- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Morning Note

presented by - |  |

Invest with us here: https://www.river1.us/invest.php

Trading Observations

Quiet start to the week with Retail sales tomorrow, Jobs Wed, and CPI Fri, and a number of tech earnings on deck

With the rally Fri, reclaimed 50-day (6885) but should we pullback, really need to hold 6860 support

GS apparently suggesting $33B of equity selling due to hit this week. So may be tested? But plenty of short exposure now to provide support? https://tinyurl.com/26x4p8yu [tinyurl.com]

7000 back as resistance level to watch

Due for a move? The S&P 500 has gone 4 weeks in a row with weekly gains between 0.5% and -0.5%. Has NOT hit 5 in a row since 1965

For the bulls, Earnings continue to rise https://tinyurl.com/ysruznz9 [tinyurl.com]

International growth a tailwind https://tinyurl.com/5n6b6yd4 [tinyurl.com]

Notable that at same time as Dow 50,000 mark cleared, new highs in both the industrials and transports trigger a DOW THEORY buy signal

Also, 52wk highs on NYSE highest since 2024, NYSE A/D line closed at new all-time high in addition to new highs in DIA and RSP

No sign of weakness to suggest a major pullback coming https://tinyurl.com/5fw2jc7u [tinyurl.com]

For the bears, correlations breaking down https://tinyurl.com/y8axnhsv [tinyurl.com]

Energy > Mag7 going forward? https://tinyurl.com/bdfapm76 [tinyurl.com]

While it 'feels' like labor weakening, haven't seen layoff talk spike yet https://tinyurl.com/29c2t78u [tinyurl.com]

Futures

DOW -100

S&P -16

Nasdaq -88

Charts/Sentiment

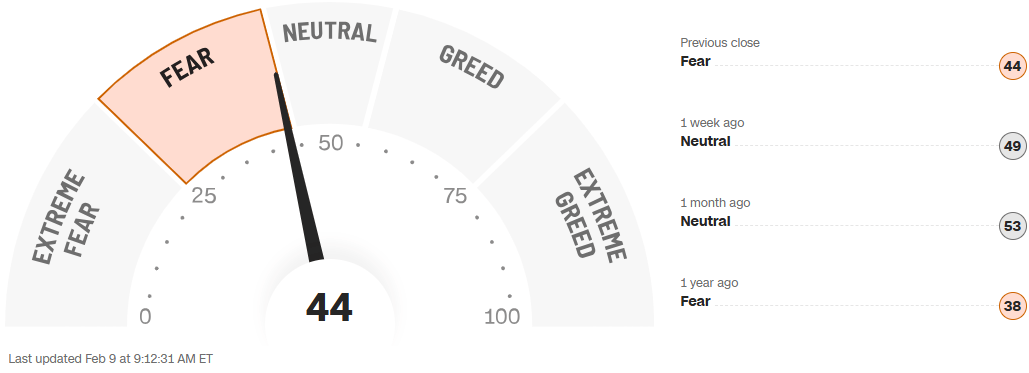

CNN Fear/Greed Index | U.S. 10 Year Treasury |

Silver | Bitcoin |

Financials / Consumer / Healthcare

Goldman expects US IPOs to quadruple to record $160B in 2026 – Reuters

HIMS – Down 22% - NVO has had enough and is suing HIMS for trying to sell a weight loss pill. It’s completely illegal to compound these drugs right now, and the patent should hold, but the stock market needed to see the suit to believe it.

LLY – Up 1% on a new drug deal worth ~$2.5B (small for LLY these days). Chinese biotech Innovent Biologics.

SOFI – Upgraded to buy at Citizens.

PGY – Down 22% - Another Fin Tech name with a very cheap valuation misses numbers and gets wrecked. There is just no bid for these falling knives.

KD – Down 54% - Think of them as a mini-Accenture. Earnings were kind of bad, but the real headlines are “material weakness in internal controls”, which the market hates.

Crypto Related – The legitimate businesses like HOOD and SOFI are up 2%, and the rest of the lot is down 2-3%. Will MSTR hit 1-1 value with its holdings? Will the White House meeting slow the tide? The Guthrie kidnapping isn’t helping use case.

KR – Kroger up 6% on a new CEO hire from Walmart.

AMC – Filed to sell $150MM in shares. The stock is $1.50. Remember when it was a meme stock?

ZION – Downgraded to neutral at Baird. They upgraded in October on the panic related to fraud losses. Bank panic buying makes them cool on the sector.

AZO – Downgraded to neutral at Baird as they call it a defensive compounder but like other ideas better at this price.

GPN – Upgraded at Baird to Bullish Fresh Pick as checks are coming in positive.

Technology

NET – Baird Preview/Checks - While execution must remain sharp to justify the premium multiple, we remain constructive on NET’s position as a leading edge-AI/agentic platform, as sentiment further normalizes and valuation resets from peak levels

MNDY - Monday.com shares drop 15% premarket after the software company’s revenue forecast was weaker than expected. The report comes at a time when investors are growing more concerned about the impact AI could have on software’s long-term growth rates.

MSFT - is being downgraded to hold from buy at Melius Research LLC, which cites concerns over AI-related disruption.

ORCL - climbs 4.7% premarket, D.A Davidson upgraded the shares to buy from neutral, saying OpenAI is set to exceed investor expectations in term of model performance.

WDAY - Workday co-founder and current Executive Chair Aneel Bhusri is returning as CEO, replacing Carl Eschenbach effective immediately.

Industrials

RIG - Transocean shares fell 3.7% in premarket trading after it agreed to acquire Valaris in an all-stock transaction valued at approximately $5.8 billio

Crown Holdings (CCK) downgraded to neutral from buy at UBS; $126 PT

Corteva (CTVA) downgraded to neutral from buy at UBS; $80 PT

Timken (TKR) upgraded to overweight from sector weight; $130 PT

Westlake (WLK) downgraded to neutral from outperform at Mizuho; $88 PT

ZTO Express (ZTO) upgraded to outperform from neutral at Macquarie; $26.60 PT

Latest Media

River1’s CIO on Schwab Network

Levered ETFs, market perspectives, etc.

But same time. Be ready to hear the phrase TREND CONTINUATION in NVIDIA. BEST day since April on Friday last….This chart remains super powerful.. NOT far from a Gap to a new high and market analysts who will chase the “TREND CONTINUATION”…NVIDIA will soon surge over $200..