- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Morning Note

presented by - |  |

Invest with us here: https://www.river1.us/invest.php

Trading Observations

After the surge last week, bit of a giveback not surprising, especially as put buying plummeted https://tinyurl.com/3m3zhmxe [tinyurl.com]But history suggests any weakness likely temporary https://tinyurl.com/2s633k3j [tinyurl.com]

And A/D pushed to new highs a tailwind as well

Will Japan trigger another carry trade unwind? That the fear, but not sure we are there yet https://tinyurl.com/4w4uk7ea [tinyurl.com]

My guess is the early weakness gets bought, but we shall see- 6870 resistance vs. 6675 first support

No signs yet of consumer slowdown... "US RETAIL SALES EXCLUDING AUTOS WERE UP 4.1% ON BLACK FRIDAY, COMPARED TO BLACK FRIDAY 2024, PER MASTERCARD SPENDINGPULSE"

Fed (fortunately) in their quiet period, loads of econ data this week as they play catchup

Futures

DOW -46

S&P -62

Nasdaq -85

Charts/Sentiment

CNN Fear/Greed Index | U.S. 10 Year Treasury |

Gold | Bitcoin |

Financials / Consumer / Healthcare

Black Friday data: consumer spending: the Black Friday spending numbers published over the weekend were respectable (but not spectacular), with Mastercard SpendingPulse (which is the most comprehensive gauge) putting the aggregate number at +4.1%, with online +10.4% and in-store +1.7% (while Adobe said online spending jumped 9.1% and RetailNext estimates in-store traffic fell 3.6%) (NYT, CNN, CBS

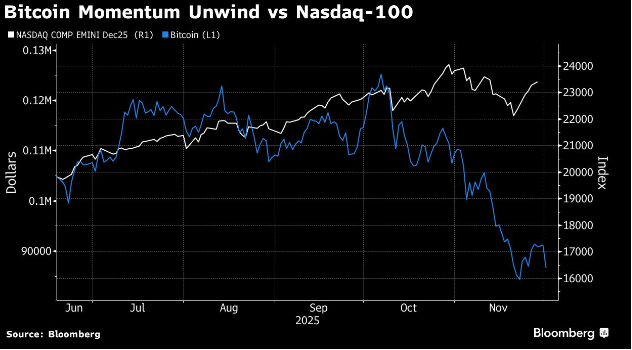

Coin related financials – Down 5-6%, testing the leverage in the system.

SBUX – Strike expands from 65 to 120 stores. Toughest job in food service.

LULU – WSJ and Chip Wilson, the founder, are out talking current problems with the company. No proxy battle has been threatened…yet.

Macau – Monthly numbers +14.4% vs +10.5% expected. GS made WYNN a Top Pick.

DIS – Big win with a $272MM box office for Zootopia 2.

COST – Bloomberg says y/y sales +5.9% as observed.

MO – Motley Fool calls it too cheap to ignore.

MRNA – Down 4% on FDA imposing new vaccine requirements.

Klarna (KLAR), Afterpay, and Affirm (AFRM): Buy Now, Pay Later (BNPL) usage surged this Black Friday, rising 9% overall, with adoption especially strong among younger consumers: 41% of shoppers aged 16–24 used BNPL, and younger millennials increased their usage by an astonishing 87% compared with last year – Reuters.

LLY – Cuts cash prices of Zepbound weight loss drug vials on direct-to-consumer site https://www.cnbc.com/2025/12/01/eli-lilly-prices-zepbound-weight-loss-drug-vials.html

Technology

AMZN: re Invent kicks off today ... AWS CEO today @ 1130am ET

DASH: +1.8% early alpha leader; massive insider buying

Crypto Slammed: BITCOIN-5%, ETH-6%, XRP-7%, etc .... equity proxies falling in sympathy: MSTR, COIN, WULF, CIFR, MARA, CRCL, HOOD, etc

DATABRICKS: raised $5 at an extreme valuation of 32x revenue (the firm was valued at $134B in aggregate) as investors embraced the company’s healthy top line growth (+55% this year) and looked past the margin deterioration (which is being driven by rising AI costs) (The Information)

GOOGL: Guggenheim +VE - raising 2026 and 2027 rev/profit ests for Alphabet, driven primarily by upward revisions to Google Cloud segment rev and further margin expansion

GOOGL v NVDA: from Friday if missed .... a Semi Analysis report published Friday morning contained a very bullish overview of Google’s TPU, noting how it played a major role in training the world’s two best frontier models (Claude 4.5 Opus and Gemini 3) and compares favorably to Nvidia not only on a TCO (total cost of ownership) basis, but increasingly on measures of absolute performance too (Semi Analysis)

NVDA/AMD: -1% China has ~4x more AI inference chips than it needs after companies stockpiled Nvidia silicon due to US sanctions and as domestic firms ramp output (The Information)

SHOP: Opco cautious comments .... Shopify announced $6.2B of merchant sales through Black Friday, which represented 25% y/y growth. Oppenheimer expects a slight negative reaction with the reported pace of sales tracking below consensus Q4 GMV growth expectations. Sentiment was elevated into Black Friday Cyber Monday with alternative data projections trending about 10pts above St in the weeks prior, offset by expectations of earlier holiday spend

TOST: upgraded @ BNP - "despite competition, leadership is intact. Says its U.S. restaurant analysis by number of locations shows Toast still has plenty of room to grow in the U.S. outside of enterprise. The stock's valuation is attractive and the co's 2026 guidance should reassure investors"

Industrials

Auto headlines: (1)Americans push back against high auto prices – after years of aggressive price increases by auto OEMs, Americans are finally pushing back (WSJ) ... (2)European auto regulations: German chancellor Friedrich Merz said he would push to ease the existing European rule that calls for a ban on ICE vehicles by 2035 (FT)

Canadian National Railway (CNR) upgraded to outperformer from neutral at CIBC Capital Markets

CNH Industrial (CNH) downgraded to underweight at JP Morgan

Kratos Defense & Security Solutions (KTOS) upgraded to buy from neutral at B Riley Securities

Leggett & Platt (LEG) - Somnigroup (SGI) proposes to acquire Leggett & Platt for $12.00 per share in all-stock transaction

Old Dominion Freight Line (ODFL) upgraded to outperform from market perform at BMO Capital Markets

Latest Media

$PM - New and hot consumer product!

Took the stock from a 15x to 30x P/E.

Purely multiple expansion.