- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Calendar

This Week – Today feels like we watch to see if this rally can hold after a rough finish to Friday. The week will be owned by NVDA earnings Wednesday post and 15 or so Fed speakers that likely cancel each other out.

Tuesday – Home Prices

Wednesday – NVDA Earnings Post, Home Sales

Thursday – Jobless Claims, Durable Goods, Home Sales

Friday – PCE. Trade Balance could be interesting.

Trading Observations

Treacherous waters as S&P closed below 6000 and 50-day ma. Will we get another attempt to rally and fade?

5960 is last support before a vacuum to 5900 vs. 6010 first level to reclaim with 6075 more significant

IWM with first meaningful close below 200-day since Nov 2023 (and at same level as Feb 21!) and EPS forecasts not really progressing https://tinyurl.com/epkpkr2x [tinyurl.com]

Hoping for a turnaround Tuesday, though I think NDVA earnings tomorrow night the first opportunity to either clear the decks, or calm the waters

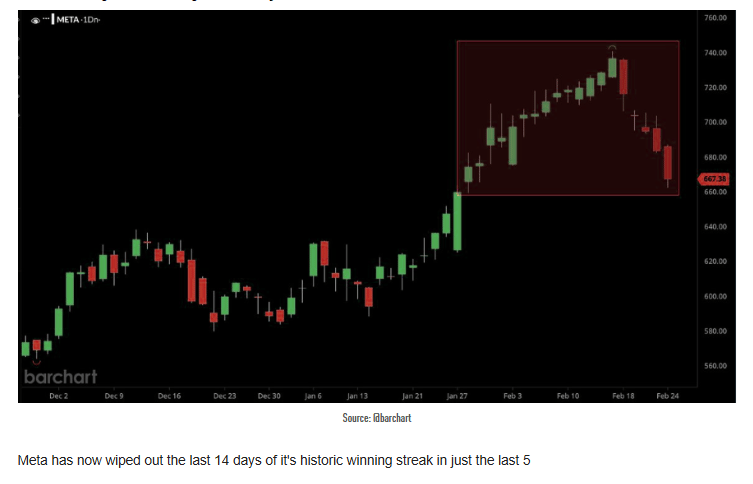

Growth remains under pressure with FFTY down 15% in 5 days

S&P oscillator at -.82% so only slightly oversold despite the heaviness last couple of days

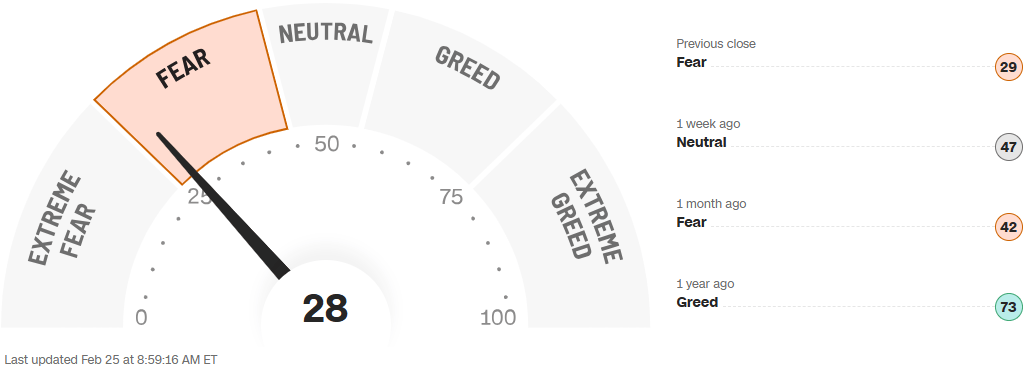

Total put/call at .97, the highest since Jan 2nd so some fear creeping in

Futures

DOW +102

S&P +2

Nasdaq -8

CNN Fear/Greed Index

10-Year Yield

Oil

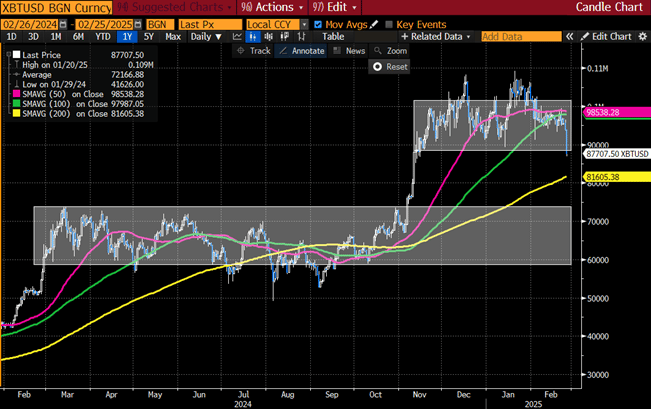

BITCOIN

Financials / Retail / Healthcare

CRYPTO Carange: Bitcoin now ~20% off highs seen last month; coincides with fading retail bid / sentiment; ETH weekly chart shows we are just below the 200 weekly moving average, hitting some sort of longer-term trend

MSTR - Saylor just bought a load of coins @ +$97k... Bitcoin trading $88k last...

