- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Morning Note

presented by - |  |

Invest with us here: https://www.river1.us/invest.php

Trading Observations

CLOSED below the 50-day (6881) but held 6800 support... early bounce puts us in middle of that range

Need to reclaim 6881 to fuel bulls, a break of 6800 opens the door to 6720

Futures up despite lower AMZN (think a weak open and reversal would embolden people more than the up open, let's hope we build as day goes on)

As to AMZN, AI commentary positive - CEO Andy Jassy noted “ I think every provider would tell you, including us that we could actually grow faster if we had all the supply that we could take."

If you dig into JOLTS report, AI showing impact https://tinyurl.com/2k4pc7v6 [tinyurl.com]

TEAM beat and raise, maybe first sign of software stabilization? Stock still down

And hence, bitcoin stabilization? https://tinyurl.com/mry5tfan [tinyurl.com]

Especially with seeming capitulation in bitcoin yday https://tinyurl.com/yx8a2ppm [tinyurl.com]

Retail out of bullets? https://tinyurl.com/45y9m5yv [tinyurl.com]

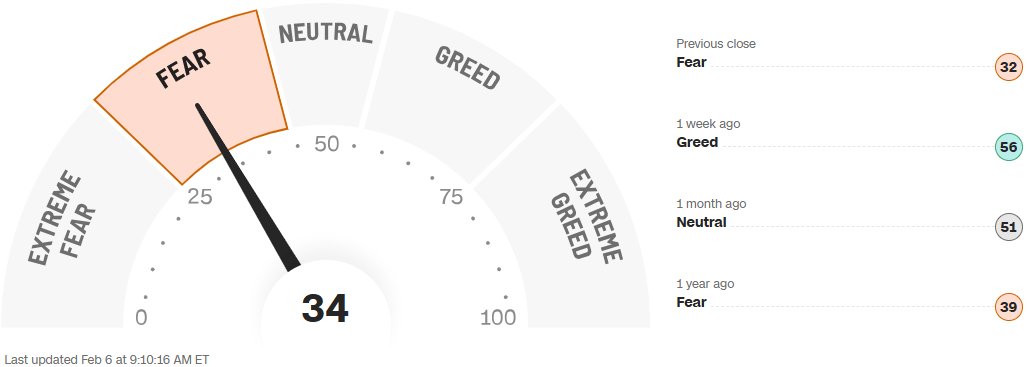

Tech selloff frustrating, and most oversold since last April https://tinyurl.com/bdzhhjp9 [tinyurl.com]

But selloff well within norms, only first of likely many pullbacks in 2026 https://tinyurl.com/yamrd7ef [tinyurl.com]

Futures

DOW +268

S&P +38

Nasdaq +148

Charts/Sentiment

CNN Fear/Greed Index | U.S. 10 Year Treasury |

Silver | Bitcoin |

Financials / Consumer / Healthcare

Wall Street Bonus Pools – Said to be up at least 10% at GS, JPM, etc.

Crypto related – Big snap back this am. HOOD +7%. Crypto related +3-8%.

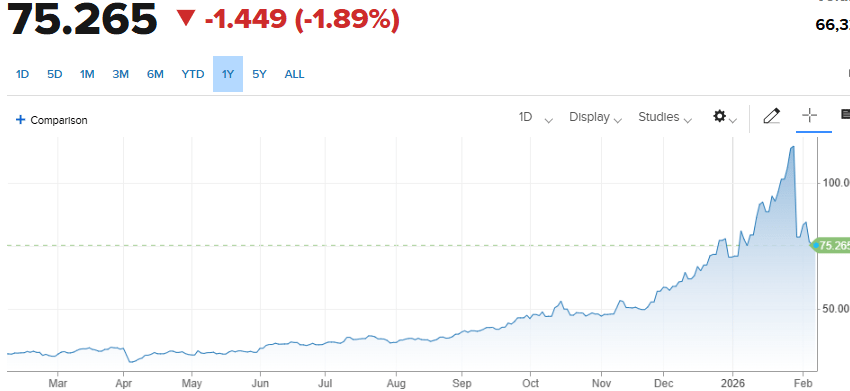

MSTR: mgmt thanking retail for support ... "This is your first downturn. I am asking you to hold on; believe in the fundamentals" (great line from TM "begging a bunch of trolls/ghouls to hold on") .... Avg px $76k / will continue with strategy (no covenants/triggers for forced selling)

MSTR: said bitcoin would need to plunge to $8K before the company had balance sheet issues

MOH – Down 31% - See UNH, but smaller. The Government read these guys 2021 income statements and said “kill them”.

