- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Morning Note

presented by - |  |

Invest with us here: https://www.river1.us/invest.php

Trading Observations

Merger Monday: KMB to acquire KVUE, ETN to buy Boyd Thermal business for $9.5B from Goldman Sachs, and MSFT & GOOGL planning AI deals. AMZN & OpenAI deal

October sentiment rose https://tinyurl.com/yvznaa7m [tinyurl.com]

With Breadth falling https://tinyurl.com/3ym55krd [tinyurl.com]

But, Mega Cap AI spending exceeds expectations https://tinyurl.com/39xbewb9 [tinyurl.com]

Earnings strong, 64% of S&P 500 companies that have reported results have beaten consensus EPS forecasts by at least a standard deviation of estimates https://tinyurl.com/ye29ehwy [tinyurl.com]

November a historically strong month for stocks, higher 59% of the time https://tinyurl.com/4bkxvsvx [tinyurl.com]

The Current Shutdown Will Have By Far the Greatest Economic Impact on Record https://tinyurl.com/pfydkfuv [tinyurl.com]

Futures

DOW -5

S&P +17

Nasdaq +219

Charts/Sentiment

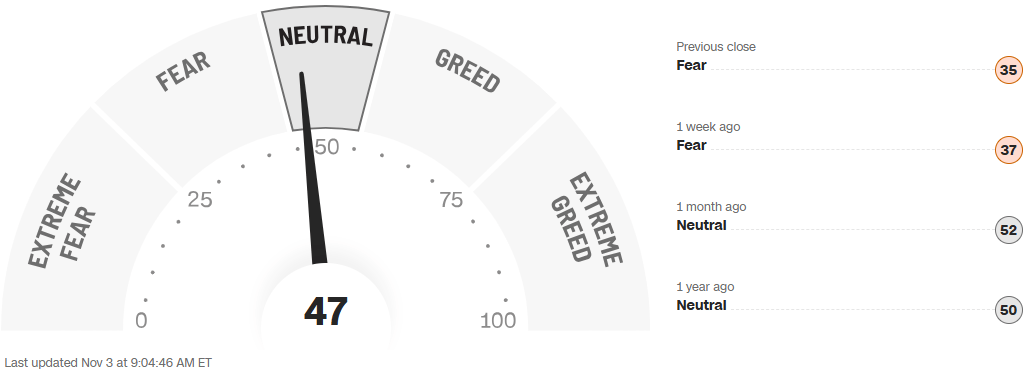

CNN Fear/Greed Index | U.S. 10 Year Treasury |

Gold | Bitcoin |

Financials / Consumer / Healthcare

Berkshire Cash Pile: company’s cash balance ballooned to nearly $382B, up from $344B in Q2 (the $382B is nearly 40% of the current market cap), driven by ~$13.8B in op. cash flow and ~$6.3B in net equity sales. Given consolidated borrowings of $127B, net cash was ~$255B, or around 25% of the market cap. The company (once again) didn’t repurchase any shares during the Q

Crypto proxies: MSTR-1.5%, COIN-1% with bitcoin back below $108k

LULU Tracker (Baird) - Mixed reads; remain Neutral-rated. While October product newness remained higher (including several new collaborations), the discounted assortment also remained elevated. Meanwhile, various brand heat/traffic/sales indicators decelerated vs. September, reinforcing category/competitive headwinds. Overall, we don't see major risk to FQ3 estimates (already incorporating sales deceleration and higher markdowns) but we believe valuation may remain depressed near term

Macau gaming revenue for Oct came in ahead of expectations at +15.9% (vs. the Street +11.7%) - Bloomey

Metsera/NVO are hit with a lawsuit from Pfizer as the drug company looks to salvage its existing deal w/the weight-loss company – WSJ

KMB/KVUE: Kimberly-Clark to Buy Tylenol Maker Kenvue for $40 Billion

Technology

Tech EPS / positioning: Crowded Longs = AMD, SHOP, SPOT, DASH, ANET ..... Crowded Shorts: ON, PINS, DUOL, FTNT, KVYO, TTD, ABNB, MCHP ... Controversial (long tilt towards all imho): UBER, U/Unity, HUBS, DDOG, DASH

AAPL: supply chain is never coming back to the US in a material or sustainable way, but Cook learned he can manage Trump by giving the president a good headline (the spending commitments Apple made this year largely reflecting existing plans and outlays that would have occurred anyway) (WSJ)

AMZN – OpenAI Signes $38B infrastructure deal with AWS . . .supply NVDA chips.

AMZN's quarterly run rate now equates to $125B which looks to be up ~60% y

CSCO: +2% upgraded @ UBS - sees a multi-year growth cycle for the company, driven by AI infrastructure demand, a large-scale Campus refresh cycle, and momentum in security. Cisco has secured over $2B in AI orders in fiscal 2025, nearly all from hyperscalers, while its Campus refresh cycle is acceleratin

DELL: +4% on $16mm (as of 658am ET) as IREN says it will buy Nvidia GPU systems from DELL for $5.8B. The five-year agreement will provide Microsoft access to Nvidia Corp. accelerator systems in Texas built using the GB300 architecture for AI workloads and includes a 20% prepayment

GEV/AT&T: both removed from US Conviction List at Goldman

MSFT: Nadella says the company is not GPU constrained (it has plenty of GPUs) but instead is facing limits on physical data center capacity and power availability (BG2Pod)

NVDA: Trump says Nvidia's Blackwell chips should only be for US customers, and hints at tightening access by other countries ..... Huang completes a massive $1B share sale that has been ongoing since June (Bloomberg)

NVDA: Loop St-High PT to $350 - implying mkt cap of more than $8.5 Trillion; saying the company is about to begin a ramp of GPU that will double its unit shipments over the next 12-15 months

NVDA’s Jensen Huang completes a massive $1B share sale that has been ongoing since June – Bloomey. I mean can you blame him!?!

NVDA CEO sounds stern “Huawei” warning…. Saying it would be foolish to underestimate them

PLTR: +2% ahead of #s tonight /8.6% implied move (which feels low). Ives lifting PT 15% to $230 (details below) ... Govt sales likely had another robust quarter given the surge in US defense spending. Yet international commercial revenue growth might remain a drag on overall growth

ROKU: +3.3% Piper upgrading - Platform investments across Advertising and SSD are beginning to shine; more confident that the momentum continues into 2026, and that the better profitability and shareholder returns helps

Industrials

AptarGroup (ATR) downgraded to market perform from outperform at William Blair

Boeing (BA) upgraded to buy from hold at Freedom Broker

Casella Waste Systems (CWST) upgraded to equal weight from underweight at Barclays

Ecolab (ECL) upgraded to outperform from in line at Evercore ISI

Eaton (ETN) trading down 2% after announcing they signed agreement to acquire Boyd Thermal for $9.5B

GE Vernova (GEV) removed from Goldman Sachs’ US Conviction List

Linde Plc (LIN) upgraded to buy from neutral at Seaport Research Partners

nVent Electric (NVT) added to Goldman Sachs’ US Conviction List

Pitney Bowes (PBI) initiated neutral at Goldman Sachs

Westlake (WLK) upgraded to Buy from Neutral at BofA

OKLO, IMSR etc - MSFT: Nadella says the company is not GPU constrained (it has plenty of GPUs) but instead is facing limits on physical data center capacity and power availability (BG2Pod)

Electricity costs are spiking across the US (thanks in part to data centers), creating a fresh source of pressure for consumers – WSJ

TSLA: Musk says the firm’s new Roadster could be unveiled before the end of the year (this is a product he’s been promising for 8 years) (CNBC)