- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Morning Note

presented by - |  |

Invest with us here: https://www.river1.us/invest.php

Trading Observations

S&P Futures down 1%, will weakness be bought, or could this be a start of a little correction?

Valuation seems to be the reason for weakness and PLTR the focus... even though amazing numbers it's down 7% and back to around its mid-October breakout area OF ~$190

An interesting take on PLTR lofty valuation https://tinyurl.com/fay25d8a [tinyurl.com]

With individual investors a significant part of this market, don’t underestimate Michael Burry’s new highly negative bets against PLTR and NVDA https://tinyurl.com/juz36m5c [tinyurl.com]

And the bears like Marko Kolanovic highlighting the absurdity of the NVDA/Open AI deals https://tinyurl.com/3aw8r58s [tinyurl.com]

Market breadth continues to be narrow: SPX once again finished higher with over 60% of the underlying stocks actually closed lower

Both the NYSE and Nasdaq have had three straight days with more stocks making new lows than new highs

DENN being bought for $6.25 but restaurants are not the hottest sector.... WING down a quick 10% on earnings

Goldman Sachs and Morgan Stanley warn of a potential 10-20% market drawdown within 24 months – CNBC

Futures

DOW - -287

S&P -80

Nasdaq -409

Charts/Sentiment

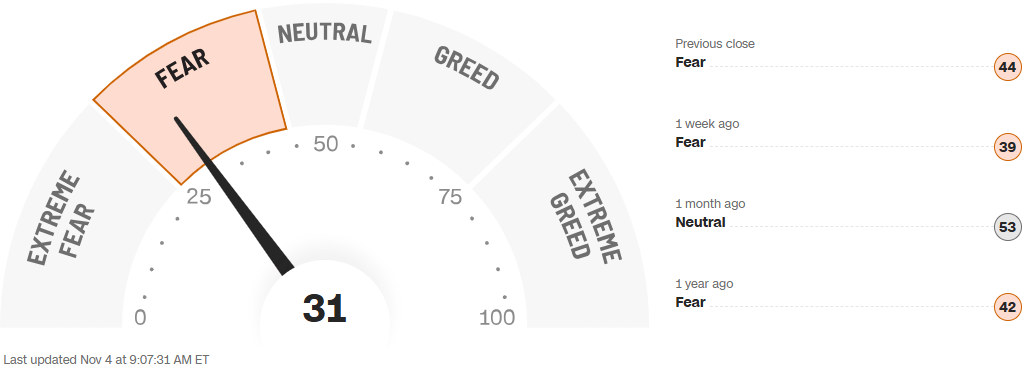

CNN Fear/Greed Index | U.S. 10 Year Treasury |

Gold | Bitcoin |

Financials / Consumer / Healthcare

HTZ- Up 17% on a profit beat. Bloomberg short squeeze is 90/100, which is the real positive.

DENN – Denny’s up 50% as P/E is taking them private for $620MM. Deny’s had a debt problem, but is now pre-leveraged, so this is likely a win/win for both.

NCLH – Norwegian Cruise line down 10% on slowing yield growth pushing against profits.

QS – Down 5% on a $6MM insider sale.

DKNG – Down 4% on a BAC downgrade. It’s a bit late, but folks realizing online gambling costs a lot when it comes to customer acquisition, especially since you rinse your customer value over time.

WING – Flat despite a double miss top and bottom line. The stock is off massively from its highs, so the sell pressure probably can’t handle it

SBUX – To sell 60% of its China business for $4B to Boyu.

RACE – Ferrari – Up 1% on slightly better than expected sales.

HIMS – Up 3% on a very solid revenue quarter, and announcement they will potentially play nice with NVO.

NVO - NOVO NORDISK BOOSTS BID FOR METSERA

ADM – Down 8% on biofuel uncertainty.

TAP – Coors flat on an earnings miss. Alcohol woes seem well priced in down here.

APO – Up 9% on assets nearing $1T, solid earnings.

GPN: +6% reit FY25 outlook; oper margins/EPS inline. Adj net rev slight beat. Merchant Solutions adjusted rev $1.88B (est $1.87B); Issuer Solutions adj rev $561.8M (est $551.7M).

