- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Morning Note

presented by - |  |

Invest with us here: https://www.river1.us/invest.php

Calendar

This Week – A few scattered earnings and Fed Speakers, but the al events are Non-Farm Payrolls off cycle due to the shutdown (Tuesday) and CPI Thursday.

Tuesday – NFPs, Auto Sales

Wednesday – MU Earnings, 3 Fed Speakers

Thursday – NKE, FDX Earnings, Initial Claims, CPI

Friday – Existing Home Sales

Trading Observations

Unemployment 4.6% multi year highs

Futures struggling to get going after NFPs and the AI / Tech pressure

However flurry of bullish sell side notes out there (ROKU, ACN, MCHP, OKTA, ZS, NOW, KLAC, TRMB)

MU earnings Wed post close

Still in the same range technically, bounced off 6800 support vs. 6900 resistance

If you think we are in a bubble, historically need to see tightening financial conditions to burst it https://tinyurl.com/3f57wh82 [tinyurl.com]

New highs encouraging https://tinyurl.com/6ux3n7eu [tinyurl.com]

Households own over 50% of the US equity market. OF that pile of household ownership ... the top 10% have 87% ... and the top 1% have 50%.

Futures

DOW -54

S&P -15

Nasdaq -85

Charts/Sentiment

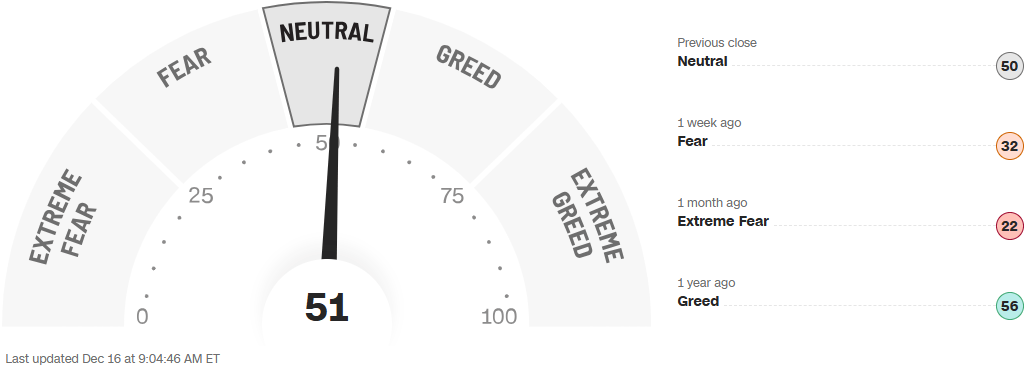

CNN Fear/Greed Index | U.S. 10 Year Treasury |

Gold | Bitcoin |

Financials / Consumer / Healthcare

Bitcoin: tested $85k around midnight but has rallied 220bps off those lows

COIN is up 1.2% after it had its price target lowered at Mizuho Securities Co Ltd to $280 from $320 as analyst Dan Dolev is cautious on its prediction markets and sees Robinhood Markets Inc. (HOOD +0.5%) as better positioned.

PYPL (RVER Name) – Up 2% on news they have applied for a Bank Charter. New age Fin Tech are all doing this to avoid the fees associated with teaming up with bank partners.

JPM on Banks – They see solid upside potential for SMID banks despite recent outperformance. Fed cuts, loan growth, and M&A are all drivers. Price Targets up across the board.

MCO – Upgraded to buy at GS on healthy global debt issuance. Reaffirmed SPGI as well. They see the global refi wall through 2029 as $5T.

PFE – Said to begin 15 obesity drug trials in 2026. FY26 rev guidance $59B - $62.5B vs $61.6B est, FY26 EPS guide $2.80 - $3.00 vs $3.05 est. Full call at 8 AM. Reaffirms FY25 EPS guide, sees FY25 rev guide $62B vs $61B - $64B. Sees 2026 covid-19 revenue of about $5B.

Visa- Saying they are now opening their US network to stablecoin settlement.

JPM – Said to have raised $1.4B for its latest P/E fund.

Japanese REITS – Up 39% YTD.

LLY – Upgraded to buy at Daiwa (late).

GAP – Upgraded to overweight at WFC.

TNDM – Upgraded at Baird, up 7%.

Fannie and Freddie adding billions of dollars of MBS and home loans to their portfolios – Bloomey

HUM fall 4.3% after the managed-care firm reaffirmed its adjusted earnings per share forecast for the full year. That forecast falls shy of analyst estimates.

