- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Morning Note

presented by - |  |

Invest with us here: https://www.river1.us/invest.php

Trading Observations

It’s mostly bad –

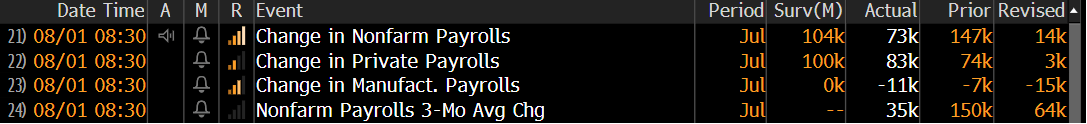

NFPs were 73k vs 104k expected, and the revision of last months 147k to 14k was even worse.

Trump punished everyone who didn’t make a deal with reciprocal tariffs, which is what caused the April selloff.

Conclusion – Today might be the turn. The market was out of control frothy, especially in AI and crypto, and Trump can’t get lower rates like he wants without some bad headlines, so let’s revise some employment numbers down and see if we can’t get the Fed to play ball.

Futures

DOW -422

S&P -69

Nasdaq -300

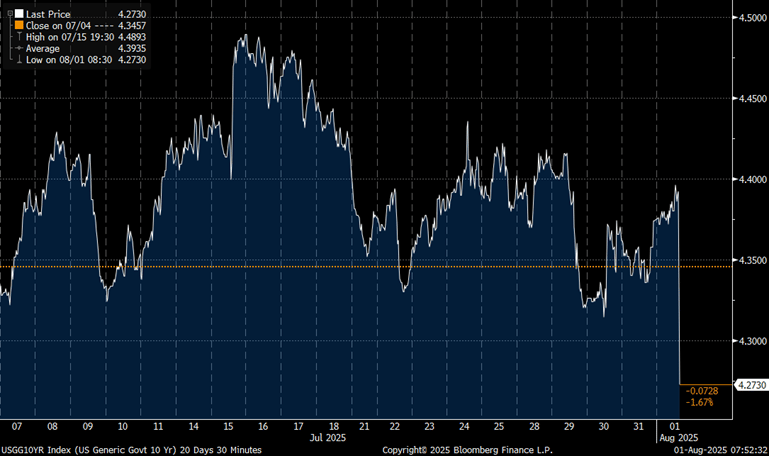

If there’s good news, it’s this drop in the 10-year yield as this helps give the Fed credibility to cut –

Woof on these revisions -

Financials / Consumer / Healthcare

COIN – Down 11% - This flier somehow had a revenue miss despite the crypto love. HOOD also down 5%.

FNMA, FMCC- Up 15% - Trump trying to get banks to step in and fix these.

KMB – Retail bright spot up 5% on a solid outlook.

CBOE – Beat, but an unimpressive one. Guiding down expenses to help next Q.

MRNA – Down 5%. Beat but guided down top end. Zero people want to take a Covid vaccine, so it’s going to need a new treatment to hit to get out of this revalue.

TROW – Low quality beat as it came from non-operating income.

JPM on Large Cap Banks – Basically all positive. Watch for a macro turn.

JPM on Small Cap Banks – Basically all positive but no outperformance on earnings because smaller cap.

Technology

FIG – They do $1B in revenue, ADBE tried to buy them at $20B and Wall Street tanked ADBE for the obvious overpay, they went public yesterday at $15B valuation, and this morning the stock is trading with a $62B valuation because the market is insane.

AAPL – Up 2% - The beat was entirely iPhone. They talked up growth to mid-single digits, which is helping the name, but I don’t see much clarity on where its coming from. Everyone waiting for them to figure out AI is still waiting.

AMZN – Down 8% - AWS missed 18% whisper numbers at 17% vs MSFT whose cloud looked good. Selloff seems a bit overdone to us.

RDDT – Up 15% - Solid growth in advertising and profitability to boot. They are becoming a haven for the SNAP chat generation and a training ground for AI.

Industrials

XOM – Solid beat on stronger international numbers. Stock up 1% in a down tape. US gas beat, international gas missed. They say they’ve taken $13.5B out of cost since 2019.

BLDR – Downgrading to neutral at Baird on volume/margin pressures given housing affordability issues.

JOBY – Up 7% on a partnership with L3Harris.

FLR – Down 21% on a very weak outlook. BE down as well despite a beat.