- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Trading Observations

Little incremental after FOUR, FLS, and ANET lower on numbers

Op-ex Fri and a big collar apparently around 6155 so that the big level, a push thru and potentially some chasing

6000 first support

Of note that Nasdaq up 4 days in a row, hasn't gone 5 since early Nov

II BULLS increase to 49.2% from 46.8%, below 60% remains a tailwind level

Futures

DOW -110

S&P -11

Nasdaq -27

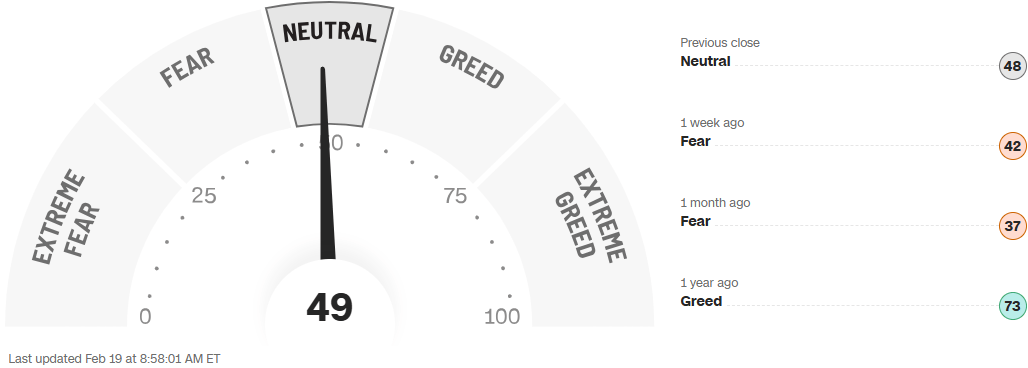

CNN Fear/Greed Index

10-Year Yield

Oil

BITCOIN

Financials / Retail / Healthcare

DPZ – Baird positive on Dominos, but a bit cautious near-term so it’s a longer-term call.

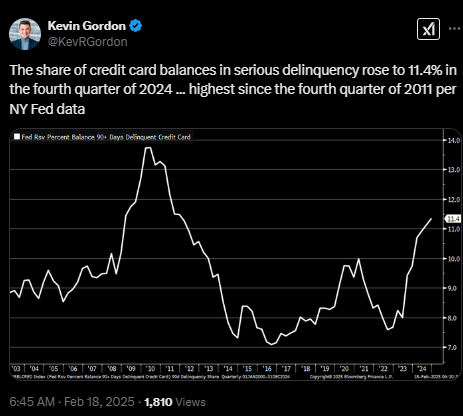

Charge Offs – Credit card net charge offs improved, but delinquencies (the leading indicator) ticked a bit higher this month. That said there has been no credit crisis, and likely won’t be one unless joblessness picks up.

PYPL – Analyst Day Today – Share losses in checkout will be a topic. Apple Pay and Google Pay taking share continues to be a bear argument.

GS on Asset Managers – They have declined 6% since they hit the rich valuation of 30x P/E minus stock based comp. They say stay selective and like KKR, TPG, and CG.

COF – Upgraded to buy at BAC on upside from Discover deal.

Technology

AAPL: event in focus - likely SE launch

ADBE: up 5 out of 6 .. MSci +VE checks ystrdy

ADI: +5% Q1 solid beat; optimistic commentary: "Our recovery is being propelled by improving cyclical dynamics and numerous new wins across our franchise converting to rev. Bookings contd to show gradual improvement during Q1 with strength in Industrial and Auto positioning us to grow q/q, y/y in FYQ2. Remain confident that fiscal 2025 represents a return to growth for ADI" ... boosted its dividend by 8% to 99c (the new yield is 1.8%) and added $10B to its buyback (taking the total authorization to $11.5B, or 10.5% of the market cap)

