- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Morning Note

presented by - |  |

Invest with us here: https://www.river1.us/invest.php

Trading Observations

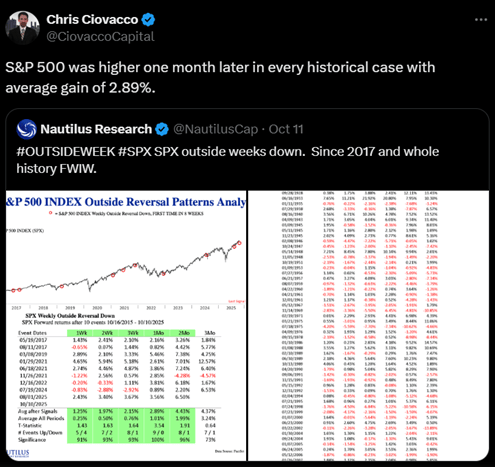

Assume everyone up to speed US/China. Hopefully rally builds as day goes on

What we DON'T want to see is a reversal without another tariff headline

Away from that, earnings start this week with banks tomorrow, AI - ORCL event this week and ASML earnings Wed, OpenAI / AVGO partnership

A reclaim of 6700 the first big level to signal the potential all clear

Breadth so bad it could be good... only 30% of S&P above 20-day https://tinyurl.com/4c5yay86 [tinyurl.com]

Fear/Greed down to 29 being only 3% off the highs

The concerns: New lows highest since April despite only being a couple % off the highs https://tinyurl.com/4c5yay86 [tinyurl.com]

Smalls with another failed breakout (still hope, but annoying) https://tinyurl.com/yx45hzc2 [tinyurl.com]

If history any guide, this bull still has plenty of room to run https://tinyurl.com/yhp92bhw [tinyurl.com]

Futures

DOW +375

S&P +83

Nasdaq +480

Financials / Consumer / Healthcare

Regional banks at new 52-wk lows relative https://tinyurl.com/bddk44be [tinyurl.com]

JPM unveils $1.5T plan to boost investments in US strategic industries https://www.foxbusiness.com/markets/jpmorganchase-launches-1-5-trillion-plan-bolster-us-economic-national-security [foxbusiness.com]

TGT is testing the sale of hemp-derived THC beverages at a handful of locations, marking a milestone for an industry that’s largely been shut out of national chains.

PYPL: GS to sell ... believes PayPal will faces several transaction margin headwinds in 2026, including interest rate headwinds and the lapping of a reacceleration of its credit products. Also sees less visibility for the co's branded checkout reacceleration in the near term given softer trends in Germany, tariff disruptions in the U.S., and competing wallet form factors.

URBN Chairman and CEO Richard Hayne discloses sale of ~672K, Co-President Margaret Hayne 588.0K shares - 144

Technology

AVGO / OpenAI - OpenAI signed a multiyear agreement with Broadcom Inc. to collaborate on custom chips and networking equipment, marking the latest step in the AI startup’s ambitious plan to add computing infrastructure.

AMZN - Amazon.com Inc. plans to hire 250,000 workers during its peak season — unchanged from the previous two years — making the online retailer a standout in an otherwise bleak holiday labor market.

China ADRs: VNET+8%, GDS+7%, PONY+6%, BABA+5%, BIDU+4%

CHINA DATA: China’s trade numbers for Sept come in solidly above expectations, including exports +8.3% (vs. the Street +6.6%) and imports +7.4% (vs. the Street +1.8%) (WSJ)

CRM: Benioff tells the NYT that Trump should send National Guard troops to San Francisco to help reduce crime in the city (NYT)

GFS: cut to SELL at BofA - doesn't see a specific catalyst for any immediate decline in the stock, but believes the company will need to display faster gross margin improvement and pricing power than what has been seen in the last two years

INTC: BofA downgraded to Underperform from Neutral - recent $80B jump in Intel's market cap more than reflects its improved balance sheet and external foundry potential, while the competitive outlook remains challenged with "no discernible AI portfolio/strategy," uncompetitive server CPU, and less flexibility now than before in divesting loss-making manufacturing. Stock has come "too far, too fast" when considering the co's still-challenged fundamentals

NVDA: aggressively seeding AI startups around the world, participating in 50 VC deals already this year, surpassing the 48 total from 2024 (Tech Crunch)

QCOM: admitted to China it never informed Beijing when it closed the Autotalks deal in June (Reuters)

STX/WDC: Citi positive

TXN: -0.3% BofA downgrading to UNDERPERFORM on macro - believes the turmoil caused by global tariffs could keep the lid on any near- to medium-term demand improvement in the industrial economy

Industrials

BE - Bloom Energy Soars on $5 Billion Brookfield AI Partnership

Newmont Corp (NEM) Raised to Buy at Goldman; PT $104.30

Tesla (TSLA) Rated New Buy at Melius; PT $520

Solar power: the White House last week moved to cancel a massive (6.2 GW) solar project backed by NEE (NextEra Energy), its latest assault on renewable energy (FT)

PANW is up 2.9% in premarket trading, after BTIG upgraded the security software company to buy from neutral.

Latest Media

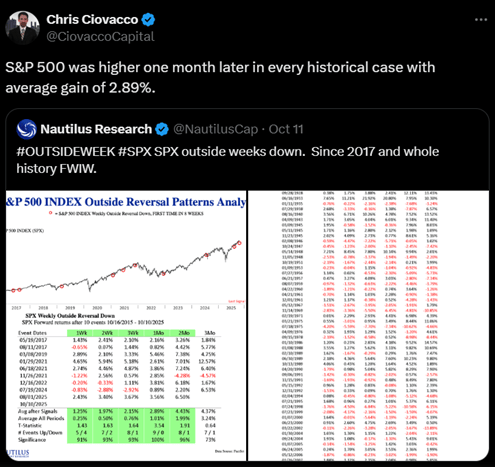

$JPM and many big banks trading at >2x P/B.

We keep saying valuation matters, especially in the medium to long run.

Another example, coupled with the history of returns when purchasing at current levels.