- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Morning Note

presented by - |  |

Invest with us here: https://www.river1.us/invest.php

Trading Observations

Fed behind up and Futures rocking higher... should move back to ATH’s

Small caps should benefit the most

The market saw a little profit taking while Powell spoke and for a moment reflected on the loss of independence but the market got what it wanted

Unemployment numbers this morning were favorable, giving fuel to the futures.

Two more rate cuts looks to be forecasted

Support at 6651 https://tinyurl.com/5zm2jrvf [tinyurl.com]

AAII big jump in bulls, just in time https://tinyurl.com/4v3c4yar [tinyurl.com]

Big news is NVDA buying a $5B stake in INTC stock at $23.28

Would also beef up INTC as a matter of national security for the US

Off INTC news, AMD down 5% while TSM down a touch

Earnings from FDX and LEN after the close.

Why small caps will enjoy lower rate cuts.... over 45% of small cap debt is short term debt https://tinyurl.com/v78j3rph [tinyurl.com]

GDP Now models 3.3% growth https://tinyurl.com/y34ax9jv [tinyurl.com]

On the back of LYFT yday, driverless taxi usage ramping https://tinyurl.com/mt6n52ds [tinyurl.com]

Futures

DOW +183

S&P +45

Nasdaq +266

Charts/Sentiment

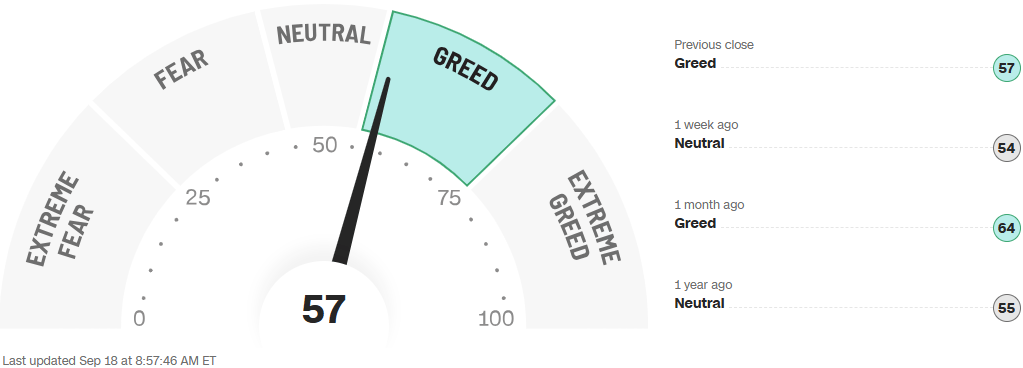

CNN Fear/Greed Index | U.S. 10 Year Treasury |

Gold | Bitcoin |

Financials / Consumer / Healthcare

AXP – Now took their platinum annual fee to $895 but added $1500 in perks including $300 in LULU credit and $400 in dining credits at Resy. It all seems a desperate stretch but LULU stock is up 4%.

SOFI – PT to $31 at Mizuho. Up 2%.

ENTB – Small biotech player in the obesity space up 87% as Roche buys them to get in the game.

PYPL (RVER Holding) up another 2% this morning on news it will IPO Pine Labs, one of its investments.

DNUT (Krispy Kreme) - Up 7% on news Kash Patel bought it and the chasers are chasing.

CRBL – Guided down after “Go Woke” campaign fell flat. Down 8%. There will be a “love to see it” crowd.

DRI – Down 8% after a slight miss in the quarter is being focused upon despite a guide up FY. Olive Garden and Longhorn misses were very slight.

LWAY – Down 24% as Danone is said to have withdrawn its offer.

ANF gains 2.4% ahead of the bell after BTIG initiates coverage on the apparel retailer with a buy rating, and a price target of $120.

NKE rise 1.7% in premarket trading after RBC Capital Markets upgraded to outperform from sector perform, citing steeper revenue recovery supported by the upcoming football World Cup.

Technology

SEMICAPS BULLISH DATA POINT: ASML+6%, AMAT+4%, LRCX+3.5% ... adding to positive commentary from LRCX / KLAC last week at GS; chatter TSMC to raise capex; INTC has been largely priced in; memory capex accelerating, etc .... NVDA/INTC headline providing a boost: "Intel to design and manufacture custom data center and client CPUs with NVIDIA" ...

MAG-7: TSLA +1.1%, NVDA +2.9%, GOOGL +1.4%, MSFT +0.5%, AAPL +0.2%, AMZN +0.7%, META +0.6%

AAPL: hoping to drive a ~10% increase in iPhone shipments next calendar year, and mgmt. thinks a new foldable version of the product could help fuel demand (Nikkei)

AMD: -4.8% negative bankshot from INTC/NVDA headlines

AMZN/CMCSA: are rolling out new AI-based tools to help automate the ad creation process, while Meta aims to fully automate ad creation by the end of next year (WSJ)

AMZN: Amazon.com's finance teams are using generative AI in new ways to more efficiently comply with complex tax regulations, help evaluate the financial impact of new products and better analyze changes in revenue.

CRWD: +6% flurry of bullish takeaways from Fal.Con 2025; announced its new Risk-based Patching feature with Falcon on Wednesday. This AI-driven solution combines security and IT operations into one platform. Provided an early annual recurring revenue outlook fiscal 2027 of 20%-plus (vs 17% for 2025) driven by a strong pipeline, retention, and internal investments

CRWD LT guide: now sees a path to $20 billion in ending ARR by FY36 (from $10 billion in FY31) representing a 15% CAGR driven by Agentic SOC and cloud, Next-Gen Identity, and Next-Gen SIEM opportunities

GOOGL: +1.5% China drops GOOGL probe during US trade talks (FT)

INTC: +29% Nvidia Invests $5 Billion in Intel With Plans to Co-Design Chips .. will buy Intel common stock at $23.28 per share, the two companies said on Thursday, a 6.5% discount to Wednesday’s closing price. Intel will use Nvidia’s graphics technology in upcoming PC chips and also provide its processors for data center products built around Nvidia hardware. The two companies didn’t offer a timeline for when the first parts will go on sale and said the announcement doesn’t affect their individual future plans

MU: set to rally for 12th consec session

PYPL: rallied late in session ... multiyear strategic partnership w GOOGL to embed PayPal checkout/Hyperwallet/Payouts across Google products, with PayPal Enterprise Payments serving as a key processor for Google Cloud, Ads, and Play; the tie-up also targets AI-driven/agentic shopping experiences built on Google’s AI

RDDT: shrs volatile Wed - alpha laggard early before rallying Google related headline; Piper positive ad metrics checks this am / recent Anthropic lawsuit is a bullish signal for Data Licensing revenues ... multiple HF buyers on am weakness

Industrials

AAON: reaffirms 2025 outlook; 3-year targets in investor presentation - 8-K

AVAV: Rated New Buy at BofA; PT $300

CSX: upgraded to outperform from sector perform at RBC Capital Markets; $39 PT

DORM: initiated outperform at BMO Capital Markets; $180 PT