- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Morning Note

presented by - |  |

Calendar

Thursday – Jobless Claims (Watch these, 300k is very bad), NY Fed Inflation Expectations.

Friday – 6 Fed Speakers.

Trading Observations

The market shrugged off Trump's comments on China and the lack of help from Powell to end in the green

Accepting the good news from UK trade deal should keep us regaining a positive foothold and create some FOMO + reweighting

We had worked off some of the overbought state https://tinyurl.com/4cr8yxp7 [tinyurl.com]

Support 5600 vs. resistance at 5750

Nice reaction higher for the dollar while yields a touch higher

Gold lower and crude higher

Jobless Claims were solid

Inflation in used cars rising Mannheim Index https://tinyurl.com/wyfa84vb [tinyurl.com]

US Treasury borrowing needs rising https://tinyurl.com/ey8nnhp5 [tinyurl.com]

AAII bulls back https://tinyurl.com/2wtv7c3p [tinyurl.com]

Futures

DOW+194

S&P +39

Nasdaq +208

Charts/Sentiment

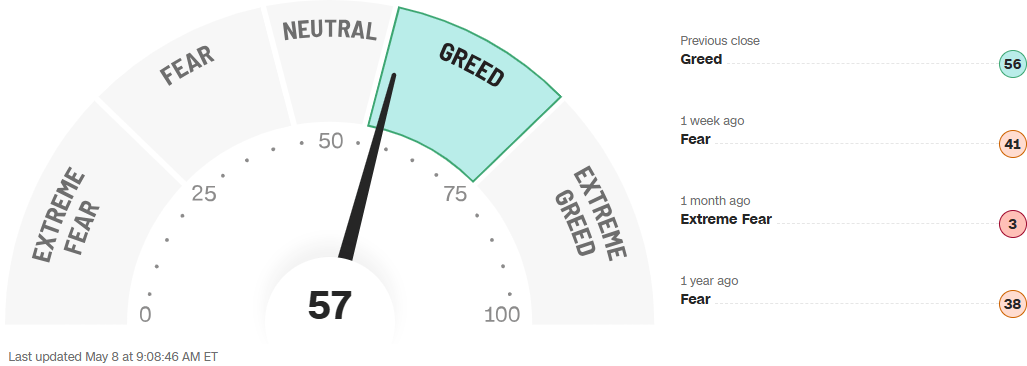

CNN Fear/Greed Index | U.S. 10 Year Treasury |

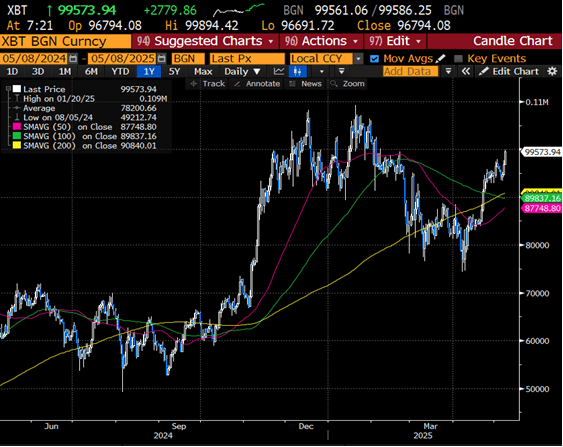

Gold | Bitcoin |

Financials / Retail / Healthcare

Solid Retail Earnings –

SN +11% - Shark Ninja crushing the blender game. FY +12%.

TPR - +9% - Coach momentum the driver.

CVNA +5% - This feels more like short covering.

DNUT – Krispy Kreme down 27% on dividend suspension.

TAP – Molson Coors reminding everyone US beer sales aren’t great, down 6%.

Beta Financials – MARA, HOOD, SOFI, RIOT, CIFR, AFRM all up 3-5% on risk on.

CODI – Down 40% - “Cannot rely on 2024 reports” . See IEP from years ago.

PTON – Down 8% - Sales continue to decline. Can we remember this the next time a public exercise fad hits?

