- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Morning Note

presented by - |  |

Invest with us here: https://www.river1.us/invest.php

Trading Observations

House vote planned for today, assumption is it will pass, but not a slam dunk

If doesn't pass, knee-jerk is lower

ADP came in light, with Jobs tomorrow

Notable smids outperformed yday and continuing to do so pre-mkt (on hopes of deregulation in tax bill)

6147 support vs. 6240 first hurdle

Oscillators short-term overbought

II BULLS leap to 51% from 38%, not a headwind until above 60%...

Still very much in sync with history https://tinyurl.com/3aw552a9 [tinyurl.com]

XLF to new highs isn't bearish https://tinyurl.com/2s3k6wke [tinyurl.com]

Futures

DOW -16

S&P -9

Nasdaq -75

Charts/Sentiment

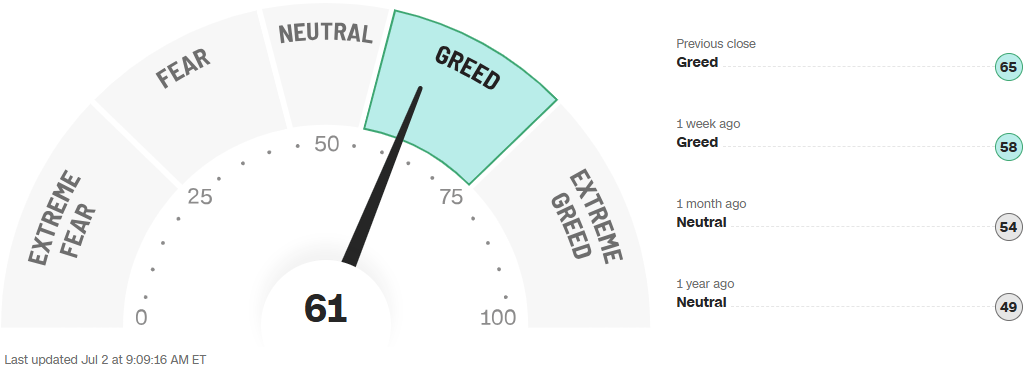

CNN Fear/Greed Index | U.S. 10 Year Treasury |

Oil | Bitcoin |

Financials / Consumer / Healthcare

CNC – Insurer Centene is down 31% after they pull guidance. They are a managed care provider in Medicaid and Medicare and are now victim of what we call “stroke of pen risk” thanks to BBB.

JPM – Down 1% on lackluster buyback and dividend numbers. The $50B buyback is their entire net income for 2025 estimated, and 6% of their total market cap, which we find more attractive than the market does apparently.

JPM Large Cap Bank Preview – Expecting larger dividends, larger buybacks after solid stress test results and likely solid trading results for the GSIBs.

KEY – Baird downgrading to neutral ahead of EPS as recent rotation into regionals keeps them from wanting to chase. KEY was up 35% since April vs 26% KRE and 24% S&P.

MLCO – Upgraded to outperform as a high beta play in Macau gambling. Stocks were all up yesterday on news June gambling take was massive.

CAVA – Baird positive long-term after the solid pullback. We were negative in a video at the top, closer to neutral here. KeyBanc Capital Markets initiated coverage of the Mediterra

CMG – 3rd party data points to Adobo Ranch helping comps.

REITs – Finished the 1H down 2.1%, underperforming the S&P by 7.6%. Rates are largely unchanged (although volatile) but many sectors are working through pandemic oversupply.

CROX - initiated SELL at GS

OSCR fell 11% after it was initiated at underweight at Barclays, with the broker saying the stock presents assymetric downside risk after shares gained more than 50% in June alone on “speculative retail interest” despite elevated policy risks.

Technology

AAPL: +0.8% early alpha leader in megacaps (for 3rd day). Clearly extreme positioning here (MFs UW; every HF short) .. Jefferies upgrade follows hope Co realizing it needs to act sooner than later to become relevant in AI ($3 tril of mkt cap to play with here) ... see if can reclaim 100D, $212.43 - its been a while

Foxconn Technology Group has asked hundreds of Chinese engineers and technicians to return home from its iPhone factories in India, dealing a blow to Apple Inc.’s manufacturing push in the South Asian country

ADBE: -1.4% d/g at Rothschild & Co Redburn to SELL - "Adobe's moat is being eroded by genAI and low-end disruption is likely to intensify; sees this continuing to put pressure on the multiple in the near-term as investors question Adobe's terminal value. In the absence of a strategic shift, the firm believes free cash flow growth will continue to slow to low single digits by 2030" ... follows failed target Figma filing who emphasized will be hunting for deals

AMZN: Bezos sells $736.7M in Amazon shares, continues funding Blue Origin, philanthropy (Bloomberg) - living his best life ... Amazon expands satellite internet to East Asia, hiring for government sales in Japan, South Korea, Taiwan (Bloomberg)

INTC: -1.2% could stop marketing its 18A manufacturing process to external customers and instead focus on 14A, a next-gen technology where the firm could have an advantage over rivals like TSMC (Reuters)

Amazon (AMZN) -0.5%, Alphabet (GOOGL) -0.5%, Microsoft (MSFT) -0.6%, Meta Platforms (META) -0.8%, Nvidia (NVDA) -1.2%

SNAP: Snapchat announced its community in India has grown to over 250 million monthly active users, which it calls "a significant milestone"

STM: +3.5% upgraded @ Oddo BHF as expect 2Q to come in near top of range .... Growth expectations for the semiconductors market in 2025 raised to +11% from +7%, 2025/2026 EPS estimates raised by average of about 4%, and target prices boosted by about 18%

ORCL and MSFT – PT raised at DA Davidson

VRNT gain 6.6% in premarket trading after Bloomberg News reported the call-center software maker is in talks with buyout firm Thoma Bravo to acquire the company, according to people familiar, who also said there is no certainty the parties will reach an agreement.

Industrials

TSLA: held 100D / shorts failed to break as Trump/Elon feud escalates once again .... Tesla saw China deliveries rise 0.8% Y/Y in June, snapping an 8-month streak of Y/Y declines (Reuters)

ABM Industries (ABM) Raised to Buy at Truist Secs; PT $58

Amcor (AMCR) Rated New Buy at Jefferies; PT $12

Aptiv (APTV) Cut to Peerperform at Wolfe

KBR (KBR) downgraded to neutral from buy at UBS

Quanta Services (PWR) downgraded to market perform from outperform at Northland Capital Markets

Stellantis (STLA) Cut to Underperform at Wolfe

TSLA reports June China sales of 71,599 vehicles, +0.8% y/y. Note: first rise in 9 months.

Visteon (VC) Raised to Outperform at Wolfe; PT $123