- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Morning Note

presented by - |  |

Invest with us here: https://www.river1.us/invest.php

Calendar

This Week – Last week was a mega cap earnings week, Fed, and NFPs. This week is none of those things. Look for second tier earnings names to paint the picture.

Monday – Durable Goods

Tuesday – ISM Services

Wednesday – Two Fed Speakers

Thursday – Jobless Claims, 1 Fed speaker (Bostic)

Friday – 1 Fed Speaker

Trading Observations

Getting a bounce, will it hold and can it build?

Nothing incremental over the weekend, macro calendar quiet this week

No reason to have a meaningful selloff given the backdrop, but hard to argue higher either, so my guess is chop

GS notes recent 2 month job revisions largest outside of a recession SINCE 1968 https://tinyurl.com/cn37ndxj [tinyurl.com]

The good news is people felt skittish heading into the selloff, that sentiment should cool very quickly

6300 first hurdle with 6400 meaningful resistance vs. 6200 next support with 6150 more meaningful (breakout level and rising 50 day-just below)

For the BULLS, VIX spike Friday and was up more than 20% on which means based on historical data (going back 25 years), a rally in the S&P is likely within 2 trading days (Monday or Tuesday).... There’s a 95% probability of it occurring

Oscillators also extremely oversold so ripe for a bounce https://tinyurl.com/y9awnv9m [tinyurl.com]

SPY vol one of highest in last 2.5 years and have market bottoms in recent past https://tinyurl.com/48phsra5 [tinyurl.com]

All world index thus far just pulling back to multi-year breakout level https://tinyurl.com/45kkwsdu [tinyurl.com]

For the bears given valuations, from Ned Davis "The percentage of S&P 500 companies with sales growth above 15% has plunged to a near record low".

Unemployment obviously on everyone's radar, and nearing an inflection? https://tinyurl.com/3j5j93w9 [tinyurl.com]

A bull signal triggered https://tinyurl.com/ymdp5356 [tinyurl.com]

Futures

DOW +191

S&P +35

Nasdaq +194

Charts/Sentiment

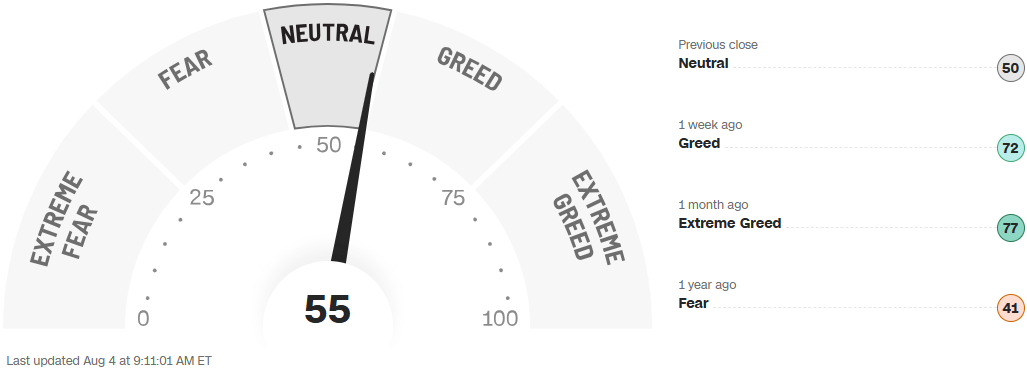

CNN Fear/Greed Index | U.S. 10 Year Treasury |

VIX - Back Below 20 | Bitcoin |

Financials / Consumer / Healthcare

Despite rates, household debt levels not a concern https://tinyurl.com/4vp9kedn [tinyurl.com]

GS Wraps up on Capital Market Player Earnings – Buy ARES and BEN, sell CBOE and TROW.

JPM Macro calling for an economic “stall speed alert”. Tariffs pointing to a large building economic drag.

HNI – To buy Steelcase for $2.2B. HNI is down 16% on the deal, SCS up 48%.

FRPT – Up 15% on solid results. High end dog food hanging in there, but some of it is the huge short interest.

