- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Trading Observations

Futures up a touch after cool payrolls data

The economy is full steam ahead, and the market continues to shrug off bad news and rally

Yields are quiet, gold and dollar stronger

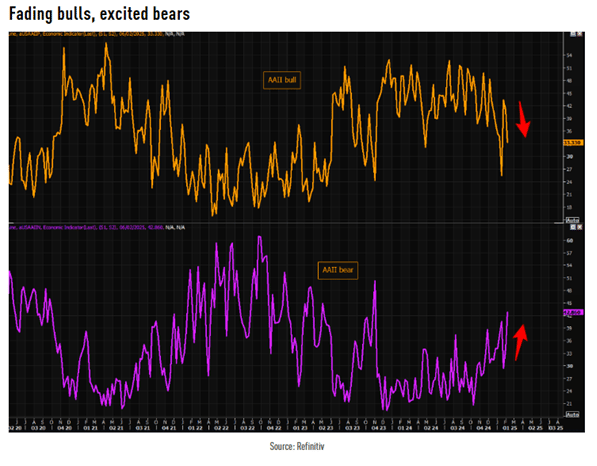

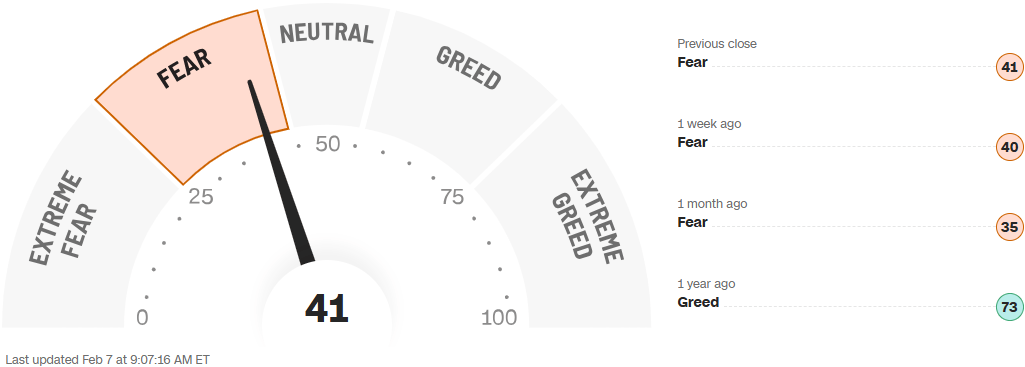

Sentiment mixed https://tinyurl.com/3fx7xxn9 [tinyurl.com]

While the Mag7 have had their issues, we still see leadership in the banks

The KBW Bank Index is at its highest since February 2022 https://tinyurl.com/ycxe9kep [tinyurl.com]

Strong dollar impacting and capacity issues similar to MSFT which leads AMZN to increase capex to over $100B

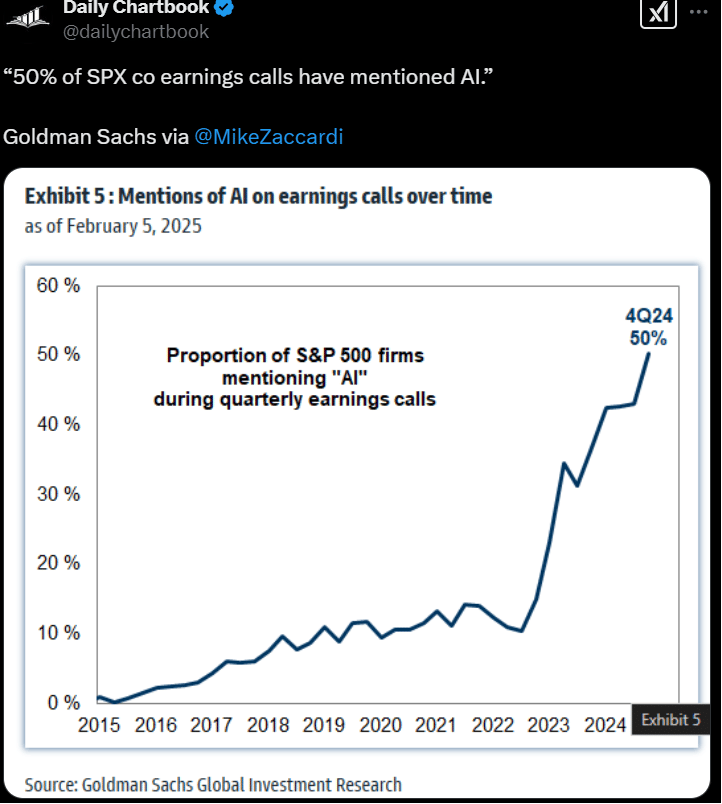

Yesterday we saw a move higher in the AI & datacenter world

Meanwhile some real blow ups today include BILL, DOCS, ELF, SKX down really hard

Over 2/3rds of the stocks in the S&P500 are positive for the year, while half of the S&P components are outperforming the index https://tinyurl.com/ymb4ut3r [tinyurl.com]

Goldbugs will love this https://tinyurl.com/2u42t7zr [tinyurl.com]

Superbowl ahead, market wants Kansas City https://tinyurl.com/23y36vf2 [tinyurl.com]

Futures

DOW +45

S&P +3

Nasdaq +5

CNN Fear/Greed Index

10-Year Yield

Oil

BITCOIN

Financials / Retail / Healthcare

BILL – Down 33% - Back office processor with great growth and a high valuation stopped growing and crushed shareholder.

