- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Morning Note

presented by - |  |

Invest with us here: https://www.river1.us/invest.php

Trading Observations

The tale of the tape: IBD 50 (FFTY) down 10% in a week and breakouts struggling

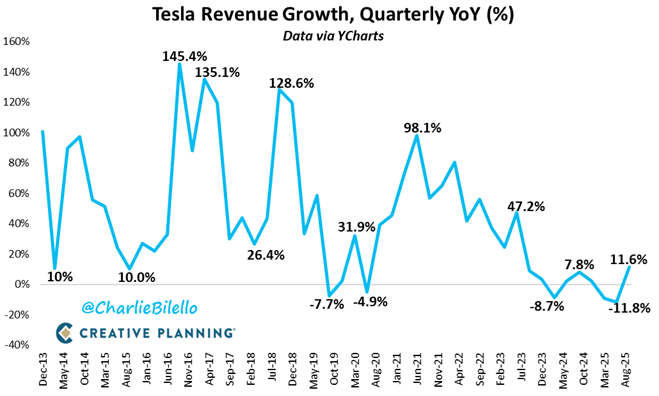

AL higher, while TSLA, IBM, SAP, and URI lower on earnings

CPI tomorrow

Oil higher on Russia sanctions being shrugged off

6765 resistance

Closed right at 6700 support, should we fade, 6660 next level to watch

AAII Bulls with a slight uptick https://tinyurl.com/yev62f6j [tinyurl.com]

Buyback window starting to re-open https://tinyurl.com/3sfwz4a4 [tinyurl.com]

While people fret over valuations, earnings doing the heavy lifting https://tinyurl.com/5n93np8n [tinyurl.com]

Healthcare in vogue finally? https://tinyurl.com/3c32akvu [tinyurl.com]

Fwiw, defensives massively underperforming https://tinyurl.com/y3m8yyd7 [tinyurl.com]

Futures

DOW -95

S&P -7

Nasdaq -50

Charts/Sentiment

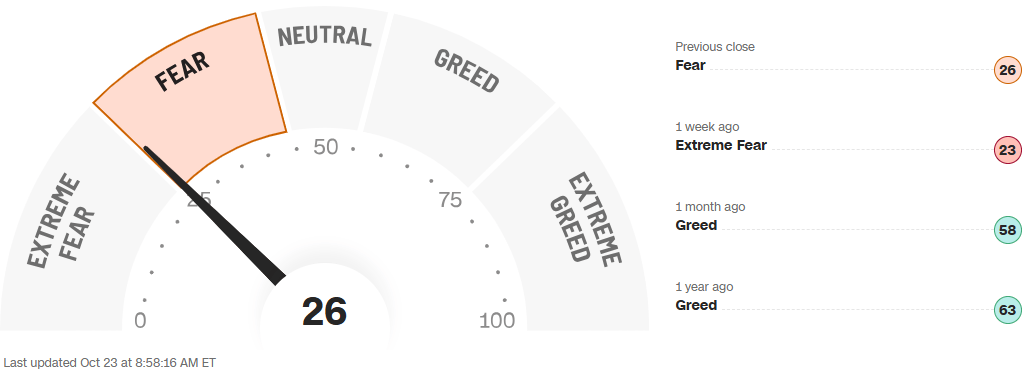

CNN Fear/Greed Index | U.S. 10 Year Treasury |

Gold | Bitcoin |

Financials / Consumer / Healthcare

Gold stocks (NEM +1.5%, B +0.9%, AU +0.1%) rise with bullion prices and as Scotiabank upgrades the mining stocks and downgrades the royalties stocks.

V/MA – Baird reviewing Puts/Takes into F26 - With MA/V reporting next week, we wanted to review the puts/takes into F2026; they like Visa better than Mastercard into earnings. Visa is reporting FQ4-25 (Sept quarter) and will guide to F2026. Mastercard is reporting Q3-25 and won't guide 2026 until early C2026.

LVS climb 6.2% after the casino operator reported adjusted earnings per share for the third quarter that beat the average analyst estimate.

Technology

Software vs Semis: +2% move ystrdy ... combo of soggy AI trade + MS positive SaaS note saying that their Q3 checks show stabilization across key metrics, supporting a potential re-emergence of positive earnings revisions after several cautious quarters

IBM - shares slid after its core software division lost steam, raising fresh doubts about its ability to keep up with rivals in cloud and AI, despite upbeat revenue guidance and ongoing acquisition strategy.

LRCX - beat and raised, but also some scrutiny on China deceleration in 2026 and GM headwinds.

MBLY are down 2.4% after the maker of software and hardware technology for automobiles reported inline third-quarter results and gave an outlook.

TMUS falls 1.4% after posting third-quarter results.

Industrials

US energy stocks (CVX +1.4%, XOM +1.5%) rose in premarket trading Thursday after US President Donald Trump put in place new sanctions on Russia, blacklisting oil giants Rosneft PJSC and Lukoil PJSC.

Valero Energy shares (VLO) rise 2.2% after it reported third-quarter adjusted earnings per share that beat the average analyst estimate as refinery throughput increased.

Avery Dennison (AVY) upgraded to overweight from neutral at JPMorgan; $195 PT

Avery Dennison (AVY) upgraded to buy from neutral at UBS; $218 PT

American Airlines (AAL) - Q3 beats, Q4 EPS guidance well ahead of cons, stock up 4%

LUV - Q3 ahead and reiterated FY EBIT guidance despite expectations for a cut.

Enphase Energy (ENPH) Cut to Neutral at Mizuho Securities

JB Hunt (JBHT) - announces new $1B share repurchase authorization

Ryder (R) – Q3 EPS beats, Q4 EPS midpoint below consensus, new stock repurchase plan announced – reported Q3 of $3.17B and $3.57, compared to cons of $3.18B and $3.54. Sees Q4 EPS $3.50-$3.70, compared to cons of $3.68. Authorizes two new share repurchase plans (2M shares for discretionary purchase and 1.5M for anti-dilutive repurchase)

RIVN - Rivian is carrying out another round of layoffs affecting around 4% of its workforce as the electric-truck maker tries to conserve cash in a world pulling back from electric vehicles.

Vertiv Holdings (VRT) Raised to Outperform at KGI Securities

URI - hit by EBITDA miss and slowdown in fleet productivity

Latest Media

$NBIS has experienced great revenue growth, but is likely to end up as a REIT...

Like $CRWV, Nebius's business model requires tremendous capex

With a large negative FCF, capex funds come from either debt or equity

We think equity holders will get diluted or own a highly levered security