 40 enterprises indicating that Copilot could drive more than $11B in revenue in calendar 2026, and Copilot is fueling Azure and Security spend) ....

OKLO: bullish init at Cantor - says the company is making it possible for the world to safely transition to nuclear power. Oklo's small module reactor technology is designed on proven fast fission reactor technology, the analyst tells investors in a research note. Cantor believes the company will be a "big winner" during the energy transition

TSLA/AI: xAI is burning through ~$1B/month trying to catch up to more established AI players like OpenAI, and Musk is now calling on financial support from Tesla and SpaceX (Bloomberg)

Industrials

APi Group (APG) Raised to Overweight at JPMorgan; PT $42

Custom Truck (CTOS) Raised to Buy at Stifel; PT $7

Carrier Global (CARR) Cut to Neutral at JPMorgan; PT $79

Enphase Energy (ENPH) Cut to Neutral at JPMorgan; PT $37

Fortive (FTV) Cut to Hold at TD Cowen; PT $50

Freeport (FCX) Cut to Equal-Weight at Morgan Stanley; PT $54

MP Materials (MP) – trading +8% pre-mkt on report that Apple intends to invest $500M in MP.

Otis Worldwide (OTIS) Raised to Overweight at JPMorgan; PT $109

Ralliant Corp. (RAL) initiated buy at TD Cowen; initiated overweight at Barclays

Ryder System (R) initiated positive at Susquehanna

SolarEdge (SEDG) Cut to Neutral at JPMorgan; PT $23

Southwest Air (LUV) Cut to Inline at Evercore ISI; PT $40

TSLA: Model Y goes on sale in India, but at a very high initial price point of ~$70K as the firm is forced to pay steep tariffs (the tariff situation could improve if the US and India strike a trade deal) (Reuters)

Latest Media

$PLTR and early 2000s $CSCO look very similar.

$PLTR trading 4-5x the valuation of peak $CSCO.