- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Morning Note

presented by - |  |

Invest with us here: https://www.river1.us/invest.php

Calendar

This Week – Way too many Fed speakers against a backdrop of few earnings keeps us in macro.

Wednesday – New Home Sales

Thursday –7 Fed Speakers. Goolsbee likely the most important (hawk). Durable goods, initial jobless claims. COST and KMX earnings.

Friday – Core PCE

Trading Observations

MU earnings, more OpenAI capex, and BABA increased AI spend the headlines grabbing attention

Will all be enough to push the tape, or are we finally seeing signs of a consolidation period beginning?

II BULLS UP to 58.5% (over 60% headwind), in the window where it would make sense to setup a run into year-end https://tinyurl.com/3aakvjt2 [tinyurl.com]

With tech the focus, QQQ 603 the level to watch

S&P 6700 resistance vs. 6625 and 6475-6500 support

Expanding margin debt can continue to fuel the bull, but the relative rate of change outpacing S&P and something to monitor https://tinyurl.com/3pm9z44s [tinyurl.com]

Vegas has been having a tough go so not sure how much to read into this, but fwiw https://tinyurl.com/y8ff6563 [tinyurl.com]

Staples/S&P lowest since Dec 2000 https://tinyurl.com/3su2jjre [tinyurl.com]

Futures

DOW +47

S&P +9

Nasdaq +51

Charts/Sentiment

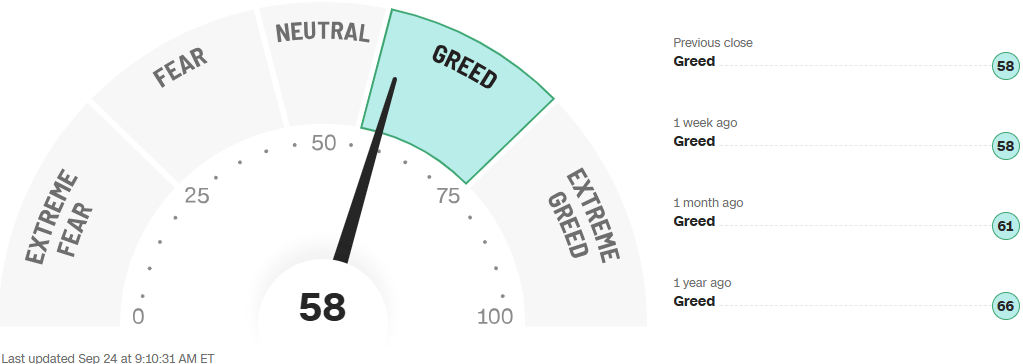

CNN Fear/Greed Index | U.S. 10 Year Treasury |

Gold | Bitcoin |

Financials / Consumer / Healthcare

PYPL, OWL – Blue Owl is buying up $7B of PYPLs buy now pay later portfolio. AFRM and KLAR already sell theirs off. PYPL also committing $100M to grow in the Middle East and Africa.

COST – Earnings this week. A Baird preview notes Q4 sales are already reported so margins are all that’s left. Relative valuation to the market is within historical norms. We think COST is fairly overpriced given its growth rate but see no reason for that to change as shareholders are more than happy and seem very sticky.

SCHW – The latest firm to attempt to offer private investments to its retail clients. They blame fewer public companies and a lot of the value creation in the later stages happening.

Ford – Announced lower interest ratees for the riskiest borrowers if you buy at F-150 by end of year. Should work out. STLA ( which is Chrysler’s ridiculous name) is pausing some production for similar inventory issues.

QURE – Big drug win here, stock up 170%. Huntington’s Disease.

IAS – Up 20% on acquisition by Novacap.

Technology

Tech SPENDING: Without tech spending the US economy would be close/in a recession. Deutsche from ystrdy: (1)Good news: The AI super-cycle — with NVIDIA effectively carrying the US economy — is offsetting demand (tariffs) and supply (immigration) shocks; (2)Bad news: The cycle can’t last without parabolic capex. With hyperscaler spending peaking this year, other growth drivers must step in

CART – Baird expects shares to remain choppy as headlines swirl around Amazon's expanding US grocery initiatives, but we'd be opportunistic buyers as we expect the "bark" to be bigger than the "bite

AMZN: +1.8% upgraded at Wells Fargo on greater conviction in AWS; sees AWS achieving 22% rev growth in 2026 (prior est 19%); its Project Rainier capacity build project with partner Anthropic is the main source of this more positive view, and is expected to contribute 5% to AWS growth in 2026 and 4% in 2027

ADBE: -1.5% MS downgrading on decelerating sales; believes the co's decelerating Digital Media ARR has created outsized concern on its ability to prove generative AI is expansive to its total opportunity; sees "cleaner" near-term stories elsewhere in the group

BABA: +9% surged to their highest in nearly four years after revealing plans to ramp up AI spending past an original $50B+ target; will soon add to a plan laid out in February to spend more than 380 billion yuan developing AI models and infrastructure over three years

BABA: to integrate Nvidia's AI development tools (Bberg)

BE: -4% downgraded @ Jefferies to Underperform; believes the share risks are to the downside given limited visibility into Bloom's growth post 2026. Some early signs of over-exuberance in the stock / wants to see significantly incremental company-specific data pts to justify current share levels

Memory Spend/LRCX: MU capex to be up 30% Y/Y in FY2026, $18B expected in FY26 vs. $13.8B in FY25

MU: -1% guide ahead of buy side / bullish commentary (as expected and priced in) + positioning cleaned up a bit as well BUT few were expecting print to shift narrative materially in either reaction. Sees EPS $3.75 at mid (buy side $3.50+), revs above whispers ... AI server demand remains robust, while the traditional server outlook improves significantly ... secures six HBM4 customers as AI-driven DRAM demand grows.

MU/Memory Bankshots: LRCX+0.5%, SNDK +0.8%, STX+1%, WDC+2%, Hynix-1%, Samsung+0.8%

NOW +3% upgraded at MS - co's consistent execution has been overshadowed by risks related to genAI and federal spend concerns however, believes Co is well positioned to deliver genAI capabilities, creating an attractive risk/reward. Sees Co positing 20% subscription and >20% FCF growth through FY27

Marvell Technology authorizes a new $5 billion share repurchase program.

ORCL – Said to look to raise $15B in a corporate bond sale. Remember that huge quarter of future “sales”? Why won’t those pay for this capital need?

RBLX: +1.4% Piper postiive - on a visits per day basis, viral hit "Grow a Garden" has now been surpassed by "Steal a Brainrot" as the number one experience of all time. Roblox continuing to get better at surfacing and promoting content gives the firm more confidence in the long-term platform oppty

Industrials

HOND (Terrestrial Energy) Barrons.com: Nuclear Stocks Are Soaring. We Size Up the Prospects for 3 New Ones.

ABB downgraded to neutral from buy at BofA

ALB trading +4% pre-mkt on news that the Trump administration may be looking for equity stake in Lithium Americas

GM upgraded to buy from neutral at UBS; $81 PT

Knight-Swift Transportation (KNX) downgraded to neutral from positive at Susquehanna; $43 PT

Mirion (MIR) to acquire Paragon Energy Solutions for $585M in cash; call today at 10:00ET; updates 2025 guidance - Organic Revenue now expected to be approximately 4.5% - 6.0% (previously 5.0% - 7.0%)

Packaging Corporation of America (PKG) initiated overweight at JPMorgan; $242 PT

PWR upgraded to buy from hold at Jefferies; $469 PT