- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Morning Note

presented by - |  |

Invest with us here: https://www.river1.us/invest.php

Trading Observations

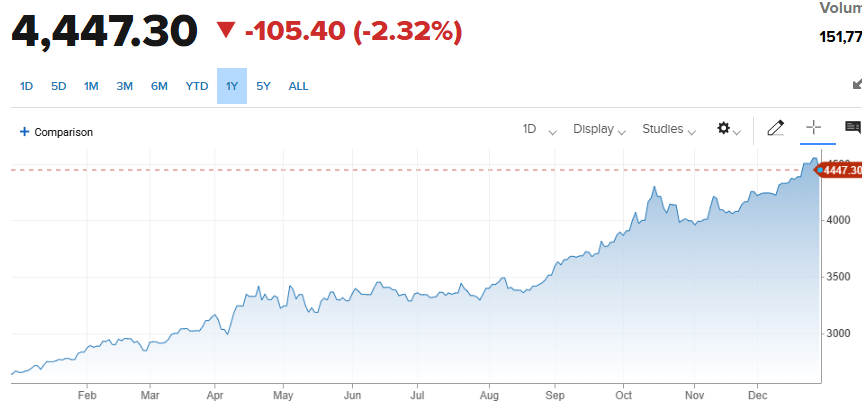

Futures down to start the week, we will see if the “Santa Rally” kicks in after already an impressive year.

Metals the only thing of note... silver reversing a bit, will see if Fri proves to be the parabolic top or more to go

Lots of rumors of banks being in trouble/strain https://tinyurl.com/pdnbdyk2 [tinyurl.com]

6860 support with all eyes on 7000

Equal weight fins breaking out https://tinyurl.com/3v5vbt4h [tinyurl.com]

Trump suggests the US conducted a land strike in/around Venezuela, signaling a potential escalation in the campaign against the Maduro gov’t – NYT

Futures

DOW -63

S&P -21

Nasdaq -124

Charts/Sentiment

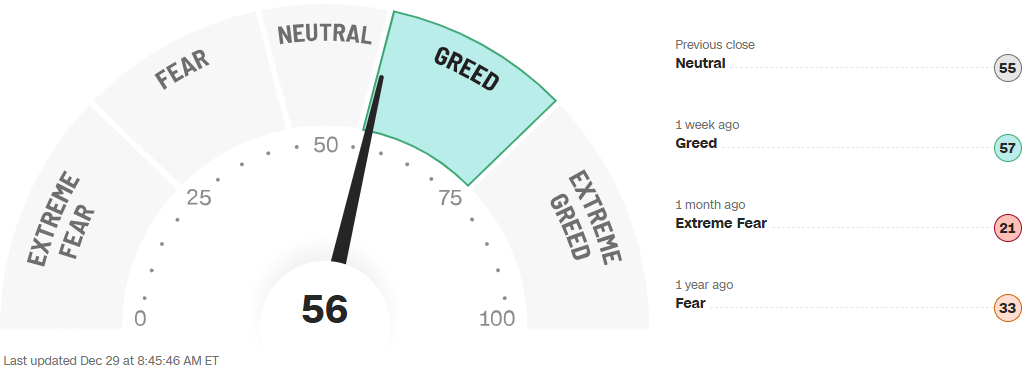

CNN Fear/Greed Index | U.S. 10 Year Treasury |

Gold | Bitcoin |

Financials / Consumer / Healthcare

Gold, silver and copper mining and royalty stocks (AEM +1.6%, CDE +2.7%, FCX +1.4%) rose as the metals continued to hit record highs amid rising geopolitical tensions.

