- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Morning Note

presented by - |  |

Invest with us here: https://www.river1.us/invest.php

Trading Observations

The old high in the QQQ at $613 looks like it will be run through this morning, and animal spirits appear to be back in vogue as the fear that permeated post-Trump China on 10/10 looks unfounded.

Next week there are a ton of catalysts on the board –

Huge earnings week, the bulk of mega-cap tech coming Thursday night

Fed to cut rates 25bps Wednesday

Government shutdown could end so everyone doesn’t miss two paychecks.

Trump in Asia/Trade

These could push us either way, but against a backdrop of fear setup feels like a positive one.

Futures

DOW +250

S&P +50

Nasdaq +50

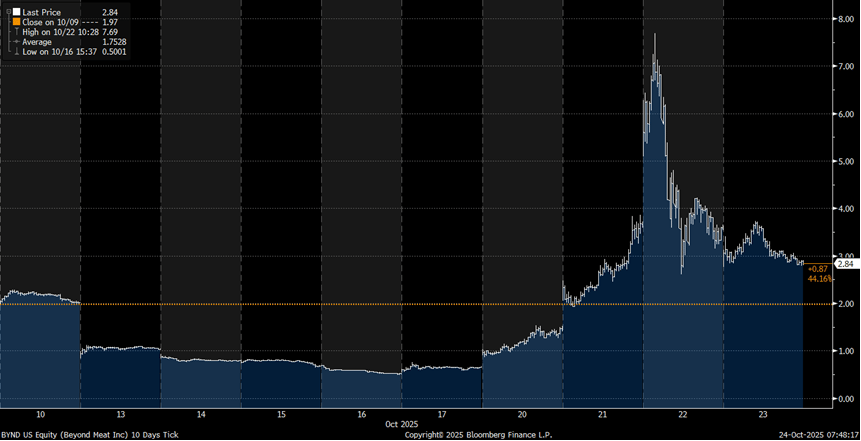

Hey BYND (Beyond Meat) Investor Relations, how was your week?

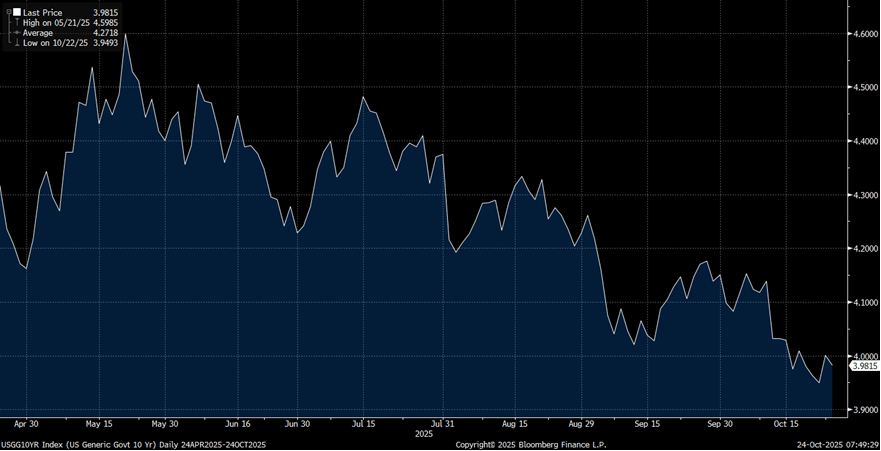

Did 4% for 10 year yield just switch from support to resistance?

Financials / Consumer / Healthcare

DECK – Down 12% - Sales growth at +7.3% vs 9% expected doesn’t sound that bad to me, but HOKA is decelerating (and the shoes are ugly).

TGT – Out late yesterday they would lay off 1000-1800 employees. Sad but necessary. Stock up 1%.

PG – Up 3% on earnings that showed tariff impacts to be manageable.

Financials – Crypto heavy fins ripping.

Baird on Restaurant Chains – Comps are slowing at Fast Casual like CMG, CAVA and WING. Higher unemployment for 16-24 could be a culprit.

PMI – Down 68% in today’s latest pharma miss.

LLY, FMDT – Announced purchase of Adverum, where they will now have a wet age-related macular degeneration drug.

JPM - Warren out saying, “Don’t lend Argentina $20B”. She says stuff. JPM sent three private planes there this week.

Technology

CART – Baird preview likes setup should they report in-line or better.

INTC – Up 6% in the middle of an epic come back run. They announced revenues, that missed street estimates, but the buying power here remains strong. The good news was they posted their first positive net income since 2023.

BAH – Down 10% on profit miss. IT Services slowly getting eaten by AI.

SNAP – Cut to sell at Stifel on negative trends. Not a shareholder friendly company. Needs an activist.

Industrials

F – Ford up 3% saying the fire that worried investors that F-150 output would slow isn’t as big a problem as feared.

ALK – Down 5% on flight cancellations due to IT glitch.

GD – Up 5% on solid results. Defense remains hot.