- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Morning Note

presented by - |  |

Invest with us (30sec to become shareholder): https://www.river1.us/invest.php

Calendar

This Week – Almost no earnings and the Fed is in a quiet period, pointing to a trade related week for creating volatility outside CPI Wednesday.

Monday – NY Fed Inflation Expectation

Tuesday –

Wednesday – CPI, ORCL earnings

Thursday – PPI, Initial Claims, ADBE earnings

Friday – U Michigan.

Trading Observations

Little incremental

US/China meeting today, though nothing really expected

CPI Wed, PPI Thurs

Is it FINALLY time? Notable S&P/Nazz flat with IWM up almost 1% pre-mkt

Still some work to do, but technicals offer hope, IWM $216 is 200-day and would hopefully really start some momentum https://tinyurl.com/mue9czj2 [tinyurl.com]

For the bulls, Industrials breaking out https://tinyurl.com/y3usdwe7 [tinyurl.com]

As well as estimates rising https://tinyurl.com/55dm83vv [tinyurl.com]

Short interest building https://tinyurl.com/2kvw9hh2 [tinyurl.com]

Closed right at 6000, a CLOSE above and I think we test the old highs if inflation data not a shock

6052 the first speedbump on the way up vs. 5970 first support

S&P announced a dud Friday evening. S&P DOW JONES INDICES SAYS NO CHANGES TO S&P 500 INDEX ... After hours movers: HOOD / APP both got hit ~6% (shares of Robinhood +65% in month; AppLovin +45% since early May .. obviously gains much greater from early April); CVNA fell >2% …. Until next time. SMCI shares remain ~65% off highs since S&P added the controversial name to index; still think some lingering scar tissue from this decision

Futures

DOW +37

S&P +9

Nasdaq +19

Charts/Sentiment

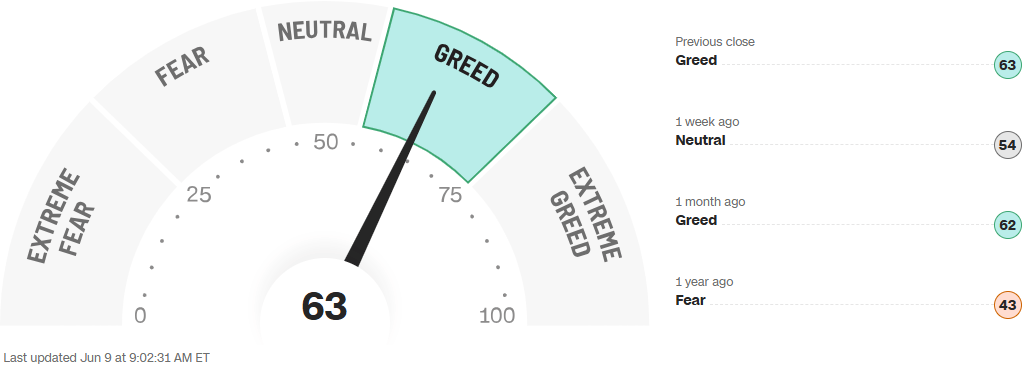

CNN Fear/Greed Index | U.S. 10 Year Treasury |

Gold | Bitcoin |

Financials / Consumer / Healthcare

JPM/Chase Spending data down ticking for May to +1.8% from +2.8% in April. Weakest since July 2024.

WMT - Annual Shareholders Meeting notes coming away largely positive as the company is embracing technology including AI and automation.

CFG – Baird calling for multiple expansion after CEO meetings helped them believe ROTCE improvement was in the cards.

April RV Traffic – Retail traffic down 9% in April, trending down 7% YTD.

CHWY – Baird positive into the print despite the +44% YTD move.

GS Bank Preview on CCAR/Stress Tests is largely positive, expecting a less onerous Fed.

WBD – Up 7% on news they will separate their cable and streaming businesses. Stock was very cheap on cable drag.

HOOD – Down 3% on no news it will go into the S&P.

ETOR – IPO initiation day has 8 buys, 7 holds.

MRK – Up 2% on solid cholesterol drug results.

Technology

Tech Positioning: Crowded Longs: Internet (META RBLX NFLX SPOT AMZN); Software (MSFT NOW SNOW CRWD ZS); semis (AVGO NVDA TSM CLS STX); Hardware (CSCO GLW) ... versus Crowded Shorts: Internet (SNAP MTCH/BMBL EXPE LYFT); Software (TDC ADBE GTLB ACN MDB PATH); Semis (INTC QCOM MRVL Analogs); Hardware (AAPL HPQ NTAP)

AMD: AI Advancing Day on Thur, 6/12 - expectations no doubt bit lofty; $120 has been level of supply

CRCL: +10% in pre ... follows 168% jump Thur; +29% Friday

CSCO: just off 52 wk highs into Cisco Live! Event; focus on Co entering Campus refresh cycle, AI positioning

Crypto IPO: Gemini files confidential paperwork with the SEC for an IPO (FT)

GOOGL: up 6 out of 7 weeks; debate to linger but I think its pretty clear that Alphabet is not turning into Kodak. Watch breakout towards $180 level

NVDA: up 8 out of 10 weeks; still struggling to make fresh all-time highs ($153.13 seen post CES, 1/7/25) ... London Tech Week; GTC Paris coming up; earnings late August

ORCL: MS +VE checks - sees the potential for bookings upside to inspire more confidence in FY29 targets and sees optionality to hit targets as underpriced today, so it leans "more tactically positive on Oracle" into earnings

QCOM: offered to buy semiconductor company Alphawave IP Group for about $2.4 billion in cash to expand its technology for AI. Alphawave’s board has unanimously recommended the deal

Industrials

TSLA – Downgraded to Neutral at Baird. Baird believes Musk's comments regarding the robotaxi ramp rate "are a bit too optimistic," and that this excitement has been priced into shares; also notes that Musk's ties to President Trump "have added considerable uncertainty"

TSLA - Downgraded to hold from buy at Argus

TSLA: analysts are cutting their delivery forecasts for Tesla as demand for its vehicles stays soft (Bloomberg) ....

ABM Industries (ABM) upgraded to buy from neutral at UBS

Goodyear Tire & Rubber (GT) upgraded to outperform from neutral at BNP Paribas Exane

Mobileye Global (MBLY) downgraded to neutral from buy at Goldman Sachs

Air mobility stocks are set to extend gains after President Donald Trump signed an executive action establishing an electric “Vertical Takeoff and Landing” integration pilot program, according to a White House fact sheet.