- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Morning Note

presented by - |  |

Invest with us here: https://www.river1.us/invest.php

Trading Observations

Very quiet

With EV credits expiring, TSLA had strong #s 497k vs 439k.

Pushed thru resistance despite quarter end

6700, 6650, 6575 support zones with blue shies above

For the bulls https://tinyurl.com/ya6t6h6j [tinyurl.com]

For the bears https://tinyurl.com/7h2chusf [tinyurl.com]

Upgrades – AMH, ACLS, CE, CRL, CTVA, CCI, DELL, RACE, KNX, NKE, SHLS

Downgrades – AMT, ARRY, AXTA, BE, CTVA, EIX, EA, MEDP, MDLZ, MLTX, MRC, RH

Futures

DOW -27

S&P +18

Nasdaq +154

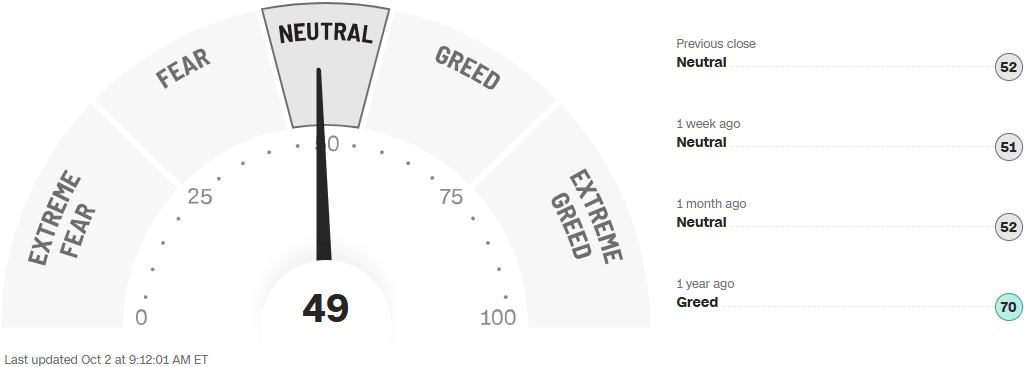

Charts/Sentiment

CNN Fear/Greed Index | U.S. 10 Year Treasury |

Gold | Bitcoin |

Financials / Consumer / Healthcare

DKNG – Cathy Wood loaded up on DKNG in the selloff, stock +2%.

BF/B – Beleaguered alcohol co Brown Forman approved a $400M stock repurchase to cushion the blow.

JPM – Said to be tapped by Kuwait for a $7B pipeline loan.

TRU, EFX – Down 8-10% on FICO entering the direct licensing program. FICO up 16%. Pulte to comment this morning.

Technology

RISING FROM THE ASHES: Tailwind for semicaps which probably hasn't gotten enough air time / not long ago, many were wondering how it may end for Intel, Samsung given grim state of their respective turnarounds .... INTC arguably now, a buy + hold in coming years with sovereign support. More co's will line up to drum up administration favor .... Since August 1: INTC+86%, SAMSUNG+25%, SOX+17%, NVDA+8%

AAPL: WSJ reports Co shifting resources away from overhauling its Vision Pro headset and toward the development of smart glasses as the company looks to counter Meta’s growing presence in the market (Bloomberg)

NFLX #s creeping closer, 10/21 .... -0.5% since May 27th (versus SPOT+11%, UBER+12%, QQQ+15%, APP+87%, RDDT+131%) ... from GS desk: multiple has consolidated YTD as investors debate topline trajectory: subs vs ARPU vs ads + less “safe haven” premium as Tariff concerns have eased ...

DISRUPTIVE TECH: Ives update .... M&A Set to Accelerate In Tech As AI Revolution Takes Hold - We believe the top candidates to be acquired for this M&A cycle are TENB, QLYS, S, ESTC, VRNS, AI, INOD, TLS, SERV, SNDK, LYFT, and TRIP.

QUBT: Quantum Computing files to sell 26.87M shares of common stock for holders

RDDT: -25% over two weeks; by far #1 inbound in pre mkt Wed.. signs of slowing + less traffic coming from ChatGPT

Samsung Electronics and SK Hynix shares surge in wake of chip supply agreement with OpenAI - FT

Industrials

Array Technologies (ARRY) downgraded to equal weight from overweight at Barclays; $9 PT

Axalta Coating Systems (AXTA) downgraded to in line from outperform at Evercore ISI; $32 PT

Bloom Energy (BE) downgraded to neutral from outperform at Mizuho Securities USA; $79 PT

Celanese (CE) Raised to Buy at Citi; PT $53

Corteva (CTVA) upgraded to overweight from neutral at JPMorgan; $70 PT

Corteva (CTVA) downgraded to neutral from buy at Citi

DAL - 2 Delta jets collide at LGA airport https://www.cnn.com/2025/10/02/us/lga-regional-jets-collide [cnn.com]

Essential Utilities (WTRG) initiated overweight at Barclays; $42 PT

Ingersoll-Rand (IR) named short-term sell idea at Deutsche Bank

Knight-Swift Transportation (KNX) upgraded to buy from hold at Deutsche Bank; $53 PT

Lennox (LII) gets buy catalyst call at Deutsche Bank

Mercury Systems (MRCY) resumed buy at Canaccord Genuity; $88 PT

MRC Global (MRC) downgraded to neutral from positive at Susquehanna; $15 PT

Olin (OLN) Cut to Neutral at Citi; PT $25

Ramaco (METC) Rated New Buy at Lucid Capital Markets; PT $50

Shoals Technologies (SHLS) upgraded to overweight from equal weight; $10 PT

Symbotic (SYM) initiated buy at Northcoast Research; $65 PT