- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Morning Note

presented by - |  |

Invest with us here: https://www.river1.us/invest.php

Calendar

This Week – Typically a positive week due to “Holiday Vibes” and low volumes. We keep watching Initial Jobless Claims (Wednesday) to see if a recession might be looming, but no signs.

Tuesday – Retail Sales, PPI

Wednesday – Initial Jobless Claims, Beige Book

Thursday – US Market Closed

Friday – US Market half day

Trading Observations

A bounce Friday, and some continuation yesterday. Historically a bullish week with upward bias

PPI came in slightly light and Retail sales were soft. More fuel for a Dec cut.

Fed goes into blackout period Friday, but most spoke last week

Held 6550 support late last week and remains key 6670 first resistance, but 6770 the bigger level to break trend and suggest Santa coming to town

Hedge funds covered Friday https://tinyurl.com/y3dudwus [tinyurl.com]

Futures

DOW +17

S&P -7

Nasdaq -84

Charts/Sentiment

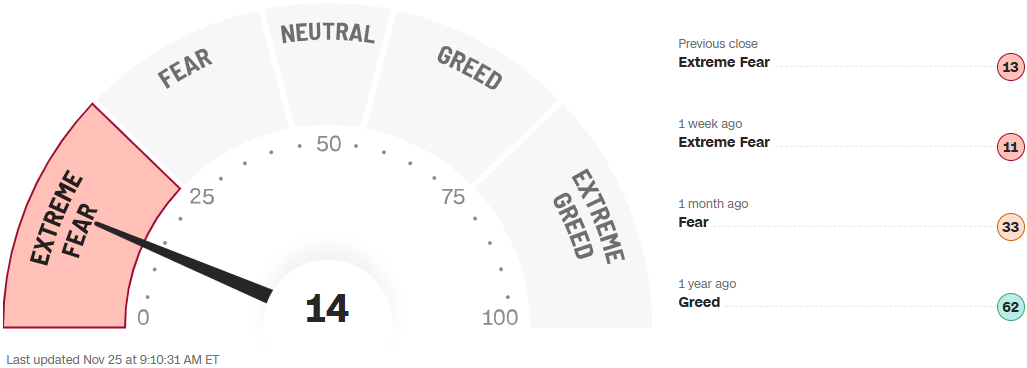

CNN Fear/Greed Index | U.S. 10 Year Treasury |

Gold | Bitcoin |

Financials / Consumer / Healthcare

CRYPTO: rallies being sold vs dips bought ... Bitcoin is sliding 200bp to ~$87K after rallying >5% over the course of Sun and Mon.

KSS – Up 28% - 27% of the float was short, so anything good here was all they needed. Comp sales were still negative at 2% this Q, 3% next, but better than expected. Overall, when these guys execute and make cash, the shorts scatter.

ANF – Up 19% - Comp sales nicely positive up 4-5%, and they didn’t beat by a ton, just taking up the low end of guidance. However, the $10+ in EPS is still intact, meaning it was trading just 6.5x P/E yesterday.

BURL – Down 5% - Comp sales roughly flat against a 30x P/E is basically the opposite as ANF.

DKS – Down 4% - Numbers look fine, but there’s some Foot Locker integration and shutdown charges muddying the picture to the tune of about $750MM.

DOJ out warning Private Credit firms to stop mis-marking their books. 61 firms are now in CCC- rating, or about1.4% of total loans.

PYPL - PayPal and Perplexity launched an integration that lets US users shop and complete purchases directly within Perplexity’s AI chat.

Home sellers – 85k listings were pulled in October, the highest month in 8 years. – Bloomberg. Florida is one of the big removers, and 15% of home sellers were at risk of selling at a loss when pulled.

NVO – Up 3% on solid results for its newest diabetes/weight loss drug.

Technology

ADI: +3.5% first prints as Q4 top/bottom line beat; Auto / consumer / Comms revs ahead; Industrial below. Sees Q1 revs $3B to $3.2B (est $2.97B). Commentary: "Healthy bookings trends continued in the fourth quarter with growth in Industrial and notable strength in our Communications market

Apple announces job cuts across its sales team https://finance.yahoo.com/news/apple-cuts-jobs-across-sales-193651118.html [finance.yahoo.com]

BABA Q2 revs $34.8B vs. est. $34.43B; said AI revenue contributing to an expanding share of our cloud revenues from external customers, and customer management revenue up 10%

GOOGL - Google is in talks to sell/rent TPUs to others, incl Meta (Meta could spend “billions” using TPUs both inside its own data centers and via rental agreements with Google Cloud. One Google Cloud exec thinks TPUs could capture as much as 10% of Nvidia’s annual rev. While Nvidia remains the dominant supplier of GPUs, its market share will face growing headwinds in 2026 from both custom chips (Google’s TPU and Amazon’s Trainium) and new AMD products

NVDA/AMD: down -4% / 3% respectively on The Info article ... no secret major hyperscalers will cont to seek cheaper alternatives (Meta stock has been a disaster since print so this will be welcomed report) ....

DELL/HPQ: #s tonight .. focus on margins/memory pricing pressures (espc post MS downgrade). From Dell, expect nothing but constructive commentary around AI demand / backdrop

DELL: 8% implied move / conf call @ 430pm ET

SMTC: -6% modest FQ3 EPS upside (48c vs St 45c) while GMs and sales were about inline, and the FQ4 guide is mixed (higher on sales but softer on GMs – the GM outlook calls for 51.2% vs St 53.2%)

SNDK: +3% S&P 500 inclusion ... follows 15% rally last 2 sessions post 20% plunge on Thur (healthy)

UBER: down 12 out of 15; saw covering in low-$80s ystrdy but yet to see any meaningful LO support

ZM: +5% beat reflect an ongoing top-line recovery, fueled by improved trends in its Enterprise segment — where sales rose 6.1% vs. 5.8% last year — driven by robust large-customer additions, the appeal of its latest AI features and solid new product sales .... Enterprise business continues to be a key point of strength

Industrials

BE: PT lifted / reit Underperform @ BofA - Better execution underpins the firm's revised estimates, but it still views consensus revenue forecasts as "ambitious" and argues that the current valuation "leaves limited upside potential."

Cummins (CMI) upgraded to neutral from sell at UBS; $500 PT

Mirion Technologies (MIR) initiated outperform at Evercore ISI; $29 PT

Oshkosh (OSK) initiated overweight at Barclays; $150 PT

TITN – healthy Q3 beat, FY EPS guidance reaffirmed, destocking initiative progressing, stock bid up 5%.

VLTO – announces agreement to acquire In-Situ for ~ $422M and establishes $750M share repurchase program.

Waste Management (WM) initiated buy at DZ Bank; $250 PT