- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Morning Note

presented by - |  |

Invest with us here: https://www.river1.us/invest.php

Calendar

This Week – Last week was a mega cap earnings week, Fed, and NFPs. This week is none of those things. Look for second tier earnings names to paint the picture.

Thursday – Jobless Claims, 1 Fed speaker (Bostic)

Friday – 1 Fed Speaker

Trading Observations

Managed to rally and closed above 6340 despite down vol > up vol

Notably on the back of AAPL, getting some follow thru this morning to make a run at 6400

Let's hope things broaden... despite the lift yday, Nazz had more new lows than new highs as we push all-time highs

S&P heavy as well under the surface https://tinyurl.com/38ccr66a [tinyurl.com]

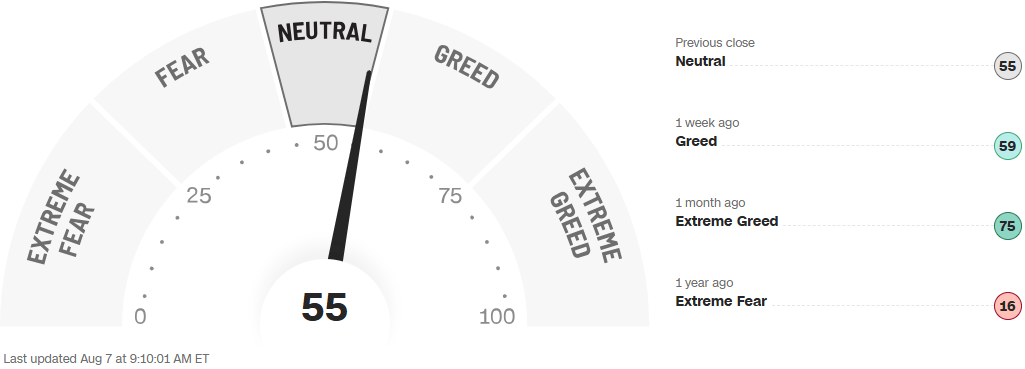

Mini pullback had AAII Bulls drop to 34.9% from 40%

Bears up to 43% (highest in 11 weeks)... amazing to have more bears than bulls 1% off the highs

Oscillators still oversold

Crypto: President Trump is set to sign an Executive Order as soon as today allowing crypto investments in 401(K) retirement plans, per a White House official

