- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Morning Note

presented by - |  |

Invest with us here: https://www.river1.us/invest.php

Calendar

This Week – A few scattered earnings and Fed Speakers, but the al events are Non-Farm Payrolls off cycle due to the shutdown (Tuesday) and CPI Thursday.

Wednesday – MU Earnings, 3 Fed Speakers

Thursday – NKE, FDX Earnings, Initial Claims, CPI

Friday – Existing Home Sales

Trading Observations

Nice afternoon recovery to reclaim (for now) 6800

A bit of early follow thru keeping 6800-6900 range intact, 6760 below, a CLOSE above 6900 opens the door to 7000

US Architecture Billings Index falls to 45.3 (prior 47.6); Project inquiries index 51.4 (prior 54.8), Design contracts index 42.7 (prior 47.1).

LEN (home builders) lower on numbers followed by JBL pre-mkt and MU after the close

II BULLS drop to 52% from 53% (neutral)

Of note on Defense: The White House preparing executive order to potentially limit buybacks, dividends and executive compensation for military contractors per Punchbowl's Jake Sherman, citing sources familiar with discussions

Smalls ready to take the lead from large (finally?) https://tinyurl.com/2jktpvjw [tinyurl.com]

Though payrolls don't suggest will be sustained https://tinyurl.com/4ek6xczn [tinyurl.com]

Software time relative? https://tinyurl.com/h6kzsef9 [tinyurl.com]

Lower end workers wage growth outpacing inflation https://tinyurl.com/ysvrrnba [tinyurl.com]

Valuation worries continue https://tinyurl.com/bdcp5b5u [tinyurl.com]

Valuation gap continues to widen https://tinyurl.com/4ywnhnvz [tinyurl.com]

Futures

DOW +123

S&P +19

Nasdaq +86

Charts/Sentiment

CNN Fear/Greed Index | U.S. 10 Year Treasury |

Gold | Bitcoin |

Financials / Consumer / Healthcare

UDMY – Up 30% on a deal to combine with COUR, which is also up 11%.

LEN – Down 5% on poor home guidance. Mortgage rates not killing homebuilders, but they have lost pricing power and growth.

GAP – Up 3% on double upgrades.

SG – Down 2% on a WFC downgrade. This stock has gotten punished this year, mostly on $25 salads not making it through the inflation window.

OWL – Flat on news it won’t back the latest ORCL data center deal. Blackstone is said to be waiting in the wings. Bet its costly.

HOOD – Up 2% on new buy at Truist and news its entered the NFL parlay game. Someone please ban this.

ALLY – Upgraded at WFC on improving credit trends.

Technology

Memory: strong overnight: KIOXIA+7%, PHISON+5%, SAMSUNG+4.5%, Hynix +4%, Nanya+4%

ORCL - shares drop as much as 3.4% in premarket trading after the Financial Times reported that Blue Owl Capital will not back a $10 billion deal for the software giant’s next data center. Blue Owl shares fall as much as 4% before the market open. - FT

AAPL: MS lifting PT to $315 - "Among the IT Hardware group, the firm recommends being overweight cloud capex winners, product-cycle beneficiaries such as Apple, and unique assets, while it suggests being underweight stocks with elevated memory exposure - like DELL/HPQ - and is increasingly more cautious on memory-exposed names as well"

ABNB: +1.8% upgraded @ RBC - sees an "increasingly attractive brand monetization story," saying first party data is likely worth a premium in the evolving consumer AI landscape. RBC is bullish on Airbnb's entry into hotels as an incremental room nights driver and as a possible entry point for outsized profit from promoted listings

ACN/PLTR: expand partnership

AMZN - climbs 0.9% as OpenAI is in initial discussions to raise at least $10 billion from Amazon and use its chips.

