- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Morning Note

presented by - |  |

Invest with us here: https://www.river1.us/invest.php

Trading Observations

S&P’s down 1.5%, Geo-political risk to the fore over Greenland

Japanese 30-year yields move 38 bps in the past 2 trading sessions https://tinyurl.com/f43mn88p [tinyurl.com]

10-year bond yields here up 1.5%

Will Europe weaponize and sell off US bonds? At 2.29% nothing to be concerned about yet for Bessent

Higher yields just as the housing market seemed to be getting relief...

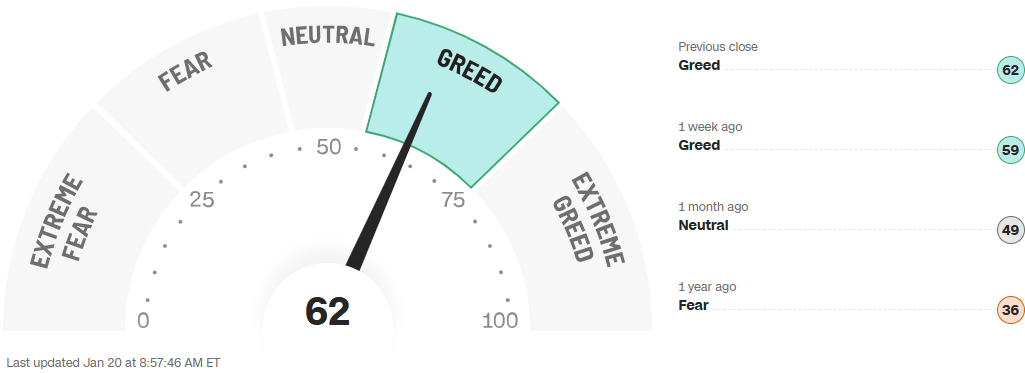

Unfortunately, the timing comes as markets are relatively overbought and sentiment relatively bullish

Friday’s put/call ratio was 0.73 so markets are short-term bullish entering today

Exposure to stocks & commodities at 4-year high vs. cash & bonds https://tinyurl.com/p52s8n3u [tinyurl.com]

Looks like we will open below 6,900 with 6,720 an important support level

Feels like we know the script that Trump will pursue but risks remain... Supreme court ruling on Tariffs more important now

The $200 billion in additional U.S. tariff revenue last year “was paid almost exclusively by Americans.” https://tinyurl.com/3tcdezhb [tinyurl.com

The MAG 7 now LAG7, losing relative performance to small caps https://tinyurl.com/35avjuex [tinyurl.com]

Gold the most crowded trade https://tinyurl.com/fmdf9vzv [tinyurl.com]

Dollar weaker https://tinyurl.com/3kb36yrh [tinyurl.com]

Futures

DOW -730

S&P -108

Nasdaq -458

Charts/Sentiment

CNN Fear/Greed Index | U.S. 10 Year Treasury |

Gold | Bitcoin |

Financials / Consumer / Healthcare

Bessent signals Trump Fed chair pick announcement possible next week; Rieder odds rising – Bloomey

FITB – Down 2% - Noisy given the CMA close. Quarter looks like it’s getting a pass.

USB – Up 1% in a down tape. Revenue, expenses, and credit all beat.

Baird on Banks – Credit metrics improving post rate cuts. Capital deployment and buybacks solid. Outlooks mixed. They like MTB and PNC as most banks are expensive.

JPM Recaps their own conference in healthcare this morning – Biotech was flat, but discussions were largely positive and interest across the space seems high. Their top picks are LLY, GILD, REGN, and ABBV.

Large up Biopharma – IBRX (RVER holding), CRVS (positive skin data), RAPT (selling to GSK for $2.2B).

IBRX (RVER Name) - ImmunityBio Climbs After FDA Meeting Update for Drug Application

MRNA cancer therapy with Merck’s Keytruda cut mortality by 49% in mid stage trial

DHI – Down 4% on a decent profit beat. Homebuilders having a bad day because of rates.

Crypto related – Down 5-6%.

PYPL – Announced a deal with MA to pay your taxes with a MasterCard fee free.

LULU - proxy fight heating up with founder Chip Wilson reportedly pushing to get PE firm Advent off the board.