TGT shares jumped during Fri trading on reports (which were out Friday morning) that the company is facing activist pressure from Toms Capital Investment Mgmt., which has built a “significant” stake in the firm – FT

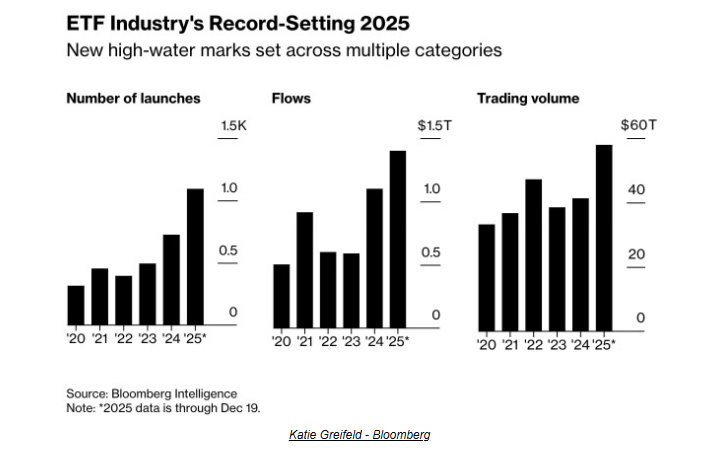

Active mutual funds suffered a further exodus of funds in 2025 following another year of poor performance – bloomey

Consumer staples sentiment is horrendous as the industry faces a slew of cyclical and secular headwinds, but companies aren’t standing still, with many making changes aimed at repositioning their portfolios for the new reality – Barron’s

Hotel operators are battling back against OTAs and AI agents by emphasizing loyalty programs to encourage direct bookings – FT

Technology

Tech TRIPLE DIGIT YTD gainers: PL +380%, LITE+365%, WDC+303%, HYNIX+265%, OKLO+262%, MU+238%, STX+232%, HOOD+217%, CIEN+185%, WBD+172%, PLTR+150%, LRCX+147%, W+131%, FROG+128%, APP+121%, FN+118%, CVNA+116%, CRDO+115%, FUBO+110%, KLAC+103%, COHR+102%, GEV+102%, U+101%, DY+100%

AI/semis soggy px action: SNDK-4%, BE-3%, CRDO-2.7%, ALAB/AAOI/ORCL-2%, MU/VRT/CLS-1.5%, SMCI/LITE/NVDA/MRVL-1.2%, AVGO/PLTR/AMD/WDC-1%

Memory/Capacity Add: Hynix is considering an expansion of its advanced chip packaging capacity in the US (Digitimes) ... MU-1.6%, SNDK-3.9% .... note Kioxia -6% overnight

SoftBank to Buy Data Center Firm DigitalBridge for $4 Billion

AI Power Up: AI data centers are relying on aircraft engines and diesel generators to produce power amid delays in connecting to electricity grids (FT)

AI Power Up Part II: GEV is supplying data center developer Crusoe with aeroderivative turbines that are expected to produce nearly 1 gigawatt of power for OpenAI, Oracle and SoftBank’s Stargate data center in Texas” “ProEnergy has sold more than 1GW of its 50 megawatt gas turbines directly adapted from jet engines.” “Sam Altman-backed aviation start-up Boom Supersonic announced a deal to sell to Crusoe turbines that are expected to provide 1.2GW of power and are “virtually identical” to those built for its jets. ”use of generators fueled by diesel and gas is also increasing. Manufacturer Cummins has sold more than 39GW worth of power to data centers and nearly doubled its capacity this year.”-FT

NOW: investors were already worried about AI disruption risk, and now they’re nervous about a fairly aggressive string of M&A under CEO Bill McDermott (who was responsible for a slew of deals, some of which were panned, during his time at SAP) (Bloomberg)

NVDA: sell side commentary overwhelming bullish on Groq deal - extends AI infrastructure leadership; Groq's second generation language processing unit will be based on a Samsung 4nm process, which could ramp in conjunction with Nvidia's Vera Rubin rack systems; addressing competition from other inference architectures with a licensing deal that is more adequate than a full acquisition

SpaceX Ripple Effect: commentary from Center15 Capital - "impressive public market performance in December for companies operating in the space domain. December MTD Performance of select public space companies = RDW +30%, KRMN +18%, RKLB +70%, FLY +35%, PL +61%, VOYG +20%, ASTS +30%, LUNR+62%"

TSM confirmed that its operations were stable after Taiwan was hit with an earthquake – DigiTimes

Latest Media

River1’s CIO on Schwab Network

Levered ETFs, market perspectives, etc.

sSoftware vs the field: Chart of the Software (gs basket with ~75 names) relative to the NDX ... while we are at ~5 year low, the pair appears to be trying to bounce at a similar ‘level’ that it did in mid-2024