- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Morning Note

presented by - |  |

Invest with us here: https://www.river1.us/invest.php

Calendar

This Week – Typically a positive week due to “Holiday Vibes” and low volumes. We keep watching Initial Jobless Claims (Wednesday) to see if a recession might be looming, but no signs.

Wednesday – Initial Jobless Claims, Beige Book

Thursday – US Market Closed

Friday – US Market half day

Trading Observations

Tech/futs extending gains. EPS dominating the narrative in pre

Odds of a rate cut now sit at 80% and Hasnett is now seen as one of the front-runners for Fed Chair

Durable goods orders rose 0.5% m/m, in line with expectations, US Census Bureau data show.

Jobless claims fell 6k to 216k in Nov. 22 week compared with median est. 225k, Labor Department data show.

QQQ look to reclaim post NVDA earnings rally before the violent reversal that sent tech -5% in two days. Seems healthy

Futures

DOW +93

S&P +17

Nasdaq +99

Charts/Sentiment

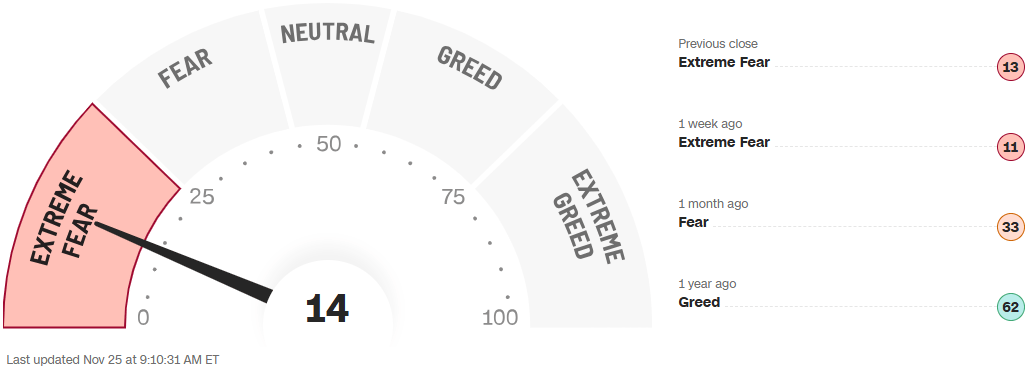

CNN Fear/Greed Index | U.S. 10 Year Treasury |

Gold | Bitcoin |

Financials / Consumer / Healthcare

Rent vs Own - More US families are renting homes because it’s much cheaper. Pretium estimates that to restore cost parity between owning and renting, mortgage rates would need to drop by about 2.5 percentage points from current levels, from 6.2% to 3.7%, holding other variables constant

HOOD - shares rise 4.4% in premarket trading on Wednesday after the company announced that it and Susquehanna International Group are buying a majority stake in LedgerX, a US-based derivatives exchange once owned by FTX

CLSK - B Riley Securities cut the target on Cleanspark Inc. to $22 from $25. Maintains buy rating.

URBN beat with UO comps ~3x consensus and Anthro and GMs also better.

LLY stock has reached new highs in recent days, becoming the first pharmaceutical company to hit a $1 trillion valuation…

Federal investigators warn Minnesota welfare fraud may have helped fund terrorist https://tinyurl.com/4uzdbx5r [tinyurl.com]

UBER rolls out driverless robotaxis in Abu Dhabi

WOOF are up 20% after the pet health and wellness company raised its full-year forecast for adjusted Ebitda.

Technology

ADI: +3.5% first prints as Q4 top/bottom line beat; Auto / consumer / Comms revs ahead; Industrial below. Sees Q1 revs $3B to $3.2B (est $2.97B). Commentary: "Healthy bookings trends continued in the fourth quarter with growth in Industrial and notable strength in our Communications market

AMBA pressured despite beat, better sales guidance and upbeat AI commentary, with some focus on slightly weaker GM guidance.

DELL +4% guide shows contd AI momentum

HPQ fall 2.3% after it gave a profit outlook for current year that fell short of estimates and the company said it will cut 4,000 to 6,000 employees through fiscal 2028 by using more AI tools.

NVDA says its GPUs are a “generation ahead” of Google’s …while acknowledging Google is a real competitor https://www.businessinsider.com/nvidia-generation-ahead-google-chips-2025-11 [businessinsider.com]

GOOGL/META: spread has rightfully blown out since May ..... Meta caught nice bid ystrdy + could see some nt outperformance/reversion post TPU purchase shift ... for GOOGL: continues to do its thing: heard from more than just a handful of people today trimming as most doing the math: 30x ‘26 EPS $12 = $360 and 25x ‘27 EPS of $15 = $350, so less than 10% of upside to the stock

ADSK +7% raised '26 sales view; one of the cleanest quarterly reports we have seen from Autodesk over the last few years with strong executions driving all metrics

ZS -7% guide fell short of buy side; guided to Q2 net new annual recurring revenue slightly lower than prior, and it declined to provide a specific contribution from the recent Red Canary acquisition

RDDT - ystrdy, +12% .... improving US DAU data and ChatGPT citations which have climbed back to June/July levels according so some sources

NTAP +7% crowded short into print; better margins; boosts FY adj EPS forecast. Catching an upgrade

NTNX slump 11% after the cloud-platform company cut its 2026 revenue forecast. JPMorgan said delays in when the company recognizes revenue after a booking were part of the reason for the shortfall.

WDAY -6% hit on mixed results; missing buy side bogeys. The question remains the impact of Paradox on the F3Q cRPO beat

Industrials

Taiwan announces special budge of $40B for arms purchases to bolster defense … good sign right?? https://theindependent.sg/taiwans-40b-defense-plan-marks-bold-response-to-chinas-rising-military-threat/ [theindependent.sg]

Autoliv (ALV) upgraded to overweight from neutral at JPMorgan; $140 PT

Amentum Holdings (AMTM) upgraded to equal-weight from underweight at Morgan Stanley; $35

Atmus Filtration Technologies (ATMU) upgraded to overweight from neutral at JPMorgan; $60 PT

DE forecast disappoints …MASSIVE run YTD

Astronics (ATRO) initiated buy at TD Cowen; $65 PT

Old Dominion Freight Line (ODFL) initiated sell; $110 PT

Saia Inc (SAIA) initiated neutral; $262 PT

XPO, Inc. (XPO) initiated buy; $152 PT