Futures

DOW +242

S&P +39

Nasdaq +183

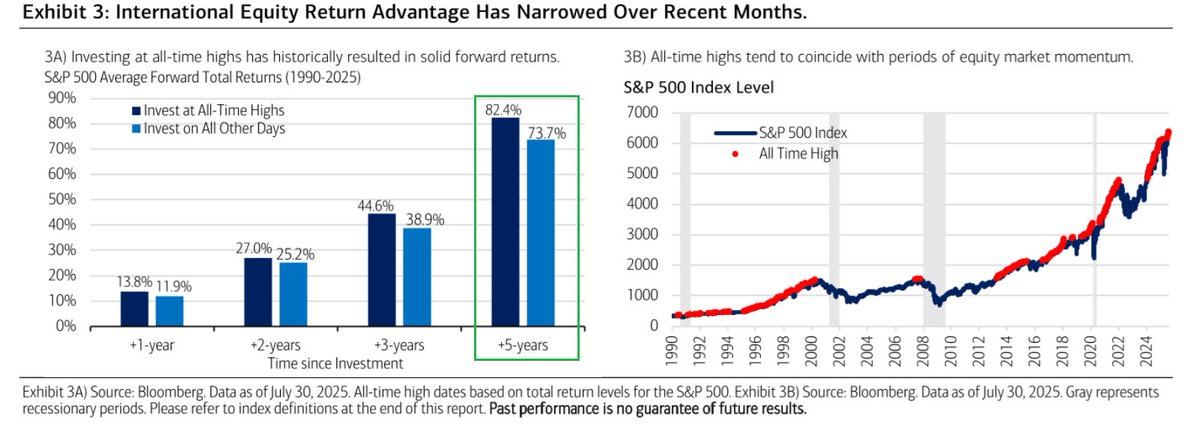

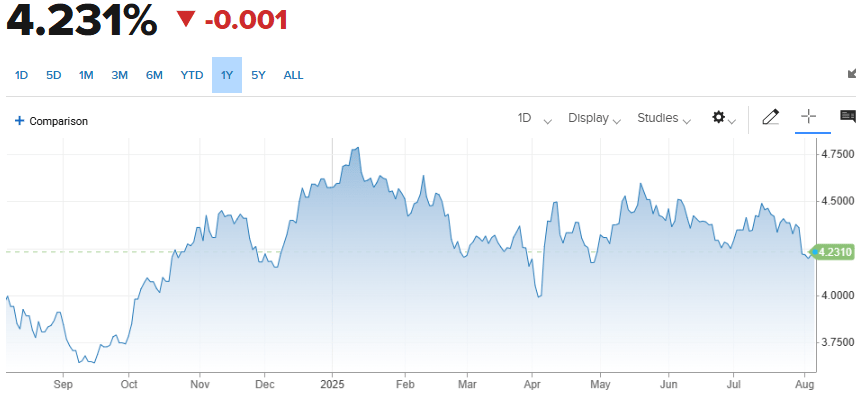

Charts/Sentiment

CNN Fear/Greed Index | U.S. 10 Year Treasury |

VIX |

Financials / Consumer / Healthcare

LLY, NVO – LLY down 8%, NVO up 8% as LLY’s pill for weight loss disappointed on trial. It still delivered 27.3 pounds of weight loss which was 12%, but NVOs does look more effective.

LLYs numbers were terrific if anyone cares.

PTON – Left for dead, but its up 11% on a very solid quarter of growth.

CELH - +24% - Alani Nu deal turned out to be a huge win here.

HTZ – Up 12% on not going bankrupt this week.

CROX – Down 20% - North American sales were very weak. CEO called wholesale orders ‘concerning’ for 2H.

DNUT – Krispy Kreme is going to cut out its entire Western footprint in a consolidation.

SN – Up 11% on boosted EPS forecast. Shark Ninja killing it in the mini blender game.

HBI – Up 20% - short squeeze.

BROS – Up 20% on solid same store comps +6%.

ELF – Down 10% on standard beat, mediocre guidance.

ABNB – Down 7% on future bookings looking a bit weak.

COST reported strong July comps.

EXAS sink 20% in premarket trading after the cancer-test maker gave disappointing results from a trial of its blood-based screening test for colon cancer and said it will pay up to $885 million to license a test from rival Freenome.

YETI - big beat driven by margins (sales were light). 2025 EPS guide raised on less tariff impact (recall they guided last Q w/ China at 145%). Investors won’t like the sales – stock -8%

Technology

Trump says chip tariffs at 100% with exemptions, baseline tariffs go into effect – FT

AAPL confirmed additional $100B investment commitment in US, bringing total to $600B. Actual clip of Tim Cook meeting Trump at the White House:

Demand for Chinese goods remains strong.. Chinese exports surged in July https://www.scmp.com/economy/china-economy/article/3321026/chinas-exports-accelerate-july-us-trade-truce-provides-boost [scmp.com]

ABNB highlighted improving trends, though some scrutiny on investment pressure on margins and comments about tougher comps. Would be buyers on pullbacks - Baird

HUBS are up 6.6% in premarket trading, after the software company reported second-quarter results that beat expectations and raised its full-year forecast.

DDOG are up 7.2% in premarket trading, after the software company reported second-quarter results that beat expectations and raised its full-year forecast.

FTNT down big on disappointing product refresh update and another services miss.

DUOL up big on better sub adds and ARPU expansion.

GLW- Corning Leads Apple Suppliers Higher as IPhone Maker Widens Deal. Also higher: COHR, AMAT, GFS

LYFT Q2 results and Q3 guide seen as largely in line.

BMBL are down 7.8% in premarket trading, after the online-dating company reported second-quarter results that were weaker than expected on key metrics, including paying users.

Industrials

Fastenal Company (FAST) – upgrading to outperform; $55 PT at Baird

Parsons Corporation (PSN) - Upgrading to Outperform; $92 PT at Baird

Symbotic (SYM) – Downgrading to Neutral; $55 PT at Baird

Alamo Group (ALG) downgraded to neutral at DA Davidson

Caterpillar (CAT) downgraded to underweight from equal-weight at Morgan Stanley; $350 PT

Emerson Electric (EMR) upgraded to equal weight from underweight at Barclays; $127 PT

ESAB Corp. (ESAB) upgraded to buy from hold at Stifel; $141 PT

International Flavors (IFF) downgraded to market perform at Oppenheimer

Joby Aviations (JOBY) downgraded to neutral from buy at HC Wainwright

Shoals Technologies (SHLS) upgraded to buy from neutral at Roth Capital

Latest Media

$OSCR - Hot name in retail and social channels

Very attractive if models’ estimates hold.