- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Morning Note

presented by - |  |

Invest with us here: https://www.river1.us/invest.php

Trading Observations

Little incremental

DAL earnings, jobless claims premkt, 30-yr auction (10-yr solid yest)

Still hoping we get one positive trade deal announcement (EU? India?) to offset the proliferation of letters

6275 resistance vs. 6175 support

AII Bulls DROP to 41% from 45%

Fwiw (20-day at 6110 currently) https://tinyurl.com/27rnej2n [tinyurl.com]

Rents continue to drop https://tinyurl.com/3z29j6tf [tinyurl.com]

Housing market starting to firm at the edges? https://tinyurl.com/2c9k4cnw [tinyurl.com]

Futures

DOW -83

S&P -6

Nasdaq -8

Charts/Sentiment

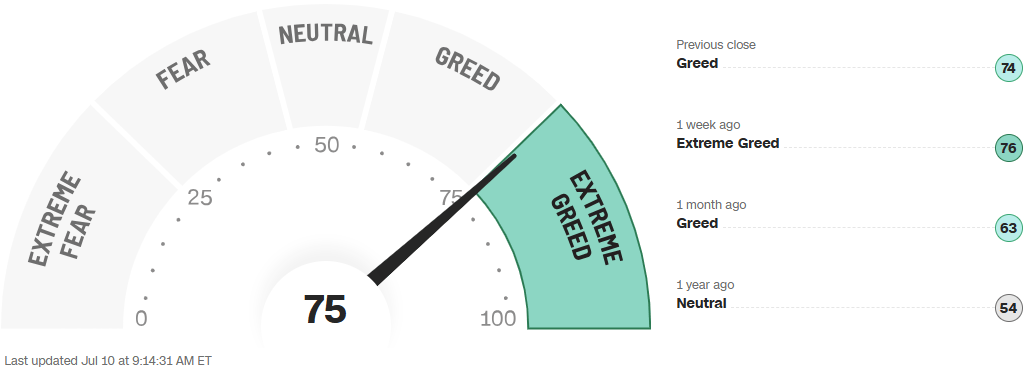

CNN Fear/Greed Index | U.S. 10 Year Treasury |

Oil | Bitcoin |

Financials / Consumer / Healthcare

CRCL – Up 3% on a deal to share revenue with crypto exchange Bybit.

JPM – Large cap bank earnings preview is cautious on valuation after the run. They think macro will be key from here.

SOFI – Strong since BBB as grad school loans can no longer be government backed, opening a window for SOFI.

COST – Comps +6.2% on solid per ticket growth. One day this valuation will implode, but it likely won’t be until comps do the same.

HELE – Down 30% on an absolute whiff on EPS and revenue ($420M vs $467M street). Think Honeywell, Revlon, Vicks, Braun, etc as the brands they own. Lots of hair care.

CAG – Conagra Down 5% blaming a massive EPS miss on the price of cans going up. FY 2026 $1.78 vs $2.45 street is scary. Middle of the supermarket brands like Duncan Hines, Orville Redenbacher, hunts, etc.

MCD – Up 1% on a GS upgrade. Spicy McMuffins call.

CAKE – Down 1% on a GS downgrade on valuation.

GOOS – Bain is considering a sale of all or part of its stake in Canada Goose – Bloomey

DLTR replenished its $2.5B share repurchase authorization.

LVMH etc - Luxury stocks are mentioned positively in a Barron’s profile article – fundamentals aren’t as bad as feared, and valuations are much cheaper than they’ve been in the past

Technology

AI: headlines remain bullish ... TSMC strong monthly sales; Groq is in talks to raise $300-500M at a post-money valuation of ~$6B (The Information) .... MSFT said increased utilization of AI in its call centers saved the company >$500MM last year

AI Power UP: Utilities in the US are attempting to push through massive rate increases as demand for power surges on back of rising AI adoption and infrastructure costs climb because of climate change (FT)

AMZN: Amazon Web Services is building equipment to cool Nvidia GPUs as AI boom accelerates (CNBC)

AMZN - Amazon Prime day sales down 41% compared to year ago after sales period extended – Bloomey

ADSK reportedly exploring acquisition of PTC https://tinyurl.com/2ptnc49h [tinyurl.com]

AMZN/AI: in talks to make another large investment in Anthropic as the companies deepen their ties (FT)

GOOGL shrugged off multiple competitive AI headlines (Perplexity around 11am ET; OpenAI closer to 2pm ET) .... feel like 6+ months ago stock would be down 5%

GOOGL Search headlines from Wed: (1)OpenAI plans to launch its own web browser, a move that’s set to ratchet up competition with Google even further (the browser will face off against Google’s Chrome) ... (2)Perplexity on Wed launched a web browser, the latest sign of AI startups aggressively encroaching into Google’s dominant footprint on the internet

Meta enticed head of Apple's head of AI models with generous package of more than $200M – Bloomey

NVDA: Jensen will meet Chinese officials in Beijing, reaffirming commitment amid US-China tech tensions (Bloomberg)

ORCL plans to team up with DayOne for cloud services in Indonesia … ORCL, WDAY. Oracle Raised to Overweight at Piper Sandler, Workday Downgraded

PLTR: Ives reit bullish view / PT to $160

ROKU: +3% KeyB ugprading (saying budget shifts and ad innovations have created multi-year tailwinds); Piper lifting PT; benefiting from a combination of secular drivers, monetization initiatives

TSLA/AI: xAI launches Grok 4, claiming it's smarter than most graduate students, amid recent controversy

Industrials

TSLA: said it would expand its robotaxi service to San Francisco within the next 1-2 months (Reuters); coming under pressure from shareholders to schedule its annual meeting (it faces a deadline of Jul 13) (WSJ)

BA - BA released its 2Q25 aircraft deliveries with a healthy delivery total for June, with 60 BCA deliveries resulting in 150 deliveries for 2Q25 (well above the consensus of 124 aircraft).

AGCO (AGCO) announces new $1B share repurchase program

Delta Air Lines (DAL) trading up 10% after reporting Q2 earnings and reinstating FY guidance

Huntington Ingalls (HII) upgraded to buy from hold at TD Cowen

Lockheed Martin (LMT) downgraded to hold from buy at TD Cowen

Mobileye Global (MBLY) 50M-share secondary (by holder Intel) priced at $16.50/share

MP Materials (MP) announces public-private partnership with the Department of Defense to accelerate U.S. rare earth magnet independence

Zebra Tech (ZBRA) upgraded to outperform at BNPP Exane