- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Morning Note

presented by - |  |

Invest with us here: https://www.river1.us/invest.php

Calendar

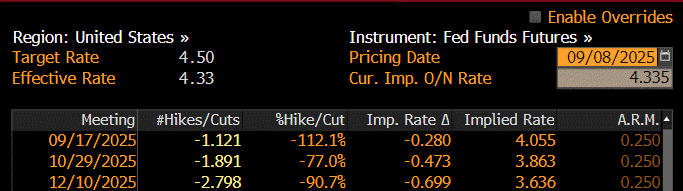

This Week – Fed Quiet Period before next week but we get three data points. If BLS revisions, PPI, and CPI are all negative/lower, look for a 50-bps cut to get fully price in.

Monday – NY Fed Inflation Expectations.

Tuesday – BLS Revisions (look for these to get revised down and be a big talking point), ORCL Earnings.

Wednesday – PPI

Thursday – CPI, ADBE Earnings

Friday – U Michigan.

Trading Observations

Shaking off the weak jobs number

Jobs revisions tomorrow (expecting -800k or so), is it AI taking over or slowing?

Less than 50% of industries have added last 6 months https://tinyurl.com/8y8e2r8p [tinyurl.com]

PPI Wed, CPI Thurs, though not likely to impact

Sensitivity stretched https://tinyurl.com/bde3b3dn [tinyurl.com]

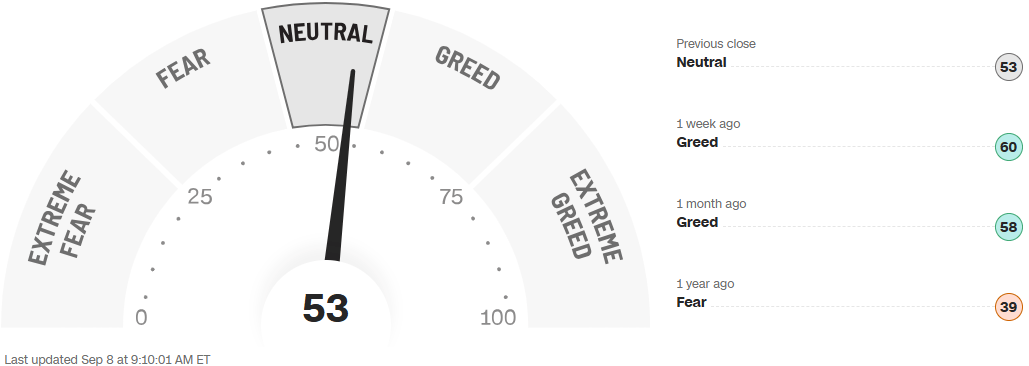

Fed in quiet period ahead of meeting next week, 25bps priced in with 11% chance of 50bps (odds feel higher for a 50)

Seasonality an issue but potential mitigation https://tinyurl.com/jkmxk6jc [tinyurl.com]

AAPL event tomorrow as well

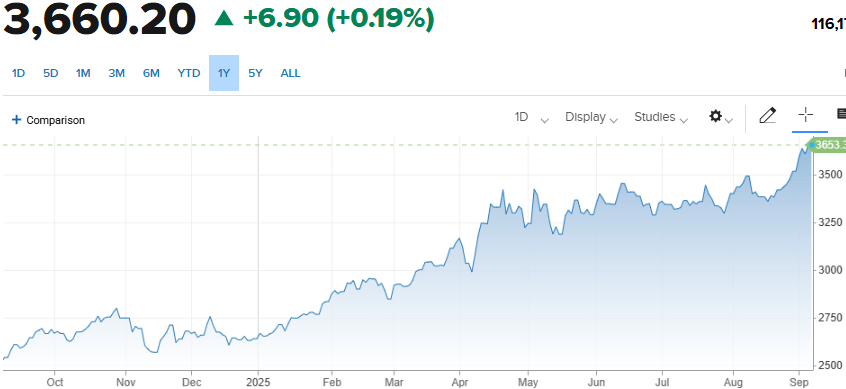

6500 being tested again, a push thru and 6550 next resistance vs. 6400 support

GS suggesting valuation fair https://tinyurl.com/yzcncr8a [tinyurl.com]

Hedge funds very short https://tinyurl.com/2w23jj6v [tinyurl.com]

With small EPS growth driving https://tinyurl.com/4ztncvzr [tinyurl.com]

Futures

DOW +80

S&P +14

Nasdaq +83

Charts/Sentiment

CNN Fear/Greed Index | U.S. 10 Year Treasury |

Gold - ATH | Bitcoin |

Financials / Consumer / Healthcare

Market now 100% 25 bps next week, 12% 50 bps, and looking at three rate cuts before the year is out.