Baird on Retail – Baird initiating ORLY at Neutral, downgrading GOOS, HUBG.

CBOE – Everything came in 1-2% better than expected. ZZZZ.

BKNG, EXPE – Baird adding a bullish Fresh Pick status.

MAA – Apartment rents at +1-+1.5% for 2026 likely to disappoint.

NWL – Rubbermaid down 10% on a miss. Street unlikely to care.

DLR: reported a few cents of FFO upside (1.86 vs St 1.82) w/solid bookings activity (Digital Realty signed total bookings that are expected to generate $400M of annualized GAAP rental rev, up from $201M in Q3), and the FFO guide for 2026 is a touch better (7.95 vs St 7.83)

HIMS, NVO, LLY, - HIMS a telehealth company, are down 7.1% after FDA Commissioner Marty Makary said his agency will take “swift action against companies mass-marketing illegal copycat drugs, claiming they are similar to FDA-approved products.”

Technology

AFRM: +1% upside on the main FQ2/Dec KPIs (sales, GMV, and adjusted op. income) and the full-year guide is tweaked higher, but not dramatically

AI TAPE BOMBS: only set to acclerate ... Thurs brought OpenAI’s Frontier product launch and Anthropic’s Claude Opus 4.6 release = 10+ major AI drops rumored/expected in the next 30+ days = DeepSeek V4; ByteDance Doubao 2.0; Alibaba Qwen 3.5; Kling 3.0; Seedance 2.0; GPT-5.3; Grok 4.20; Gemini 3 GA; Apple Gemini-powered Siri; Meta Avocado; new Codex

AI WARS: Anthropic's quarterly ARR additions have overtaken OpenAI's (Anthropic is adding more rev every month than OpenAI) (SemiAnalysis) ..... Anthropic: Goldman is tapping Anthropic’s AI model to automate accounting, compliance roles (CNBC)

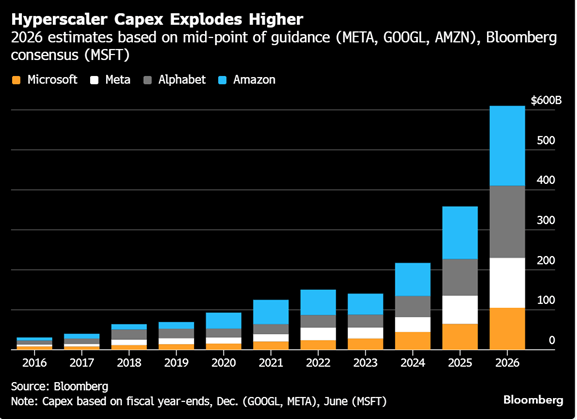

AMZN: -8% capex sticker shock offests AWS accel ..... capex $200B (well ahead of St; at this stage of AI investment cycle - only a few select names getting a free pass vs 12 mos ago). EBIT outlook worse. AWS +24% came ahead of buy side but still growing less than GCP/Azure ... Oper Income guide huge miss .... AMZN looks like it will be the only hyperscalers to post negative FCF this year as the others, including META, MSFT, and GOOGL, have the op. cash flow to support capex

FTNT: +2.3% solid upside in Q4 on EPS - beat driven by higher margins (oper margins were >200bp better) and top line outperformance (billings strong at $2.37B vs St $2.24B), and the 2026 guidance is OK .... traction with sovereign demand and healthy retention of its firewall customers have aided product growth, yet the company’s Services segment continues to trail peers

MCHP: already issued two upside preannouncements for FQ3/Dec (thanks to improved demand and prior inventory reductions), so the real focus is on guidance - FQ4 outlook is ahead of plan (they see EPS/rev of 50c/$1.26B vs. the Street 48c/$1.23B). “Our March quarter starting backlog is substantially better than the December quarter levels, and our booking momentum remains strong”

