- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Morning Note

presented by - |  |

Invest with us here: https://www.river1.us/invest.php

Calendar

This Week – Way too many Fed speakers against a backdrop of few earnings keeps us in macro.

Wednesday – New Home Sales

Thursday –7 Fed Speakers. Goolsbee likely the most important (hawk). Durable goods, initial jobless claims. COST and KMX earnings.

Friday – Core PCE

Trading Observations

Little incremental as we await PCE tomorrow

Another day of negative breadth – AI trade under pressure again esp high beta.

End of quarter rebalancing into tomorrow likely keeps a lid on things

Notable, despite the mild selling, VIX red on the day

6625 (minor) and 6475-6500 (more significant) support levels to watch on weakness

Energy has been a laggard, but if inclined it may be time to think about adding https://tinyurl.com/5fyu4sfs [tinyurl.com]

Some hope on trade - *CHINA TELLS ITS COMPANIES IN THE US TO STOP PRICE WARS, SIGNALS BEIJING WANTS TO PROTECT FRAGILE TRADE TRUCE WITH WASHINGTON*

The wealthy feel better about the economy than poorer do by a much wider margin than historically https://tinyurl.com/tt53khkx [tinyurl.com]

Futures

DOW -149

S&P -35

Nasdaq -182

Charts/Sentiment

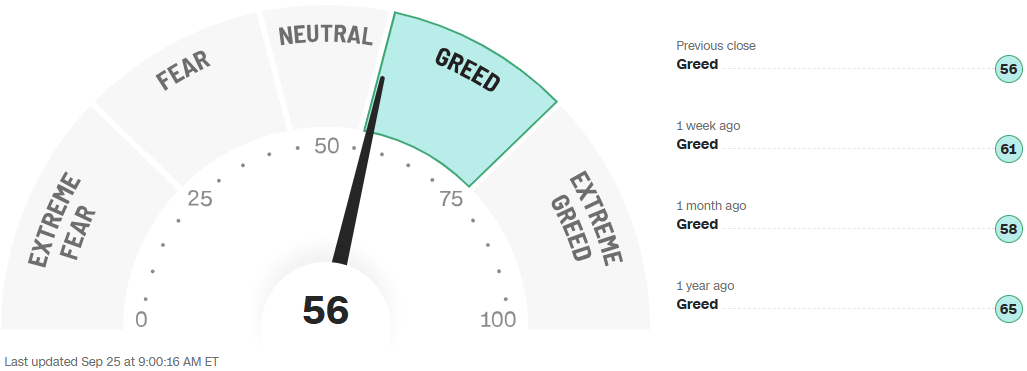

CNN Fear/Greed Index | U.S. 10 Year Treasury |

Gold | Bitcoin |

Financials / Consumer / Healthcare

CRYPTO COOLING – Another morning of weakness in the momo-barometer. Ethereum now -7% MTD, $4k big watch level, Bitcoin flat on the month ... Rotation out of the coins risks more upside USD pressure into month end.

KMX – CarMax down 15%. Loan loss provisions were bad. This is the first real sign of bad credit actually hitting a public companies earnings report we have seen in quite a while. All those scare charts about bad credit have been a nothing burger…until potentially now. CVNA down 5% too.

BIRK – Up 3% on solid sales outlook.

SBUX ––Flat in a down tape as they announced a host of store closing and $1B job restructuring. They are likely trying to get lean in corporate to push better bottom line.

SFIX – Down 10% on client losses.

LULU – Cut to hold at Needham. Crazy late.

COST, BJ, WMT – COST EARNINGS TONIGHT! Baird out saying they don’t think US Club buying is saturated yet and see another decade of growth. They think the group is “out of favor” which seems crazy to us given the multiples they carry.

Baird RV Bust Tour points to healthier inventory levels and decent demand on the downtick in interest rates.

LLY – Halted a small muscle-sparing drug.