Technology

Semis / Goldman call: sees hyperscaler AI spending continuing to move higher, driving tailwinds for digital, memory and storage in 2026. It also also sees a gradual industrial and automotive recovery driving cyclical tailwinds in analog.

AVGO: T+2 reaction not much better; slid an addtl 5.5% ... few inbounds early on flows/px action but margin concerns, fragile AI sentiment cont to weigh on entire AI complex ... Ppl still hoping for clearer detail on AI backlog and a tighter margin narrative. Also not helping - was the news out Sunday that claimed MediaTek starts trial production of TPU v7e in C1Q26 and is positioned to win TPU v8e

CRWV: subject of a relatively cautious profile article in the WSJ, with a focus on how construction issues delayed data center buildouts, exacerbating the stock’s recent slump

AI POWER UP: Fuel cells and SMRs emerge as possible alternatives to AI data center power shortage (DigiTimes)

BE: -19% last two sessions; down 5 out of 6 ... RSI @ 41 and drawdown off Nov 7 highs at 41%

MCHP: +1.8% Cantor upgrading ... shrs up 8 out of 10

Memory Price Surge: few DigiTimes articles - (1)Acer CEO urges firms to boost resilience amid memory price surge; (2)Apple braces for DRAM cost surge as Korean suppliers reprice contracts

META: Reuters published a neg. article Mon morning claiming that ~20% of META’s rev from Chinese advertising customers were for fraudulent or illegal products/services

NOW: zero defense on desk ysrdy as stock crated post Armis deal; bears focused on price / execution risks / crowded security space

OKTA: +1.8% Jefferies upgrading - " has a significant opportunity as it attempts to build out a complete identity platform and capture growing agentic demand"

ORCL: -18% T+3 as financing concerns linger

ROKU: +4% DOUBLE upgrade to OW @ MS (Wedbush added to Best Ideas List last week) - sees a strong 2026 for U.S. ad spend due to digital strength. Connected TV should be the fastest area of growth in a healthy ad market

Semis: SNDK +1.7% (follows positive Clev/Edgewater checks on Monday) .. INTC +1.2% Samsung's foundry division is in the final stages of preparations to begin mass production of Intel’s Platform Controller Hub chips (Korea Economic Daily); names Trump economic advisor as head of govt affairs

TEAM: Cleveland Software Checks: (1)TEAM: F2Q Seen Tracking In-Line QTD, Outlooks Lean Constructive on DC to Cloud Migration Pipeline

ZS: +2% upgraded @ Mizuho - citing valuation + confident that Zscaler remains very well-positioned within zero trust

LYFT / UBER pressure - CNBC article discusses robotaxi market in 2025: Waymo grew its lead in the robotaxi market in 2025, and is now operating, planning to launch a service or testing its vehicles in 26 markets in the U.S. and abroad. Amazon’s Zoox began offering free driverless rides to the public around the Las Vegas Strip and certain San Francisco neighborhoods. Tesla launched a Robotaxi-branded service in Austin and the San Francisco Bay Area, but those cars still had human drivers or safety supervisors on board as of mid-December.

Industrials

US declares energy transport emergency as cold slams four northeastern states – Bloomey

Albemarle (ALB) Raised to Equal-Weight at Morgan Stanley

Bunge Global (BG) Raised to Overweight at Morgan Stanley; PT $120

C.H. Robinson (CHRW) Raised to Overweight at Barclays; PT $200

Cognex (CGNX) upgraded to buy from sell at Goldman; $50 PT

General Dynamics (GD) upgraded to overweight from equal-weight at Morgan Stanley; $408 PT

Illinois Tool Works (ITW) downgraded to sell from neutral at Goldman; $230 PT\

L3Harris (LHX) raised to overweight at Morgan Stanley

MYR Group (MYRG) initiated buy at Clear Street; $295 PT

Rockwell Automation (ROK) upgraded to neutral from sell at Goldman; $448 PT

Shoals Technologies (SHLS) Cut to Equal-Weight at Morgan Stanley

SolarEdge (SEDG) Raised to Equal-Weight at Morgan Stanley; PT $33

Southwest Air (LUV) raised to overweight at Barclays

Trimble (TRMB) upgraded to overweight at KeyBanc; $99 PT

Latest Media

River1’s CIO on Schwab Network

Levered ETFs, market perspectives, etc.

Rotation - Flows are rotating into undervalued cyclicals, small-capitalization stocks and economically sensitive segments of the market as traders position to benefit from the anticipated boost in economic growth next year.