AVs/Waymo: Waymo is in talks to raise several billion dollars (perhaps as much as $15B) at a valuation of $100B (which could be up from $45B a little more than a year ago) as the company rapidly expands throughout the US and internationally (it hopes to do 1M rides per week by the end of 2026) (The Information, Bloomberg)

BE: up 3% in pre ... shrs down 40%+ off highs; down 6 out of 7 sessions (-20% last three) ... feedback has been Co is ORCL proxy / transition year ahead / lot of tourists involved

Cyber Security/AI: Cyera, an AI-linked cybersecurity firm, is raising $400B in a Blackstone-led round at a valuation of ~$9B (WSJ)

FTNT: -2% d/g to UW at JPM - "company is facing headwinds as platform consolidation trends continue into 2026; sees risk to Fortinet's growth, saying larger platform vendors are better positioned to dominate the company's markets"

HUT: +20% massive deal / signs 15-yr, 245MW AI Datacenter lease with Anthropic / Fluidstack, with GOOGL providing a financial backstop, valued at $7b over the base term; will see if this positive for HUT spills over to other HPC power providers ... watch WULF / CIFR which have been smoked off highs

META: is set to release in Q1 a new AI model, dubbed “Avocado”, that it built from scratch and hopes will perform on par with Gemini and ChatGPT (FT)

PANW are up 0.2% as JPMorgan rates the security software company overweight with a $235 price target.

Industrials

Lithium stocks (ALB +4.4%, LAC +2.5%, SGML +7.5%) rise as lithium futures prices continue to gain with expected demand growth.

TSLA: printing fresh highs as autonomous / AI / robotic narrative fueling px action into 2026 ... faces a sales suspension in California if the company doesn’t change the marketing around its Autopilot and FSD products (the suspension won’t go into effect for 90 days)

AAR Corp (AIR) initiated buy at Jefferies; $100 PT

ABI: November US Architecture Billings Index (ABI) falls to 45.3 from 47.6 in October – New Project Inquiries index 51.4 vs. month-ago 54.8 - "Weakness in business conditions at architecture firms continues to be widespread, with declining billings across all major specializations and in every region except the Midwest.”

ADT Inc (ADT) assumed equal-weight at Morgan Stanley; $9 PT

BrightView Holdings (BV) assumed equal-weight at Morgan Stanley; $13 PT

Defense - The White House preparing executive order to potentially limit buybacks, dividends and executive compensation for military contractors - Punchbowl's Jake Sherman, citing sources familiar with discussions.

Garrett Motion (GTX) initiated overweight at JPMorgan; $23 PT

Herc Holdings (HRI) upgraded to overweight from sector weight at KeyBanc; $200 PT

Homebuilders – LEN lower (down 4.5%) post earnings - results missed expectations and issued soft initial Q1 guidance – conference call at 11:00 ET today - Q1 homebuilding gross margin guide of 15-16% and orders outlook below already reduced expectations, alongside a cautious initial FY26 delivery forecast. Analysts expected both FY26 and Q1 EPS expectations to move sharply lower, as still looking for color around the equilibrium between pace and gross margins and the direction of demand, incentives, and margin beyond Q1.

Rollins (ROL) assumed overweight at Morgan Stanley; $72 PT

Latest Media

River1’s CIO on Schwab Network

Levered ETFs, market perspectives, etc.

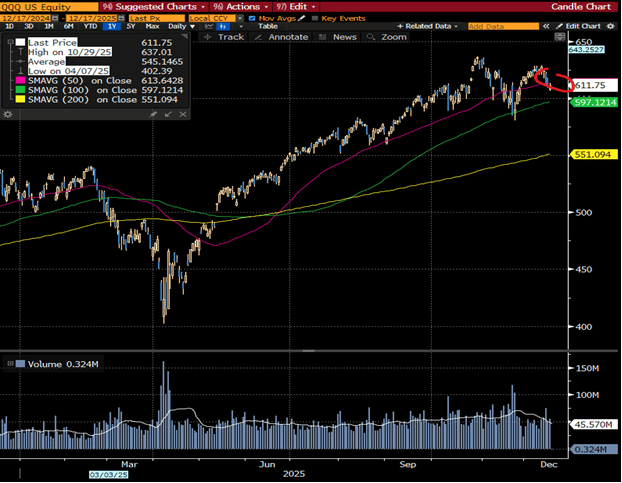

QQQs back above 50D in pre …

Software vs Semis (GSPUSOSE) up 5 out of 7 sessions … bouncing off the mat