- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Morning Note

presented by - |  |

Invest with us here: https://www.river1.us/invest.php

Trading Observations

Futures higher, Nasdaq coming back some more on the back of PLTR and TER but some weakness elsewhere

RMBS sold off 15%, FN weaker may lean on Optical, NXPI saw Auto weakness, PYPL just reported down 16% with CEO leaving

Gold & Silver ripping 5% again

Fed Miran pushing for rate cuts of 1 full point

10-year yields up small but back to Aug levels

Breadth yesterday was ok not great... only 51% of the volume was on the upside on the NYSE and 55% on Nasdaq. That said, we look to regain 7000

Some trends & charts, transports ripped yday after a great January, we highlighted spot rates at truckers and Ism orders https://tinyurl.com/54rukncv [tinyurl.com]

CAT to new highs and Industrials strong https://tinyurl.com/34t78hj8 [tinyurl.com]

Value gaining on growth https://tinyurl.com/mrzjhcb8 [tinyurl.com]

Indeed VTV breaking out https://tinyurl.com/387xvbyt [tinyurl.com]

Small cap banks KRE at the highs https://tinyurl.com/3v56cvpb [tinyurl.com]

Consumer still spending according to Chase credit card data: Total spending growth for up 5% yoy https://tinyurl.com/2kbsy9a2 [tinyurl.com]

WMT new high yday, Staples best Jan ever https://tinyurl.com/yus6u2pc [tinyurl.com]

Futures

DOW -17

S&P +13

Nasdaq +117

Charts/Sentiment

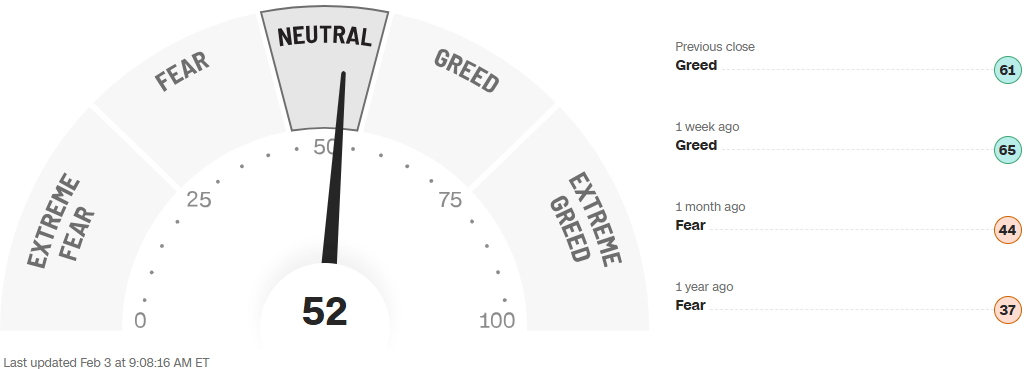

CNN Fear/Greed Index | U.S. 10 Year Treasury |

Gold | Silver |

Financials / Consumer / Healthcare

PYPL – Stock lower on a top and bottom-line miss. The stock is very cheap, holding it back from worse and probably keeping the floor on it a bit higher. Free cash flow yield of about 12% is crazy, but without a stop to the pain, our stock market doesn’t care. Announced a new CEO from HP, which isn’t a company the market will swoon over. There were also some board changes which should make some activist investors happy.

SOFI – Up 5% on a JPM upgrade. The growthy bank has executed fine, but the stock is well off the highs. Kudos to this timely upgrade.

JPM – Upgraded to neutral at Baird from underperform. The recent underperformance has been enough to catch the stock down to peers. Valuation is still 2.5x Book, which isn’t typically a good time to get outperformance.

PEP – Down 1% - Solid quarter, but it lowered price to do it. Stock is +8% YTD so the beat looks expected.

DIS – GS reiterating buy on pullback. Thinks 2026 earnings acceleration is coming.

SPG – Tiny beat for the mall name, but leasing looks +3.2% and could be revised higher, which feels like the stock market will deem as a win.

IBKR – Think of them as a smaller SCHW. Announced a record new accounts and solid January metrics.

STLA – Stellantis (should be called JEEP) – Down on MS downgrade to equal-weight.

MRK beats by 3c & revs beat by $190M….company posted a modest 2026 outlook that fell short of expectations as it prepares for a few drugs to lose patent protection later this year and face generic competition.