Technology

Memory: group hit hard overnight / easy target for profit taking .. HYNIX-7%, SAMSUNG-6.5%, PHISON-6%, NANYA-4%, KIOXIA-1% .... in US pre: SNDK-7%, STX-4.2%, WDC-3.6%, MU-3.5% as of 620am ET

ALAB: #s tonight / 13.8% implied move ..... bogeys Q3 revs $225M vs St @ $207M; Q4 rev guide $235M vs St at $215M

AMD: #s tonight at 4:15pm ET / 6.2% implied move ... even more focus on 11/11 Investor Day . hearing Q3 rev $9B+ vs guide of $8.74B; Q4 rev $9.35B at mid vs St at $9.21B ... bullish thesis has been built around expanding story / narrative beyond OpenAI

ANET: #s tonight / 9.3% implied move .. bogeys hearing: Q3 rev 28% vs St 25% y/y; Q4 rev 22-23% vs St @ 20.5% y/y

PINS: #s tonight / 12.8% implied ... hearing Q3 rev +17.5% vs guide of 15-17% at St at 16.5%

APP: Edgewater says Ecom checks remain constructive in Q4 (BofA also positive) ABNB/EXPE: M-sci negative saying Q4 suggests weaker volume trends in U.S. and Europe … CONSUMER CONCERNS CREEPING HIGHER IN FACE OF ONGOING GOVT SHUTDOWN

PLTR: -7% momentum poster child getting hit on valuation / US concentration (+400% y/o/y to keep things in perspective). Order momentum fueled beat + raise (ppl looking for cheaper Software ways to play AI - ie SNOW, MDB etc)... Results remain overwhelmingly U.S.-centric, with international performance stagnant and bookings heavily skewed toward multi-year U.S. commercial Al contracts that may pull forward demand. Fundamental momentum at the company remains extremely strong, and the only issue with the stock is valuation

GRAB: -7% big run off '25 lows ... solid print met with sell the news reaction. Better-than-expected quarterly profit and raised its earnings outlook, helped by both its high-margin offerings and low-priced products; stronger-than-expected EBITDA was mainly attributable to outperformance in deliveries GMV and margins

BIG SHORTS: Michael Burry 13F shows new puts in PLTR, NVDA

DKNG/FLUT: downgraded @ BofA amid relentless headwinds - argues that sports outcomes in Q3 and Q4 raise concerns around volatility and long-term earnings; DraftKings has underperformed in iGaming

LDOS: lifts FY25 EPS view; reit revs. Solid Q3 beat. "Despite the government shutdown, we are raising our 2025 earnings and margin guidance and holding firm on our 2025 revenue and cash guidance"

LSCC: Q3 results right inline w/the Street down the line (sales, GMs, and EPS), and the Q4 outlook mid-points are consistent w/ consensus too (see EPS/rev 32c/$143M vs St 32c/$142M

MU: CFO sells $28,000,000 worth of shares .. cant go broke taking profits

SHOP: -2% whipping around in pre (Huge run into print ... Up 4 out of 5 weeks .... Sentiment sits near highs with stock up 15% after last q’s GMV acceleration as OpenAI’s Instant Checkout partnership has gotten the long-term bulls even more excited. 3p data also remains strong) .... Sees Q4 rev up mid-to-high 20s pct rate (buy side 26%). Q3 revs +32% (buy side +30%); GMV +32% (buy side +36% y/y growth). Tough setups all over the place (+65% YTD, +120% Y/Y

UBER: First reaction lower as slightly below buy side on some key metrics. Call on deck) ... Q3 bookings $49.74B (buy side 49.5B+); sees Q4 GBs $52.25 - 53.75B (buy side $54B at high end so touch below); Q3 mobility +20% y/y (buy side +19%); Q4 EBITDA guide $2.46B at mid (buy side closer to $2.5B) ....

UBER -7.5% tanking during call. “AV won't be profitability for years; will also use our bal sheet”

Industrials

Energy / Nuclear - Microsoft CEO says the company doesn't have enough electricity to install all the AI GPUs in its inventory - 'you may actually have a bunch of chips sitting in inventory that I can’t plug in' | Tom's Hardware https://share.google/mFWbQg2HBsgaFQWvB [share.google] Caterpillar (CAT) hosting an Investor Day in Dallas, TX today

Eaton (ETN) Q3 EPS beats modestly, Q4 EPS midpoint below consensus, FY guidance reaffirmed, stock trading down 5%

James Hardie (JHX) upgraded to buy from neutral at Citi

Knife River (KNF) upgraded to overweight from equal weight at Wells Fargo Securities

NAPCO Security (NSSC) upgraded to buy at TD Cowen

Steel Dynamics (STLD) downgraded to neutral from buy at UBS; $165 PT

Sterling Infrastructure (STRL) upgraded to buy from hold at Texas Capital Securities

Terex (TEX) upgraded to equal-weight from underweight at Morgan Stanley

Waste Management (WM) Upgraded to Outperform at Baird, mainly on valuation

TSLA slump: -2.6% China shipments fell ~10% in October (Reuters); posts another steep monthly decline in sales across Europe (Bloomberg)

TSLA: Norway’s SWF, a top-10 holder in TSLA, said it would vote against Musk’s compensation package (Musk has threatened to leave the company if the package is rejected) (FT);