Technology

YTD PERFORMANCE: winners = SNDK+74%, UCTT +73%, BE +70%, ICHR+63%, ASTS+60%, TTMI/PL +46%, CRWV/FORM/ONTO +40%, LRCX/KLAC+30% ..... Versus .... Losers = TEAM-27%, WIX/HUBS-22%, GWRE/ASAN-20%, INTU/DOCU/NOW/INTA/TWLO-17%, APP/ADBE/BILL-15%, CRM-14%

APP: (-9%) The Southeast Asian Money Laundering Syndicate’s NASDAQ "Laundromat"" Capitalwatch writes .... "This report is based on exhaustive forensic investigation and fund penetration analysis. It reveals systemic compliance risks and suspicions of major financial crimes within the core capital structure of the NASDAQ-listed AppLovin Corporation (NASDAQ: APP)" - link: https://www.capitalwatch.com/ [capitalwatch.com]

AI DATA POINTS: (1)NVDA - suppliers for the H200 chip are beginning to halt output as the prospects for strong sales in China diminish due to opposition from Beijing (the Chinese gov’t is imposing significant restrictions on purchases) (FT) ... (2)OpenAI’s CFO said the company’s ARR surpassed $20B in 2025, up from $6B in 2024 (Reuters)

AAPL: recaptured the top market share position in China during CQ4 following a spike iPhone demand (Bberg) Downgraded at Citi this am

AAPL/FFIV/IBM: added to tactical OUTPERFORM list @ Evercore ISI

CIEN: -7% BofA downgrading citing valuation and future backlog ... "sees Ciena facing downside risk to backlog levels that are

DKNG/FLUT: both -3% amid ongoing worries about share losses to prediction markets

GOOGL: seeing surging demand for its Gemini AI models, which should translate into higher revenue for Google Cloud (The Information)

GOOGL – Baird raising PT to $350- Based on Q4 industry checks, combined with updated proprietary advertiser and user surveys, and our bottoms-up models, we are slightly increasing 2026 digital ad growth estimate to +12% (from 11-12%.)

INTC UPGRADE: HSBC says agentic AI is driving upside to server central processing unit demand. While foundry uncertainties remain for Intel, engagement is increasing, the analyst tells investors in a research note. HSBC cites improving general server CPU from rising agentic AI for the upgrade to Hold

MU: will buy a chip fab from Powerchip in Taiwan for ~$1.8B to expand its memory production capacity (Bloomberg) .... Mgmt. reiterated an extremely bullish message about industry supply/demand conditions (“The shortage we are seeing is really unprecedented”) (Bloomberg)

NFLX: #s tonight / sentiment and expectations v low given WBD deal overhang (has been funding short for last ~3 mos). Stock has been in penalty box since last print for variety of reasons (lack of fresh hook/narrative; '26 guide overhang; Warner deal; Internet source of funds for reignited AI trade).

WBD, Netflix bid provides all cash deal valued at $27.75/share

NVO - ServiceNow shares outperform peers in premarket trading as the software company and OpenAI signed a multi-year agreement that will allow customers to use OpenAI models and custom AI capabilities

NVDA: suppliers for the H200 chip are beginning to halt output as the prospects for strong sales in China diminish due to opposition from Beijing (the Chinese gov’t is imposing significant restrictions on purchases) (FT)

TRUMP IN DAVOS: Trump will arrive in Davos and deliver an address that day followed by a reception with global CEOs

TSLA: will restart work on its Dojo supercomputer project and aims to become the world’s largest maker of AI chips (Barrons)

WDC/STX: UBS/Rosenblatt positive fwiw

Industrials

Energy stocks (XOM +0.5%, COP -0.3%) are mixed as JPMorgan analyst Arun Jayaram sees a cautious outlook for the oil market with lower breakevens despite geopolitical risks from Russia-Ukraine, Venezuela and Iran.

Albemarle (ALB) upgraded to buy from hold at HSBC

Allegiant Travel (ALGT) upgraded to outperform from peer perform at Wolfe Research

Builders FirstSource (BLDR) downgraded to Equal Weight from Overweight at Stephens

BWX Technologies (BWXT) downgraded to neutral from buy at Seaport Research Partners

Celanese (CE) resumed equal-weight at Morgan Stanley

Clearwater Paper (CLW) initiated hold at Truist

Eagle Materials (EXP) downgraded to equal-weight from overweight at Stephens

Enphase Energy (ENPH) upgraded to buy from neutral at Goldman Sachs

Helios Technologies (HLIO) initiated overweight at JPMorgan

Rockwell Automation (ROK) downgraded to perform from outperform at Oppenheimer

Trane Technologies (TT) upgraded to outperform from perform at Oppenheimer

Latest Media

River1’s CIO on Schwab Network

Levered ETFs, market perspectives, etc.