- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Morning Note

presented by - |  |

Invest with us here: https://www.river1.us/invest.php

Trading Observations

Initial Jobless Claims just hit at 217k, which is very good for the economy, but bad for those begging the Fed to lower rates. We honestly need a near 300k print to scare the Fed.

Dow down, other indices up. Blame IBM vs GOOGL earnings.

The latest rally has been mixed and unimpressive, but each morning selloff has been met with buying, so the trend remains. Next week will be more telling as we get a larger deluge of earnings.

Today Trump is touring the Fed. Expect him to make a point that the facilities were upgraded above and beyond as a case against Powell. Initial Jobless Claims not helping his narrative.

Futures

DOW -321

S&P +1

Nasdaq +32

Financials / Consumer / Healthcare

CMG – Down 12% - Negative comps at Chipotle? Unheard of. This former 15-20% growth darling is now slated to grow just 8% topline and the starch is coming out of its multiple.

AEO – Up 18% - The Sydney Sweeny campaign is red hot all over social media currently which has the 22MM shares short running scared.

BX – Up 4% - Profit up 25% on a combination of retail and Evergreen fees.

LVS – Up 6% - Strong numbers out of Singapore.

TSCO – Up 4% - Nice comps beat.

BIRK – Upgraded to Buy at GS.

UNH – Down another 5% as they have said they are cooperating with the DOJ as they are probed into their Medicare business. The valuation is there, but there has been zero good news here lately to drive revaluation higher.

Technology

GOOGL (In RVER, largest position) – Up 4% - The quarter was literally perfect outside of an increase in Capex spending for AI to the tune of $85B vs $75B (this will have NVDA and the like higher). AI use numbers are astounding at over 1B humans. Cloud and search have shown no signs of decay.

MBLY (In RVER) – Up 4% - They had pre-announced when INTC sold its slug earlier in the month, but overall numbers remain impressive for this self-driving car technology play. FY25 to $1.85B midpoint vs $1.75B previous.

TMUS – Up 4% on strong post pay net adds. The cell phone game is zero sum at this point, so share takers win, and vice versa.

IBM – Down 6% - This name has the Dow negative while the Nasdaq is green. Enthusiasm for IBM as a cheap AI play is waning after GOOGL showed them how it’s done comparatively on the same evening of earnings.

NOW – Up 8% - Any worries of a slowdown on the Government side were put to rest as this software share taker continues to do so.

Industrials

TSLA – Down 6% - As EV incentives end, so do TSLA’s stellar industry margin. Add that to Elon ostracizing half the population and we continue to think TLSA remains toxic.

AAL – Down 7% - CEO blaming “uncertainty”. They say the worst of revenue weakness is behind them.

DOW – Down 10% - How do you lose money selling chemicals? By taking on too much debt in a low margin business line and needing CAPEX.

STLA (Just change the name and stock symbol to JEEP already) – Down 5% after yesterday’s Japan deal rally has reminded folks STLA is terrible at making money.

LKQ – Down 15% - Used auto parts auctioneer missed estimates hardily.

Latest Media

$PLTR and early 2000s $CSCO look very similar.

$PLTR trading 4-5x the valuation of peak $CSCO.

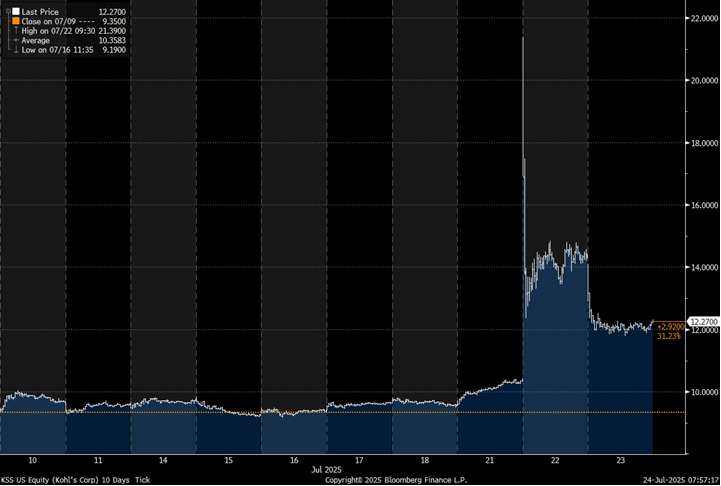

Who paid $21 in KSS/Kohls Tuesday? Idiot of the year award candidate.