Technology

ALAB – shrs -4.5% again in pre; ystry chatter that ALAB had cut their 2H26 tape out #s by 20% weighed + followed negative reaction to shrs during Nvidia/Intel press conf last week ... ~25% off highs

ANET – +1.5% upgraded at BNP - calling the company a "key beneficiary" of the multi-year AI data center capex supercycle; also expects enterprise campus opportunities to offer incremental margin expansion and rev opportunities. Highlights hyperscalers/neoclouds’ accelerated AI infrastructure buildouts for both training and inferencing

CRWV – COREWEAVE EXPANDS PACT WITH OPENAI BY UP TO $6.5B

GOOGL/AI – ALPHABET aggressively courting AI startups for its Google Cloud business (“nearly all generative AI unicorns run on Google Cloud - 60% of all gen AI startups worldwide have chosen Google as their cloud provider”) (Tech Crunch)

INTC – +4% in pre as catching tier 3 upgrade; shrs popped late on Apple related headlines .. tough short to fight as it's clear Co going to leverage Trump/US elevated interest. Domestic chip manufacturing remains #1 priority in coming years

MRVL - CEO extremely bullish at JPM + clearly chip on shoulder; said they are using ~18% hyperscaler AI CapEx growth as the baseline index for 2026. Said they expect faster growth in 2027–2028 vs. 2026 as new XPU programs, rising XPU-attached content, 1.6T & 800G ZR optical ramps, scale-up connectivity, and switching stack (TMTB h/t)

MSFT– will expand its use of Anthropic’s AI technology, incorporating Claude into Microsoft 365 Copilot assistant for businesses (CNBC)

MU – Micron joins forces with TSMC for HBM4E memory, targeting 2027 launch (DigiTimes)

NVDA – Barclays bullish - PT to $240 - now ests $2 trillion of AI capacity additions by the end of the decade. When tracking AI capacity adds over the long term, TAM expectations "don't seem so outlandish anymore" and Nvidia "looks like the most interesting name in our group”

PINS – weak in alpha all session .. ppl pointing to (1)Google's Mixboard - an AI-powered concepting board that helps you explore, expand, and refine your ideas; (2)Depop- owned by ETSY - also launched a fashion collaging tool to style Pinterest-worthy outfits; (3)Yipit negative update on MAUs

ORCL – -2% Redburn initiates coverage of the stock with a Sell rating - saying the market is materially overestimating the value of the firm’s cloud revs. Says Oracle’s five-year OCI rev guide equates to roughly $60B in value—meaning the market is already pricing in a risky blue-sky scenario that is unlikely to materialize. Sees further downside risk as the market appears willing to overlook the subdued non-Infrastructure as a Service growth

RDDT – Baird Raise PT to $240/$177 and ests as we gain more confidence in Reddit's pipeline of new rev opportunities and expanding LLM data partnerships, which improves visibility for sustained top-line momentum

Industrials

TSLA – Baird- Q3 Deliveries Preview; Consensus Too High, but Buy on Any Weakness

• Expect choppiness in deliveries/fundamentals to continue.

• Our 414.0K delivery estimate is below the FactSet consensus of 445.6K, and we believe the pull forward of demand related to the expiring EV tax credit will fall short of consensus expectations.

OKLO – Insider sold $6.7M worth of stock, Goldman initiates Neutral $117 PT.

OWL – Blue Owl and Qatar’s QIA set up a $3bn data center venture the firms said. BBG

ADNT – upgraded to overweight from equal weight at Wells Fargo Securities; $31 PT

AMTM – upgraded to overweight from neutral at Cantor Fitzgerald; $35 PT

AMRC – upgraded to buy from hold at Jefferies; $39 PT

CSX – upgraded to overweight from equal weight at Wells Fargo Securities; $40 PT

FCX – downgraded to neutral from buy at Clarksons Securities; $42 PT

FCX – downgraded to sector perform from sector outperform at Scotiabank GBM; $45 PT

FCX – $37.67 upgraded to outperform from market perform at Bernstein; $48.50 PT

GFL – initiated outperform at William Blair

OKLO – initiated neutral at Goldman Sachs; $117 PT