- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Morning Note

presented by - |  |

Invest with us here: https://www.river1.us/invest.php

Trading Observations

Again little incremental as we await earnings

Powell speaks tomorrow

6225 support vs. 6305 resistance

Certainly could see (due) a pullback, but none of them ended with strong reversals nor tip new bear trends https://tinyurl.com/34tapftn [tinyurl.com]

As we head into earnings, industrial positioning full https://tinyurl.com/3k3uz7d9 [tinyurl.com]

Price/Sales elevated https://tinyurl.com/5edcmw8y [tinyurl.com] Bar is high could get sell the news, price action in TSM

Overall, hedge funds largest net short since April https://tinyurl.com/mskv3kdm [tinyurl.com]

Futures

DOW +66

S&P +7

Nasdaq +9

Charts/Sentiment

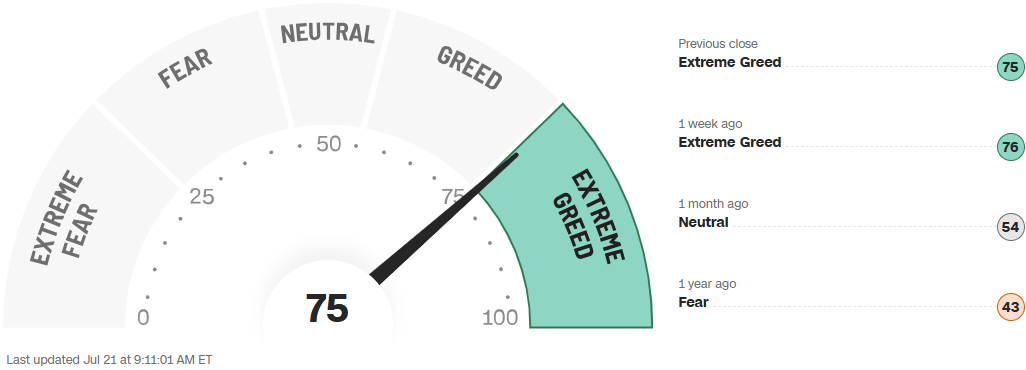

CNN Fear/Greed Index | U.S. 10 Year Treasury |

VIX | Bitcoin |

Financials / Consumer / Healthcare

Bullish, a cryptocurrency exchange whose co-founders include Peter Thiel, has filed for an initial public offering on the New York Stock Exchange, according to a regulatory filing. The company, based in the Cayman Islands, is seeking to be listed as “BLSH” https://www.cnbc.com/2025/07/18/peter-thiel-backed-cryptocurrency-exchange-bullish-files-for-nyse-ipo.html [cnbc.com]

Block (XYZ) jumps 9.5% as Jack Dorsey’s fintech firm is set to join the S&P 500 index.

AFRM) are up 2% premarket after Oppenheimer initiated coverage with an outperform recommendation, seeing strong growth ahead for the buy-now-pay-later provider.

JPM will begin providing research coverage for private companies such as OpenAI – Reuters

HOOD - hit another all-time high on Friday…. the stock is now up 191% in 2025, with growing rumors of a potential S&P 500 inclusion fueling the momentum… and then this news hits -> XYZ has been added to the S&P 500 (had the stock +10% after hours)…. (going forward, the list of potential S&P 500 entrants include HOOD, APP, CNVA, IBKR, and VRT)

IVZ are up 2.2% premarket after TD Cowen analyst Bill Katz raised the recommendation on the investment management company to buy from hold, calling its move to unlock fee revenue from the QQQ ETF a “game changing event.”

DLTR rise 3.1% after a couple of bullish analysts’ notes, including an upgrade from Barclays, and a Street-high PT boost from JPMorgan, which also added the retailer to its Analysts Favorites List.

Domino’s Pizza shares (DPZ) rise 3.9% in premarket trading after the restaurant operator reported second-quarter comparable sales growth that topped Wall Street expectations.

Pinterest (PINS) and Etsy (ETSY) rise 4.9% and 3% respectively in premarket trading as Morgan Stanley upgrades the social media stocks citing improving macroeconomic trends.

TGT fall 1.5% premarket after Barclays analyst Seth Sigman cut his recommendation on the retailer to underweight from equal-weight.

Technology

Mag 7 - Tesla (TSLA) +1.6%, Alphabet (GOOGL) +1%, Meta Platforms (META) +0.5%, Apple (AAPL) +0.8%, Amazon (AMZN) +0.3%, Nvidia (NVDA) +0.2%, Microsoft (MSFT) -0.5%

Megacap Rankings: NVDA/META/MSFT consensus top 3 (feel like can rotate if like); GOOGL sentiment creeping higher; followed by AMZN; while AAPL remains cellar dweller

AAPL will be launching a foldable iPhone at the end of 2026, although it won’t contain any breakthrough innovations that aren’t already present in Samsung devices – Bloomey

AMZN reportedly has raised prices on everyday essential items vs cuts at WMT

GOOGL YouTube has become the most-watched video provider on televisions in US. (This came up in the Netflix earnings)

META AI hiring flurry continues to get a lot of attention in the press.

NVDA - The Information reported NVDA has only limited availability of its H20 chips and at least for right now, does not plan to resume production.

ARM, SWKS, QRVO, QCOM, LRCX, KLAC etc – UBS raising PTs in chips

VZ are up 3.1% in premarket trading, after the telecom company reported second-quarter results that beat expectations and raised its profit outlook.

Industrials

CSX Corporation (CSX) upgraded to buy at TD Cowen; $45 PT

Keysight (KEYS) upgraded to neutral at BofA

Norfolk Southern Corporation (NSC) upgraded to buy at TD Cowen; $323 PT

QXO, Inc (QXO) Initiated outperform at RBC; $33 PT

Stellantis preannounced H1/Q2 results, including EU3.3B of pre-tax charges and a EU300M headwind from tariffs while shipments in the US tumbled 25% Y/Y

CEO Musk on Robotaxi's: Need to validate that Austin improvements don't cause regressions elsewhere; Waiting for EU and China regulatory approval – press