- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Morning Note

presented by - |  |

Invest with us here: https://www.river1.us/invest.php

Calendar

This Week – Typically a positive week due to “Holiday Vibes” and low volumes. We keep watching Initial Jobless Claims (Wednesday) to see if a recession might be looming, but no signs.

Tuesday – Retail Sales, PPI

Wednesday – Initial Jobless Claims, Beige Book

Thursday – US Market Closed

Friday – US Market half day

Trading Observations

A bounce Friday, but hard to say 'THE bottom' is in

Usually a light trading week with an upward bias but we are due a fair amount of data, and given the dearth we've had, may take on more significance

PPI and Retail sales Tues most significant with beige book Wed

Fed goes into blackout period Friday, but most spoke last week

Held 6550 support late last week and remains key 6670 first resistance, but 6770 the bigger level to break trend and suggest Santa coming to town

"Everyone wants a pullback in an uptrend until they get a pullback in an uptrend." Perspective https://tinyurl.com/yxb8a87h [tinyurl.com]

Positioning the headwind https://tinyurl.com/2mdpv6nj [tinyurl.com]

But the selloff already corrected things? https://tinyurl.com/ysmncp2w [tinyurl.com]

Hedge funds covered Friday https://tinyurl.com/y3dudwus [tinyurl.com]

Futures

DOW +116

S&P +38

Nasdaq +214

Financials / Consumer / Healthcare

NVO – Down 9% to another fresh low. Hopes that Ozempic would show positive results for Alzheimer’s have been dashed. This name cannot get out of its own way lately. LLY down in sympathy

AMZN – Long-form Bloomberg article out showing how deep their datacenter play has gotten as sites for AWS now number 900.

OSCR (RVER Holding) – Up 14% - The WSJ is out saying cracks in the ACA hate are forming on the Republican side, and a deal might be likely. The rest of the insurance plays are up today as well.

Crypto Related – Up 2-3% this morning on snapback.

XYZ – At Block Analyst Day, someone asked Jack Dorsey if he was Satoshi and he answered the question with a question and a quip. Most people think it was the late John McFee

KSS reportedly planning to make interim CEO Michael Bender the permanent CEO, with announcement likely coming soon.

TSCO jump 1.3% after Jefferies upgraded its rating on the farm retailer to buy from hold, citing early-stage initiatives and valuation dislocation.

Cipher Mining (CIFR) and CleanSpark (CLSK) shares rise 5.2% and 4.8%. respectively, after JPMorgan upgraded the Bitcoin miners and data center operators citing recent high-performance computing deals

Technology

AI related prints left on 2025 calendar: Alibaba, DELL, MDB, CRDO, MRVL, PSTG, SNOW, CRM, HPE, ADBE, CIEN, AVGO, MU

AAPL: while the iPhone 17 cycle overall is performing well, sales of the new iPhone Air have fallen short of expectations (FT)

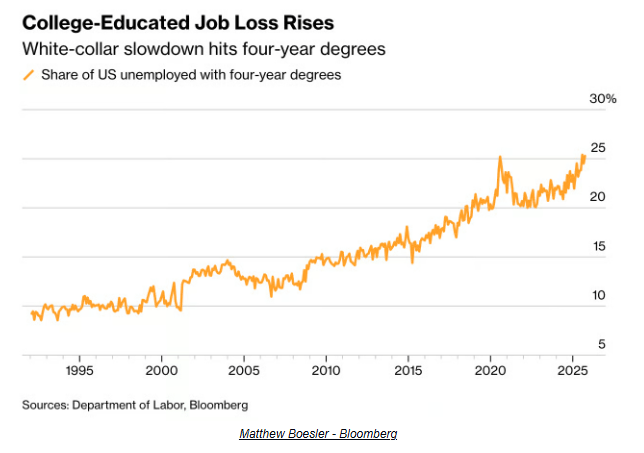

Amazon cut more than 1800 engineers in record layoffs, despite saying it needs to innovate faster https://www.cnbc.com/2025/11/21/amazon-cut-thousands-of-engineers-in-its-record-layoffs-filings-show.html [cnbc.com]

BABA gain 4% after the company said its re-branded Qwen AI tool hit 10 million downloads in the first week after it became available to the public.

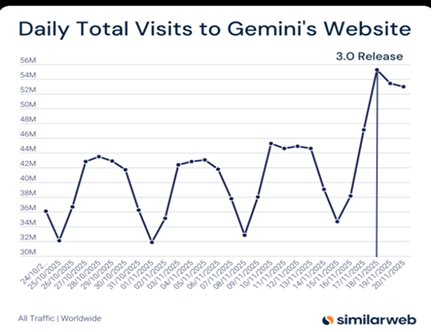

GOOGL: up 3.2% in pre as of 7am ET ... freight train as Gemini 3 generated LOT of buzz over the weekend. OAI falling behind? Helps explain elevated oddness/desperation from Altman & Co in recent weeks

GOOGL: +8.4% last week post Gemini 3 launch (up 21 out of 28 weeks) … Since I/O in mid-May, GOOGL > META by 89.7% .... Gemini 3 blew especially past all competition on the ARC-AGI-2 benchmark.

GOOGL: received permission to expand Waymo across a larger portion of Cali (Tech Crunch)

GOOGL : Reinstated Outperfrom at BNPP Exane PT $355

MSFT: Crowded AI market challenges Microsoft's enterprise ambitions ... Anthropic continues to dominate enterprise segment

MU: +1.5% denied reports it is redesigning its HBM4 product and says production capacity for 2026 is already fully booked (Digitimes)

TSMC CEO on AI demand: "Based on the product planning and growth expectations of various major customers, "TSMC's current capacity is still about three times insufficient," and advanced process capacity is "insufficient, insufficient, and still insufficient."

Industrials

MP are up 3.5% after BMO upgraded its recommendation to outperform from market perform, saying the stock’s recent pullback offers a buying opportunity into the long-term theme of the US shoring up its rare-earth supply chain.

Latest Media

$PM - New and hot consumer product!

Took the stock from a 15x to 30x P/E.

Purely multiple expansion.