- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Morning Note

presented by - |  |

Invest with us here: https://www.river1.us/invest.php

Trading Observations

Bit of weakness to start on the back of AVGO, but was it really that bad? https://tinyurl.com/mc9h48kd [tinyurl.com]

RH + LULU higher on numbers

Wouldn't surprise to see us try and rally again as the day goes on ala ORCL. Historically AVGO weakness is bought

CLOSED above 6870 again, 6920 speedbump above, but think we make a push toward 7000 vs. 6800 support below

Oscillators still slightly overbought

For the bulls, growth wins https://tinyurl.com/y6zh7y82 [tinyurl.com]

Worth noting that for the first time in months, a break of the downtrend line in RSP/SPY https://tinyurl.com/4k8de79a [tinyurl.com]

New highs expanding https://tinyurl.com/ypbvrtew [tinyurl.com]

A/D line suggest the top not in https://tinyurl.com/5cje6ajv [tinyurl.com]

Tax refund season should be a tailwind https://tinyurl.com/56e38ty [tinyurl.com]

Futures

DOW +80

S&P -6

Nasdaq -124

Charts/Sentiment

CNN Fear/Greed Index | U.S. 10 Year Treasury |

Gold | Bitcoin |

Financials / Consumer / Healthcare

LULU – Up 10% - CEO to exit and the company is making a strategic reset. It’s been cheap for a while, and now sentiment has caught a bid on desire to change the sales growth slowing.

COST – Flat – Earnings are typically boring because they release monthly sales throughout the quarter. The EPS beat was tax and costs, so unimpressive. Comp sales remain remarkable. Valuation is cheaper than historical, but still very high. Cult stock continues to stay that way most likely.

DRI – Baird calling for a potentially soft quarter guide.

How Was NAREIT? – Poorly attended because REITs remain out of favor, likely until rates come down in the back end.

TLRY – Up 33% - This Canadian weed stock is up on Trump likely reclassifying marijuana as a Schedule III drug.

PYPL (RVER Holding ) – Cut to neutral at Baird on “taking time to fix”. The valuation is off the charts low, so any sign of progress likely creates a rip. Honestly some megacap tech company should just buy them.

IBRX – Up 5% on news Europe will allow them to trial patients.

BMY – Up 3% on positive Guggenheim comments.

RH - Q3 sales beat but EPS below on tariff headwinds and Paris opening expense and company cut FY25 sales and profit guidance.

LLY / NVO - shares rise before the bell after Reuters reported that the FDA’s Commissioner Office pushed to shrink the review window for documents tied to the drugmaker’s experimental weight-loss pill from 60 days to just one week.

Technology

Mag 7 Stocks Mostly Lower After Broadcom Outlook Falls Short

Trump signs executive order seeking to ban states from regulating AI companies https://www.nbcnews.com/tech/tech-news/trump-signs-executive-order-seeking-ban-state-laws-ai-rcna248741 [nbcnews.com]

China prepares as much as $70b in chip sector incentives – https://theedgemalaysia.com/node/785832 [theedgemalaysia.com]

AVGO - Broadcom Inc., a chip company vying with Nvidia Corp. for AI computing revenue, slumped after its sales outlook for the red-hot market failed to meet investors’ lofty expectations. Margin forecast getting hit by 100 bps.

GOOGL – PT raised to $385 from $340 at JPM

NVDA - Nvidia has told Chinese clients it is considering adding production capacity for its H200 AI chips after orders exceeded its current output level, Reuters reports, citing people familiar with the matter

SoftBank Group Corp. is studying potential acquisitions including data center operator Switch Inc., people with knowledge of the matter said, underscoring billionaire founder Masayoshi Son’s growing ambitions to ride an AI-fueled boom in digital infrastructure.

RDDT - World-First Teen Social Media Ban in Court vs Australia

Industrials

Air Products (APD) downgraded to neutral from buy at UBS; $250 PT

Badger Meter (BMI) initiated buy at Jefferies; $220 PT

Parsons (PSN) initiated buy at Citi; $86 PT

Pitney Bowes (PBI) initiated hold at Truist; $11 PT

QXO, Inc. (QXO) initiated buy at Loop Capital Markets; $31 PT

Ralliant Corp. (RAL) initiated buy at Truist; $62 PT

Watts Water Technologies (WTS) initiated hold at Jefferies; $300 PT

Zurn Elkay Water Solutions (ZWS) initiated buy at Jefferies; $58 PT

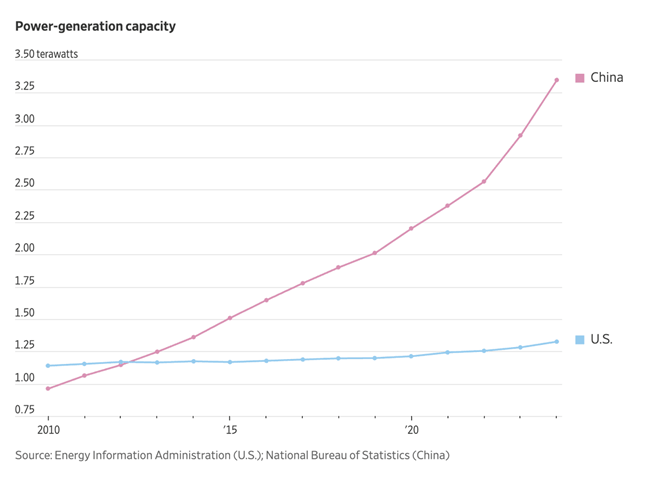

From the WSJ: "China now has 3.75 terawatts of power-generation capacity, more than double US capacity. It has 34 nuclear reactors under construction, according to the World Nuclear Association, and nearly 200 others planned or proposed.

Latest Media

River1’s CIO on Schwab Network

Levered ETFs, market perspectives, etc.