- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Morning Note

presented by - |  |

Invest with us here: https://www.river1.us/invest.php

Trading Observations

Very quiet pre-market trading as we enter a two day period that is not much about individual stock company news, and more about end of year risk positioning and movement, not unlike a typical quarterly expiration.

The mid-week New Years means most folks have largely rolled what they need to, so we would expect volumes outside of the programmatic to be light and non-betting, especially Friday.

When we re-open for real on the 5th, expect some pre-announcements to hit.

If none hit the AI Capex space, it gives the market enough to keep going, but without some likely retail losers that will have to fess up here shortly.

Futures

DOW +10

S&P +1

Nasdaq +5

Financials / Consumer / Healthcare

UAA – Up 3% - Under Armor is basically a penny stock now that rips on new holders that might impart change.

Technology

IONQ – Up 3% on news it will pair with another firm and bring the first 100 Qbit Quantum computer to the party. This technology is evolving quickly, and probably eating its own lunch the faster it goes.

META – Paying $2B for a Singapore AI company called Manus. Too small to matter to the stock.

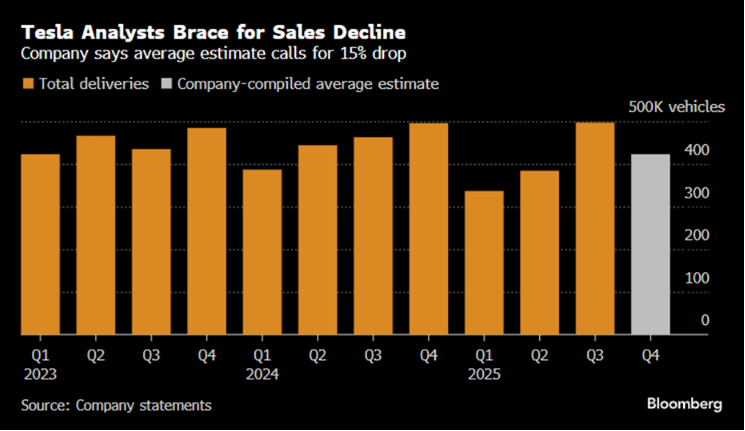

TSLA – Guides vehicle sales down. Stock does not care.

Industrials

Baird on Power Generation Winners – We continue to view CAT as well-positioned to grow in the space (detailed in 2030 Strategy) with tailwinds also benefiting companies outside of our direct coverage (GEV, CMI, INNIO, BE, Siemens, and Mitsubishi).

Latest Media

River1’s CIO on Schwab Network

Levered ETFs, market perspectives, etc.

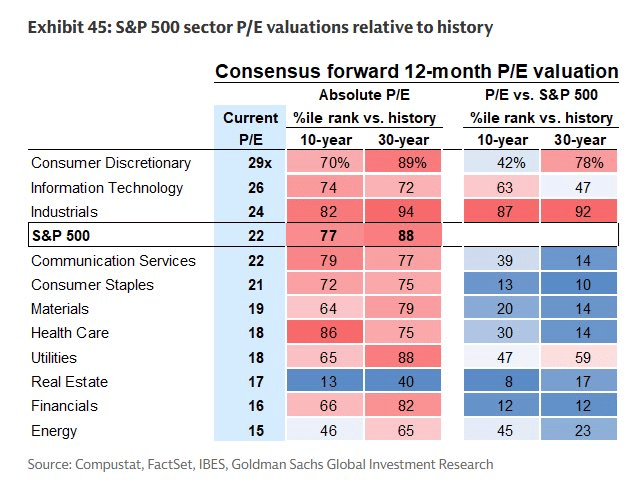

What is cheap? Nothing…except real estate