ANET: -5% Raised FY25 revenue guide to high end of 15-17% y/y growth (street at 19%). Also reiterated targets for new markets, but investors hoping for more upside on Q1. Renewed concerns over Meta rev concentration but nothing new (15% of sales) ... unchanged 2025 AI backend-networking sales forecast is more a reflection of the timing of deals, 2H visibility and conservatism

BMBL: -18% Q4 results that were essentially inline across the board (sales, users, ARPU, and EBITDA), but the Q1 guide falls a bit short; mgmt noted its FX audit is not complete, which equates to a wait for GAAP results on a quarterly and full-year basis

ETSY: -8% hit as sees Q1 GMV declining; Q4 GMV misses, revs below. Take rate 22.8% vs. 21% y/y, estimate 22.3%; Active sellers 8.13M (est 8.76M); Active buyers 95.46M (est 96.61M)

MRVL +70bps closed in green but relative laggard within AI chip complex - MS notes Alchip's 3nm Trainium3 chip is moving to mass production in late 2025, with AWS transferring CoWoS capacity from Marvell's Trainium2 to Alchip's Trainium3

MSTR – has cut 20% of its workforce as its bitcoin buying multiples… MicroStrategy has been buying so much bitcoin that it now reports when it didn’t buy any

NTAP: BofA upgrading - sees opportunity for an increasing TAM driven by AI and demand for public cloud and stable gross margins in the 71-72% range after strong margin growth in FY24; still sees limited upside to consensus estimates, the analyst added.

NVDA - Stock is having its best month since May and has retraced more than 90% of what it lost during the DeepSeek dive…we get numbers 2/26….

RDDT: contd bleed lower since T+1 reaction (APP ROKU COIN DASH SPOT also notable weak in alpha)

SMCI: now up 100% pos DeepSeek shock; best performer in the S&P 500 this year on hopes of some very hefty artificial-intelligence server deals in the near future .. UP ANOTHER 4.7% IN PRE

TSMC: -1% overnight; ppl question the participation in an Intel break up/tie up

WDAY: -2.2% MS downgrading ... #s Feb 25; closed above 50D last night but back below in pre - back + forth chop since Nov

Industrials

BWXT Technologies (BWXT) announces $2.1B in contracts for Naval nuclear reactor components

Heartland Express (HTLD) files mixed shelf for up to $150.0M

Illinois Tool Works (ITW) upgraded to hold from sell at Deutsche Bank

Southwest Airlines (LUV) enters into amended cooperation agreement with Elliott Management

Tri Pointe Homes (TPH) downgraded to sector perform from outperform at RBC Capital Markets

Valmont Industries (VMI) downgraded to neutral from buy at DA Davidson

Not an issue yet, but credit card delinquencies highest since Q4 2011

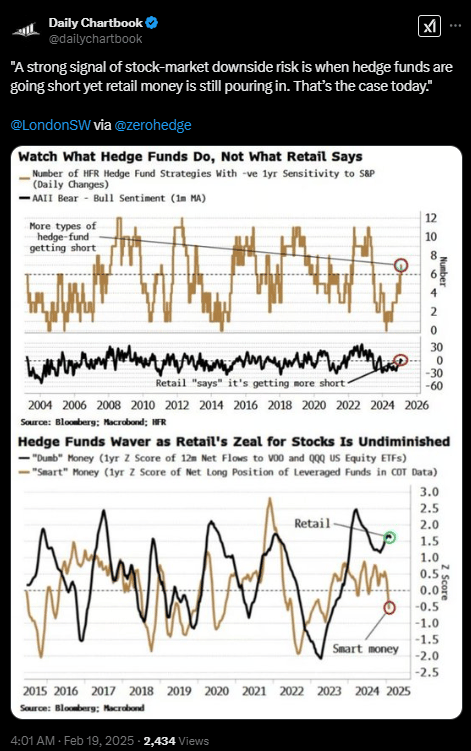

Big divergence between retail and hedge funds