BRK/B – Down 1% on Kraft Heinz. Q2 EPS a bit above the Street, but the company’s overall narrative stays the same; cash bal slight downtick but still elevated

Technology

AVGO positive: Meta has placed big orders to Taiwan's Quanta Computer for customized AI servers based on its next-generation ASIC; Chenming Electronic is making cabinets, some liquid cooling parts, and sidecars for the servers

CART: Edgewater checks - channel reads imply contd momentum thru July; outlook on fundamentals encouraging though inflation + SNAP/EBT overhang dilute enthusiasm

PLTR: #1 risk proxy for tech/retail #s on deck ... 11% implied move (feels low); +494% y/y vs SPX +14.6% / conf call 5pm ET

META: Zuck's absurd spend spree getting bit more attention post Friday px action .... (1)Zuckerberg’s AI hiring spree remains extremely aggressively, and he apparently offered one individual a compensation package potentially worth as much as $1.5B over 6 years (WSJ); (2)Meta moves forward with plans to bring on outside financial partners to help fund its massive data center infrastructure needs (Reuters)

NVDA: China state media calls to prove H20 AI chips are secure without backdoors after the company was summoned last week by cyberspace authority amid concerns

SPOT: +4% upgrade + price increases

TSLA: +2% on 1mm shrs .... approves 96M shr stock award to Elon

W: +10% solid beat / ahead of buyside, shrs +235% off April lows .... statement reads well: Year-over-year revenue growth of 6% - excluding the impact of Germany - marks the highest growth rate we have seen since early 2021

Industrials

This morning, prompt crude futures trade down by over $1/bbl after OPEC+ announced a 0.55 mmbpd increase in required production for September, which marks a full reversal of the 2.2 mmbpd voluntary cuts

AeroVironment (AVAV) initiated market outperform at Citizens; $325 PT

AVAV – Baird - AeroVironment, Inc. (AVAV) - Raising Price Target to $267 Reflecting New Financing, Raising Estimates

Boeing (BA) 3.2K Boeing workers in St. Louis area factories go on strike after rejecting latest labor agreement

CommScope (COMM) confirms agreement to sell its connectivity and cable solutions segment to Amphenol (APH) for $10.5B

Joby Aviation (JOBY) to acquire Blade Air Mobility’s Passenger Business for up to $125M

NIO Inc (NIO) upgraded to outperform from neutral at Macquarie

Quanta Services (PWR) downgraded to hold from buy at Daiwa; $420

Tesla (TSLA) discloses new award of 96M shares to CEO Elon Musk under company's 2019 equity incentive plan - 8-K

Latest Media

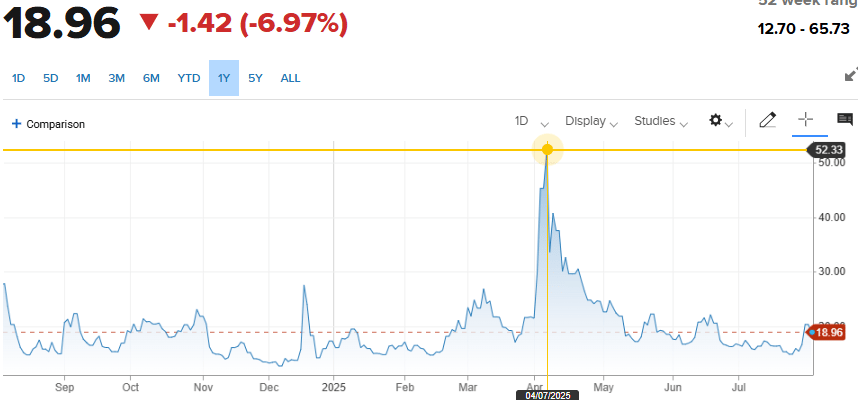

$PYPL - From Darling to Dog, where to next?

We believe there might be some value down here.

Megacaps hit frsh highs Thurs am before fading hard; ~5% off those highs seen Thur as AWS whiff pressured AMZN while lack of AI narrative kept lid on Apple