AFRM - delivered a strong Q2 2025 performance, marked by accelerating customer growth, robust RLTC margins, and strategic initiatives like the UK market expansion and 0% APR offerings.

Net Exposure to Banks has risen to a 12m high per JPM. Most bought the package with BKX or the big capital markets players like BAC, JPM, WFC, GS and MS.

LA Fires – Bloomberg is out pointing out that Citi National has the most exposure to jumbo loans in the LA fire area with FRC (now JPM) right behind.

NKE – Baird Management conversations were net positive on product, marketing and marketplace fit.

HBAN – Investor Day implied 2027 Estimates 3-5% higher than the street.

Fed’s Logan – “prepared to keep rates on hold for “quite some time”.

P/E – Trump out saying he may end the carried interest loophole.

PINS: +22% much better than feared / crowded short on big Q1 guide down .... Solid Q4 (inline revs/better MAUs + better EBITDA); Q1 guide MUCH better than feared. Q1 Guide: Revs+13-15% vs buyside 12-13%; expect Q1 EBITDA $155-1700m (est $142m) ... y/o/y comps will ease after 1Q — “which means the company could accelerate if the pipeline plays out. Ad innovations like Direct Links, Performance Plus are creating platforms for long-term growth

Crypto: Gemini crypto exchange by Winklevoss twins weighing IPO this year (Bloomberg)

Shein set to cut its valuation in a potential London listing to around $50B – Reuters

EXPE: +8% strong Q4 - Room Nights +12% vs St +9% & GBs +13% vs guide 6-8%, EBITDA $643m vs St $571m .... may be conservatism baked in for 2025 from the new CF

ELF - Stock fell over 20% in extended trading after announcing a disappointing outlook on annual sales and profit projections.

WYNN – secures financing for resort project in the United Arab Emirates

NVO – Eyes 2025 regulatory filing for Hemophilia candidate after encouraging pediatric study data

Technology

AI: Amazon remains very bullish on AI – “AI represents for sure the biggest opportunity since cloud, and probably the biggest technology shift and opportunity since the Internet”

AMZN: -3.2% positioning cleaned up A LOT post Azure/GCP (bogeys tempered in sympathY) ... Q4 topline slightly light of bogeys (inline with street) while Op Inc Beats handedly; Q1 top line guide misses street and bogeys; Q1 Op Inc roughly inline with street/bogeys ... Capex: $26B - above $4B ahead of St. for the quarter ... said AWS growth remains constrained by capacity, although the company sees this easing in the second half of 2025 (meaning capacity will be in place by then to support growth)

AMZN/MRVL: says Nvidia will remain a key partner, but they are VERY BULLISH on their own proprietary Trainium chip. “Most AI compute has been driven by NVIDIA chips, and we obviously have a deep partnership with NVIDIA and will for as long as we can see into the future. However, customers want better price performance, and it's why we built our own custom AI silicon. Tranium 2 just launched at our AWS Reinvent Conference in December, and EC2 instances with these chips are typically 30% to 40% more price performance than other current GPU powered instances available”

FTNT: +10% extending breakout - strong Q4 driven by product revs - billings above at 7.5% vs street at 6%. Forward billings guide inline to slightly lower but will be seen as conservative given the beat. Rev guide looks v healthy for the year

MCHP: -3.5% confirms what we know, non-AI demand remains terrible and recovery choppy, L-shaped at best. Sees Q3 top/bottom line below ... inventory levels reached 266 days ... "While we have seen substantial inventory destocking at our customers and channel partners, we believe the correction cycle is still not completed"

NET – Traded +12% after hours on a beat… Trades at 23.6x EV/revs… seeing significant growth in large customer cohorts. Record number of new large customers added…. Guided down Q125 and FY25 vs the street. Obviously viewed as “conservative”….

OpenAI: is close to selecting additional locations for Stargate data centers (Bloomberg)

META: winning streak @ 14

QLYS: -7% FY EPS outlook below; rev view inline. Higher investments to weigh on margins

TTWO: +9% GTA 6 coming in the fall ... all the matters - lack of 2nd trailer / update had spooked quite a bit of ppl. Green light to regross long TTWO/ss EA pair ... Surprise breakout success of NBA 2K, which saw growth reaccelerate to levels not seen since 4Q21. Ovearll, a stark contrast to otherwise disappointing video game publisher earnings this quarter

Industrials

Air Products (APD) downgraded to neutral from overweight at JPMorgan

Aptiv Plc (APTV) upgraded to buy from hold at Deutsche Bank

Beacon Roofing Supply (BECN) downgraded to hold from buy at Stifel

FMC Corp (FMC) downgraded to neutral from buy at UBS

Honeywell International (HON) upgraded to buy from hold at Deutsche Bank

TransDigm Group (TDG) upgraded to overweight from equal weight at Wells Fargo

XPO, Inc. (XPO) upgraded to positive from neutral at Susquehanna