OPEN – Up another 7%. Still feels like the next/current GameStop.

LLY – Positive Phase 3 data for its lymphocytic leukemia drug.

LDI – Up 17% on mostly short cover driven by a Citron report, calling it a potential housing winner.

HOOD – Up 8% on S&P inclusion.

Baird’s Top Restaurant picks – WING, SBUX, CAVA, CMG on solid August comp data across the board.

NCLH – Down 2% on a bond offering.

CHWY: upgraded @ Mizuho - "outlook to be strong and provide a positive share catalyst. Company's results in the back of the year should ease several investor concerns due to strong customer growth surpassing 100,000 net additions each quarter and core margin weakness fading as initial auto-ship discounts become less impactful"

DUOL: new SELL @ Wells Fargo - believes Duolingo's user growth issues will persist in the medium term, creating downside for the stock's multiple. Wells believes the company's fiscal 2027 estimates have downside risk

HOLLYWOOD THREAT? OpenAI tools and technology will be used to make a feature-length movie, the latest sign of AI upending Hollywood (WSJ)

GOOS rise 4.2% after TD Cowen raised its recommendation on the parka maker to buy from hold as it sees new products driving sales growth.

Technology

AAPL App Store: firms such as Epic and Spotify have slowly chipped away at one of the most lucrative (highest-margin and highest-multiple) revenue streams of the Apple ecosystem: the App Store (WSJ)

AAPL: Evercore lifting PT

AMZN: decision to end the practice of sharing free shipping Prime benefits among adults could impact tens of millions of Americans, potentially driving some to sign up for Prime subscriptions themselves (WSJ)

APP rises 9.5%, HOOD advances 8.2% and Emcor Group Inc. (EME) is up 2% after S&P Dow Jones Indices said the stocks would be added to the S&P 500 Index.

AI Power/Data Center (Goldman): US power demand is up 2.9% year-over-year year-to-date and growing more quickly than US GDP, in large part because data center capacity is growing at a breakneck pace (Exhibit 1). We estimate data centers now account for 8% of total US power

AI ROI: OpenAI now forecasting $115B cash burn through 2029, up $80B from prior expectation (substantially larger than prev thought, hence Broadcom $10B deal); company looking to better control costs by developing its own data center sever chips and facilities to power its technology (The Information)

GOOGL: nice follow post DoJ clearing event … A LOT to like here. Stock up 5 weeks in a row (up 15 out of 17 wks) …. Room for further mean reversion as Meta/Zuckerberg have attracted majority of tech dollars over the last 3 years …. GOOGL < META by 242% on three-yr basis

NVDA: Colette keynote @ GS Conf today, 3:25pm ET … shares have fallen four weeks in a row (down ~9% over period) as upticks have been few + far between since T+1 reaction. Friday slumped fueled by uptick in ASIC > GPU debate post Broadcom’s extremely bullish conf call (Hock also speaking at GS)

RBLX: flurry of PT hikes/bullish notes post RDC (including Wedbush) - Co announced an excellent balance of features aimed at both supply side productivity and demand-side TAM expansion

RDDT: +3% contd upside .. Anthropic ruling from Friday reinforces the strategic value of Reddit platform/data to LLMs ... Reddit sued Anthropic in June 2025. Reddit accused the AI startup Anthropic of unlawfully using data from Reddit's more than 100 million daily users to train its AI models, without a licensing agreement or compensation. The lawsuit, filed in the Superior Court of California, alleges that Anthropic accessed Reddit's data over 100,000 times, violating Reddit's content policies and user agreemenT

SATS: +38% STARLINK in talks to acquire Echostar spectrum (prev reported)

UBER: Dara speaking at Goldman 1:10pm ET on Monday: story has gotten A LOT more controversial over the last several months as AV disruption fears / path has made Uber’s growth story a lot murkier (Lucid deals; Waymo / Avis partnership for Dallas; analysis which shows AV disruption of ride-share model; Waymo announcing Seattle + Denver with partner yet to be named; Robotaxi launch of free app to all US users + it quickly jumping to #1 in charts UBER: will partner w/China’s Momenta to launch autonomous rideshare services in Germany (WSJ)

Industrials

Ashland (ASH) initiated equal-weight at Morgan Stanley; $60 PT

ABM – Downgraded to Neutral at Baird, Demand Less Robust than Thought

Goodyear Tire & Rubber (GT) initiated neutral at Citi; $10 PT

International Flavors & Fragrances (IFF) upgraded to peer perform from underperform at Wolfe Research

NIO Inc (NIO) upgraded to buy from hold at Everbright Securities

TransDigm Group (TDG) downgraded to sector perform from outperform at RBC Capital Markets; $1,385 PT