Technology

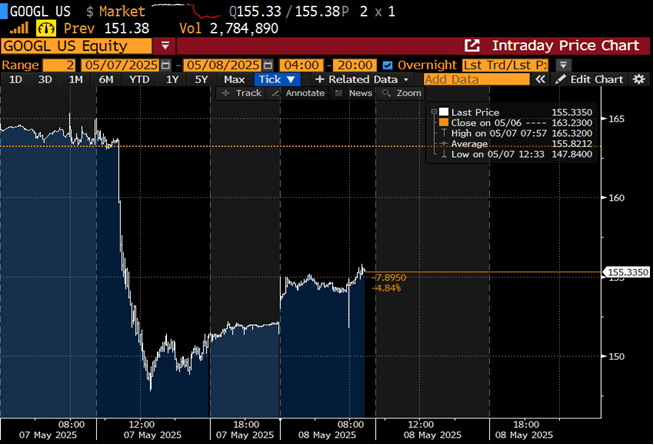

AAPL/GOOGL/AI BOMBSHELL YESTERDAY: dont think anyone had Eddie Cue testimony triggering nasty fallout on their bingo cards - Cue said that search volumes on AAPL’s Safari browser went down for the time in April, saying it “has never happened in 20 years .... it’s because people are using Chat GPT app They’re using Perplexity.” .. for GOOGL, adds to search 3P data decel’d in the latest two weeks

GOOGL: +2% in pre; bounce of $150 level

SEMIS: SMH +2% as chips extending gains / INTC+3.3%, AVGO +2.4%, MRVL+2.2%, MU+2.2%, AMD+2%, ASML/NVDA/STM+1.9% .... INFINEON +4% locally as cuts its FY (fx + tariffs); strong order intake points to a potential recovery in industrial/auto chips ... Trump admin plans to rescind AI chip curbs step in right direction (what mastermind Jensen has been pushing) - light on details but seems like at least a bit more dovish than initial Biden AI diffusion rules

APP: +15% CEO motivated to crush + delivered .. Big beat driven by advertising. Ad revenue hit $1.15B (vs ~$1.1B bogey), while Advertising EBITDA surged to $980M (vs. $813M consensus) ... Outperformance comes before the global launch of self-service, which is likely to cause yet another inflection

ARM: -8% Q1 roughly inline w street but worse than bogeys, with growing v9 mix. F1Q outlook came in light and no FY26 guide was provided .. shorts will lean into it

CVNA: +5% strong reversal off post lows / unit growth continues to shine; strong 1Q25 results with revenue, GPU, and adj. EBITDA ahead of consensus expectations. positive commentary during cal ... Qualitative commentary on the rest of the year remains positive, and mgmt outlines a new long-term goal: “our new management objective is to sell 3 million retail units per year at an Adjusted EBITDA margin of 13.5% within 5 to 10 years”

CART: CEO to join OpenAI as CEO of applications

DASH: -7% Wednesday .... supply on our desk driven by long sales vs shorts; 2 deals despite strong GOV growth odd to some

DKNG: #s tonight / 11% implied move .. focus on 2025 guide

FTNT: -8% reit FY not enough; Q1 billings beat. Q2 top line guide falls a bit short (see billings of $1.685-1.765B vs St $1.724B) .. company hasn’t seen much sales acceleration in high-growth areas like Secure Access Service Edge even with its recent acquisition of Lacework

NVDA: highest close since March 25

SHOP: -8% .. Q1 revs below buyside ($2.36B vs expects $2.38B); GMV below .... Revenue to grow at a mid-20%s y/y (buy side around $2.5B); gross profit to grow high-teens ... conf call 830am ET … BEARS think GMV is at risk in next couple qrtrs

UBER: dip to $80 bought pretty aggressively ... Uber quickly being recognized as ultimate AV winner .. Susq positive, PT to $100

SWKS: -3% solid quarter with better-than-expected guidance BUT call didnt go great. Modestly better than feared

VECO: -10% beats, but guides below

Z: -4% guides 2Q Revs / EBITDA below the street. anncs $1bn buyback

Industrials

Archer-Daniels-Midland (ADM) Cut to Underperform at BofA; PT $45

Axalta (AXTA) Cut to Neutral at JPMorgan; PT $32

International Flavors (IFF) Raised to Overweight at Barclays; PT $84

Mosaic (MOS) Raised to Outperform at RBC; PT $40

Rockwell Automation (ROK) Raised to Neutral at JPMorgan; PT $271

Latest Media

Wall Street's Top Indicators Are Sending Mixed Signals.

Recession or Resilience?

GOOGL $150 BOUNCE … has put out a statement saying that overall search volume is still growing—even on Apple devices. The company says, “People are finding Search more useful in new ways." …. May 20-21 ... Google I/O has def got a lot more interesting … MAJORITY of sell side calling for move as overblown

Crypto Bros feeling good….

SPY vs IWM .... many see IWM as a likely outperformer should we see the "all clear" signal for stocks. Short interest/shares outstanding is at the highest levels in 5 years