MEMORY: Rising memory prices prompt Samsung, SK Hynix and Micron to adopt short-term contracts (ETNews) - payments are adjusted based on market prices even after supply ends, effectively capturing price gains. Trendforce solid article: https://www.trendforce.com/news/2026/02/06/news-samsung-sk-hynix-micron-reportedly-shift-to-short-term-post-settlement-deals-for-north-american-big-tech/ [trendforce.com]

NVDA: warns the White House that the rules attached to the H200 chip sales into China are too onerous and risk destroying mainland demand (WSJ)

RBLX: +9% squeeze / sentiment has been terrible (shorts pressed/longs puked on recent Project Genie launch) ... Roblox strong print, incl DAUs, but more importantly strong guide and walking back the large capex increase by saying "slight increase" in 2026 CapEx ...

RDDT: +10% another name where sentiment had gotten pretty grim ... strong upside in Q4 on EBITDA ($327M vs St $286M), w/the beat driven by better sales (+70% to $726MM vs St $667M w/ARPU accounting for most of the top line outperformance while DAUs were a touch ahead) and higher margins (EBITDA margins of 45% were about 200bp ahead of plan

SNOW: Jefferies positive - "remains one of the clearest AI beneficiaries in all of public software, supported by strong AI tailwinds, new product catalysts (Snowflake Intelligence), improving sales productivity, expanding partnerships, and accelerating leading signals (RPO +37% growth)"

TEAM: +2% upside in FQ2 on EPS (1.22 vs. St 1.15), w/ most of the beat coming from higher margins (op. margins were >220bp ahead of plan) while sales were a touch above plan, and they tweak up the full-year guide for total rev (now +22% vs. the prior +20.8%) and cloud rev (now +24.3% vs. the prior +22.5%) while the op. margin outlook is unchanged (at 25.5%)

TESLA OPENS AI TRAINING HUB IN CHINA: Tesla has launched a new AI training center in China focused on local driving conditions and assisted driving systems, according to Chinese media. The facility, confirmed by Tesla VP Tao Lin, will develop AI models tailored specifically for the Chinese market (X/Twitter)

VST: upgraded @ GS - "We upgrade VST from Neutral to Buy following the pullback in shares (-12% YTD, -35% from all-time high), as we increase our ests and see upside risk to consensus after incorporating the Meta PPA into our numbers. We see potential upside of 3%–9% to our 2028 EBITDA if Vistra contracts the rest of its nuclear generation in a similar price range"

Industrials

Caterpillar (CAT) initiated outperform at CICC

Crown Holdings (CCK) downgraded to neutral from overweight at JPMorgan

Crown Holdings (CCK) downgraded to peer perform from outperform at Wolfe

Hub Group (HUBG) downgraded to sell from buy at Stifel

Linde Plc (LIN) downgraded to neutral from overweight at JPMorgan

MSC Industrial (MSM) downgraded to neutral from overweight at JPMorgan

Norfolk Southern (NSC) downgraded to neutral from buy at UBS

Old Dominion Freight Line (ODFL) downgraded to hold from buy at Deutsche Bank

Latest Media

River1’s CIO on Schwab Network

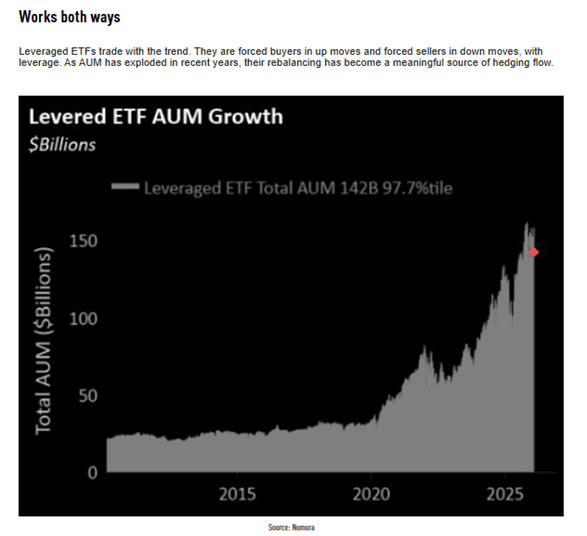

Levered ETFs, market perspectives, etc.