- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Morning Note

presented by - |  |

Invest with us here: https://www.river1.us/invest.php

Trading Observations

Fed more dovish than most expected so a tailwind

Most dovish since 2021 on paper https://tinyurl.com/ycyskc2f [tinyurl.com]

Some weakness early on the back of ORCL (-11%) dragging NVDA (-2%) but equal weight S&P (RSP -.1%) and IWM barely down

ORCL has been under pressure for weeks and market rallied, Banks pushing higher, so my view is we recover as day goes on given Fed at our backs and wasn't expected

As long as 10-yr stays below 4.25%, think market ignores bonds

CLOSED above 6870 and if we can do again, opens door to 7000 with intraday highs of 6920 a potential speedbump vs. 6800 support

New highs on NYSE most since early October

AAII Bulls remain at 44%, Bears 30%

Beating the S&P is hard, just 28% of large cap fund managers beating their benchmark, and while easy to say this year due to Mag7, only 2 of the 7 outperforming the index https://tinyurl.com/45t38mhw [tinyurl.com]

Futures

DOW +12

S&P -24

Nasdaq -136

Charts/Sentiment

CNN Fear/Greed Index | U.S. 10 Year Treasury |

Gold | Bitcoin |

Financials / Consumer / Healthcare

LULU – Earnings tonight. Stock has been a mess as everyone takes share. Value investors in love with the price.

Baird on Banks – Downgraded TFC, CFG and FHN to neutral as risk/reward for banks becomes more neutral on this rally.

NKE – Baird calling it a bullish fresh pick into earnings on improving demand indicators since September.

OXM – Down 25% on an EPS cut. Never heard of them? They own Tommy Bahama, Lilly Pulitzer, and other fun summer related brands.

RZLT – Today’s drug loser is Rezolute, which missed its late-stage trial numbers and is down 90%.

Coin Based names all down 2-3% this morning. BMNR down 4%.

YUM – JPM positive after an HQ trip. They like their chances to do better post Pizza Hut sale.

LLY’s experimental shot reduces body weight by 23% in study – Bloomey POSITIVE FOR NVO as well

$$$ in college sports à A TON of chatter about PE money hitting Utah (“Sports & Entertainment Holding Co.”)https://www.sltrib.com/sports/utah-utes/2025/12/09/university-utah-nears-private/ [sltrib.com]

CV – This healthcare device stock, where you ingest a camera and its safe for kids, is ripping on no news.

Technology

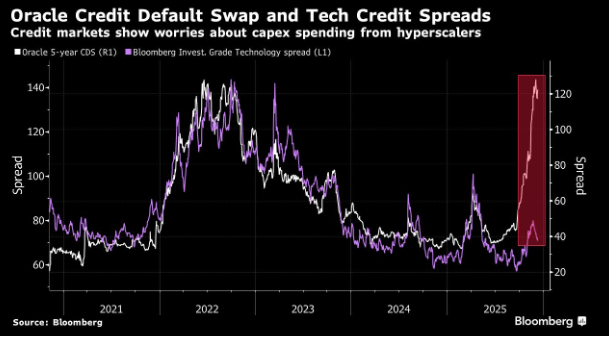

ORCL -11% mixed qrtr / AI debt funding concerns were unresolved. Ppl increasingly losing confidence in Oracle’s ability to turn a large and still-expanding backlog into durable, profitable rev streams ... capex outlook for this FY went up by $15B, implying they will spend ~$50B in total, which is an astounding 75% (!) of rev in F26 ……….. AI complex: ORCL opened the door wider to non-Nvidia GPUs

ADBE: -0.6% upbeat FY forecast but shares whipsaw in extended trading amid investor caution about AI growth plans. Operating margin guidance toward 45% missed expectations and implies 120 basis points of year-over-year compression as Adobe invests for AI

AI movers (as of 650am ET): COHR-4.3%, ALAB-2.5%, TSM/CLS-2%, MRVL/AMD/ARM-1.8%, NVDA-1.8%, AVGO/WDC/MU -1.5%, DELL/SNDK/PLTR/SMCI-1.2%, CRDO-1%

AI Trade/Narrative: Google’s momentum (with Gemini and TPU) has permanently fractured the narrative, which means it’s unlikely all the tech mega-caps will be moving together going forward (the AI trade is splintering into mutually exclusive camps) - Vital K says it well

APP: Benchmark positive checks

CIEN: +11% another beat + raise .... BEAST mode as $$ has contd to pour into the group as AI trade broadens out .... Reads well for CSCO, LITE, etc

COHR: -4% block from Bain

CRM: announced an expanded agencywide transformation initiative with the U.S. Department of Transportation

CSCO: shares hits a 25 year record as AI spending boom fuels renewed investor optimism in legacy tech

META: -1% in pre ...set for 4th consec decline .... reports of friction internally, lackluster updates on AI front adding to sources of frustration

NFLX: plans to add tens of billions in debt to fund $72B Warner Bros acquisition replacing $59B temporary financing (Bloomberg)

NVDA: -1.5% Oracle opened the door wider to non-Nvidia GPUs

RDDT: begins testing verified profiles in a move it says could boost transparency on the platform (Tech Crunch)

ROKU: Jefferies upgrading as well - "Roku’s 2026 platform revenue growth could reach >20% in an upside scenario, boosted by an ad partnership with Amazon, political tailwinds and subscription momentum; says Roku won’t be in an investment cycle for the foreseeable future, and a $2b operating expense base should support double-digit revenue growth for multiple years"

SpaceX: Musk says reports about a SpaceX IPO are “accurate” (Axios)

U/Unity: +3.4% multiple upgrades amid improving checks (Piper, BTIG). Bulls sees upside to Grow expectations, an improving industry backdrop, and a few other levers for upside including the Create IAP oppty; Piper says the mobile app advertising market looks healthy / positive Vector checks

Industrials

GE Vernova (GEV) downgraded to neutral from buy at Seaport Research Partners

J.B. Hunt Transport Services (JBHT) upgraded to buy from hold at Deutsche Bank

Norfolk Southern (NSC) downgraded to hold from buy at Deutsche Bank

Union Pacific (UNP) downgraded to hold from buy at Deutsche Bank

Latest Media

River1’s CIO on Schwab Network

Levered ETFs, market perspectives, etc.