- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Morning Note

presented by - |  |

Invest with us here: https://www.river1.us/invest.php

Trading Observations

ADP employment was a complete whiff at 32k jobs lost vs expectations of 51k jobs gained.

Their revision was also terrible for last month. One cannot claim BLS manipulation here so it’s a real negative employment data point on the board.

The Government shut down. The market won’t care unless it goes past October 15th.

Will Trump and co use this opportunity for DOGE 2.0? The first version only cut $200B of spending when they had promised $2T, which is the only reason why Virginia isn’t in a recession.

RVER1 AM is predicting a decent selloff in the near future as valuations are ridiculous in some spots and employment and credit are trending negatively.

Futures

DOW -114

S&P -28

Nasdaq -123

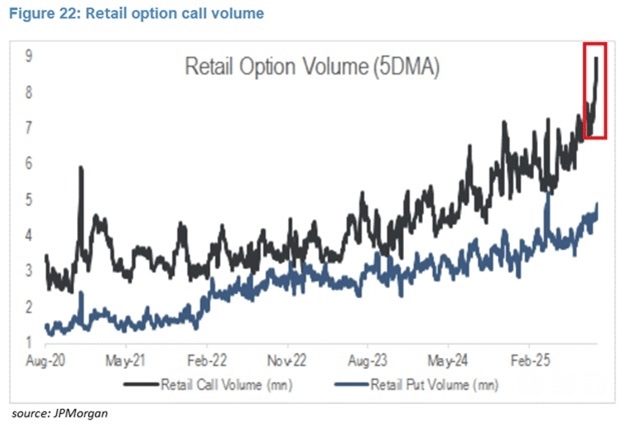

Too Many Retail Call Buyers Could Slow the Rally (these have to expire, then we can go up typically).

Something to monitor – Smaller banks not participating in the rally as signs of credit issues hit the headline roll (nothing has been huge, maybe CarMax).

If you’d like proof credit is a worry, here’s the UPST chart –

Financials / Consumer / Healthcare

NKE – Up 5%. Solid 6% revenue beat, which was much needed. Mix was negative as direct business is lower, wholesale higher, so we don’t think there’s much more upside than this little relief rally. JPM says “Just Buy It!”.

CAG – Conagra up 2% on an earnings beat. They are calling the consumer cautious, but the stock is crazy cheap at single digit P/E.

NVO (RVER name) – Up 3% as drug prices gain more clarity. All the Euro drug makers up 2-6%.

Technology

CART (RVER name) – Baird defending saying sentiment is rock bottom. Competition is clear, but TAM is so high they see winners across the board including CART.

RDDT – Down 10% - No news yet as to why. Likely one of the AI players stepping back training usage.

UPST – Up 5% as Seeking Alpha and others defend.

DKNG – Down another 2% after a bad week as HOOD is pushing more gamblers to “prediction markets” vs traditional sites. You are all going to lose everything in the account, so it’s just a matter of who you want to give it to.

MRVL – Down 2% on a TD Cowen downgrade stating, “lack of cloud visibility”.

RZLV – Rezolve AI up 22% on higher ARR guidance. New entrant into the AI stock love affair.

AMZN – Move over Kirkland, AMZN is launching a private label grocer business.

JPM on AAPL iPhone Launch saying Upgraders are the drive, not AI features. Points to a boring upgrade cycle.

Industrials

AES – Up 10% - Blackrock is said to be in talks to buy this Power Company as the bets on electricity being more valuable continue.

HRI (Herc), URI – Upgraded to outperform at Baird.

Other upgrades – DAL, MRCY, RUN

Other downgrades – GEV (valuation), MYRG, TTEK