The top 10% of income earners in the US now account for half of all consumer spending, a record high.

(Note: top 10% = households making >$250k). {https://bilello.blog/newsletter [bilello.blog]}

LLY ticks about 1% higher as management ramps up the fight against cheaper, copycat versions of Zepbound by lowering prices for a version of its blockbuster obesity drug.

SBUX – several bidders, including KKR, Fountainvest, PAG, China Resources, and Meituan, are interested in buying a piece of Starbucks’ China business

HIMS - down big with concerns about 2025 outsized contribution from weight loss.

Crypto Related – MARA, HOOD, CLSK, RIOD, COIN all ~4% lower as BTDR, down 19%, missed.

HD – Up 1% - Net sales up 14% y/y should help. Comp sales beat expectations too. Average ticket is up a little, transactions in general up 7.6% y/y is solid.

January Powerboat sales up 3% y/y. Nice to see a positive number in this area.

CHH – Domestic unit growth remains sluggish in this middle of the road hotel player.

TREX – Up 4% on above the street numbers. 5-7% sales growth for this decker vs +0% for the category shows good share take, and the market loves that right now.

Restaurants – Baird pointing out that quarter to date sales comps remain weak but are blaming weather and not throwing in the towel. DPZ was very uninspiring yesterday.

PYPL – Up 3% on investor day guidance announcement.

DNUT – Krispy Kreme down 20% on a sales miss. Brand from the past stock proving that.

Technology

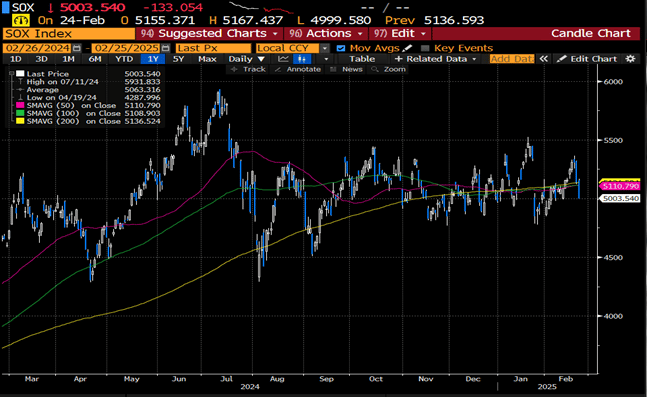

Semi Restrictions: Trump is planning to toughen semiconductor restrictions on China, continuing and expanding the Biden’s efforts to limit China’s technological prowess. U.S. officials recently met with their Japanese and Dutch counterparts about restricting Tokyo Electron and ASML engineers from maintaining semiconductor gear in China. Some Trump officials also aim to further restrict the type of Nvidia chips that can be exported to China without a license

AAPL: reaches a deal w/Indonesia to allow sales of the iPhone 16 in the country (Bloomberg)

AMT: sees '25 adj EBITDA below at mid. Q4 better

MSFT (Goldman comments post close): "Adjustments to CapEx allocation reaffirms our conviction in Microsoft's prudent AI investment approach ... reit ests for $588bn/91tbn in FY25/26 CapEx unch following recent reporting that Microsoft has potentially delayed or canceled some of its AI data center leases ..... While unconfirmed, we believe this reporting emphasizes what the Co has already telegraphed: that as a responsible capital allocator, Microsoft cont to invest in AI capacity prudently with an eye towards returns.

NVDA: Nvidia's H20 chip orders jump as Chinese firms adopt DeepSeek's AI models, sources say (Reuters) ... Investors are hoping for a tech-driven market bailout after the Nvidia report on Wed

CSCO / NVDA – Partnership on AI rollout.

PYPL Investor Day

TSMC: AI GPU orders max out TSMC’s CoWoS capacity; IC testing firms booked through 2026 (DigiTimes)

ZM: -5% hit as outlook below - raising questions around the sustainability of its recovery. Qrtr was fine .. just not a lot of appetite for stories bouncing along the bottom

Industrials

Quanta Services (PWR) Raised to Outperform at BMO; PT $316 while Quanta Services (PWR) Cut to Hold at Daiwa; PT $280

SOX continues to chop around; essentially unch since last March

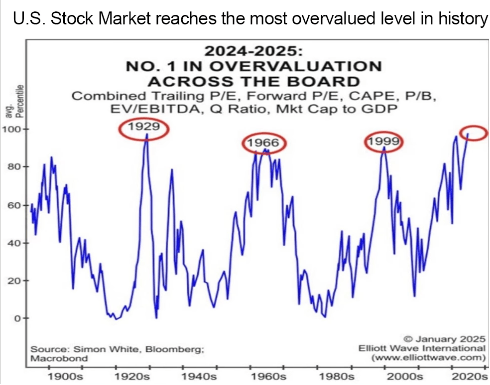

For the bears, CTAs sellers

Bitcoin breaking support