Technology

Megacap Bogeys (AMZN/GOOGL via MS): (1)GOOGL #s Wed night - expects seem to be for Search +16% y/y, YouTube +13%, Cloud +38% (hearing bulls want 4-handle) and FY26 Capex of $135B ... (2)AMZN - Thurs night - 4Q AWS rev growth of +22-23% y/y, total revs $212B, OI $27B, 1Q guide top-end revs $177B (want AWS implied +24%), OI $23B

Memory: SNDK+3%, MU+1% ... Asian names mixed but SAMSUNG/HYNIX surged .... Chinese memory giants CXMT and YMTC are set to aggressively expand production capacity as they look to capitalize on the AI-driven demand boom (Nikkei);

ADBE: -1.4% cut at Piper - concerned that seat-compression and vibe coding narratives could put a ceiling on the multiple

AFRM: +4% upgraded @ MS - "recent stock price weakness presents an oppty to own arguably the best fintech asset in our coverage. BNPL as a category will cont to gain share within broader e-commerce, and we expect Affirm will be a key driver of that share gain.

GOOGL/POWER UP: Google ramps spending on nuclear and geothermal power for AI data centres in bid to lead the AI energy race ... pending deal to buy Intersect, a wind and solar developer, would make it the only tech giant to own a power company

GOOGL/AI: besides Gemini has a 10-15% stake in Anthropic and a 7% stake in SpaceX that just bought xAI. This means that $GOOGL now has exposure in 3 of the 4 frontier AI labs ...

NVDA: closed on its lows .. after hours reportd that OAI has 'determined it needs alternatives to Nvidia's latest AI chips in some cases, has sought alternatives since last yr'

NXPI: -5% inline report all around / not enough post TXN blowut. Auto source of weakness; modest recovery

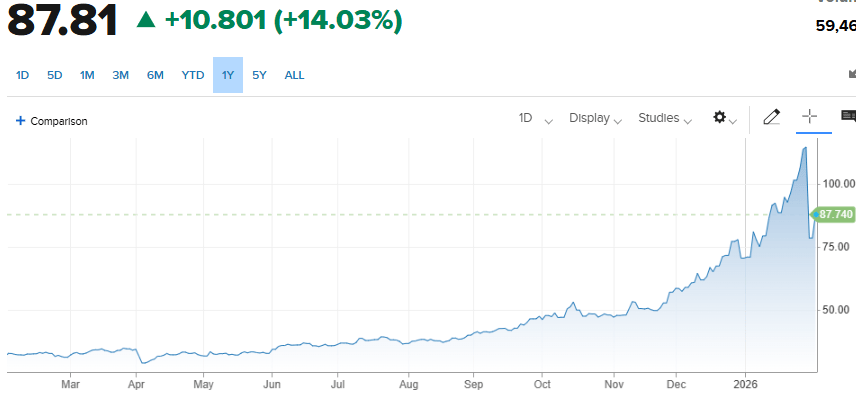

PLTR: +11% BLOWOUT - how this closes today will be closely watched ... strong upside in FQ4 on op. margins (57%, about 500bp ahead of expectations) and total rev (+70% to $1.4B vs St $1.33B), and the 2026 guide is very bullish (they see sales of $7.19B vs St $6.27B w/op. margins of ~57.5% vs St 50.5%).

TER: +21% blowout ... "fueled by AI-related demand in compute, networking and memory within our Semi Test business. Across all of our business groups – Semi Test, Product Test, and Robotics – we experienced sequential growth, and at the company level we achieved 13% growth in 2025. In 2026, we expect year-over-year growth across all of our businesses, with strong momentum in compute driven by AI.”

TSLA/xAI/SpaceX: SPACEX HAS ACQUIRED XAI ... Elon roughly estimates launching 1M tons/year of satellites at ~100 kW of compute per ton could add ~100 GW of AI compute annually, with a path to 1 TW/year. He also said he thinks the lowest-cost AI compute could be in space within 2–3 years

WDC Investor Day @ 930am ET

Industrials

AI POWER UP: Siemens Energy plans to invest $1B in US manufacturing over the next two years to meet surging power demand, with a focus on gas turbines and grid gear like transformers. The company will also set up an AI digital grid lab in Orlando with NVDA (X/Wall St Engine)

FedEx (FDX) upgraded to outperform from neutral at Bernstein; $427 PT

FedEx (FDX) upgraded to overweight from equal weight at Wells Fargo; $380 PT

JetBlue Airways (JBLU) upgraded to neutral from sell at Citi; $6 PT

Lockheed Martin (LMT) downgraded to hold from buy at DZ Bank; $665 PT

Schneider National (SNDR) downgraded to hold from buy at Stifel; $26 PT

Sun Country Airlines (SNCY) downgraded to hold from buy at TD Cowen; $18 PT

Latest Media

River1’s CIO on Schwab Network

Levered ETFs, market perspectives, etc.