- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Morning Note

presented by - |  |

Invest with us here: https://www.river1.us/invest.php

Trading Observations

Futures down slightly, no dip buying yet, institutions derisking it seems

Individual investors may not be able to buy the dip with these crypto downdrafts

Yday’s retail favorites hit hard https://tinyurl.com/ykrzkfc8 [tinyurl.com]

6752 is next support level where we gapped up Oct 24th

You know the Gov shutdown really starting to hurt when people are calling for re-opening as a positive catalyst for the market

The K economy in full mode with Staples weak

AMD, ANET and SMCI turned the futures lower last night, but the AI trade is still relatively strong

The amount of bond deals is amazing https://tinyurl.com/nhhvkawy [tinyurl.com]

Japanese and Korean markets closed down 2.5% having been down 5%... Maybe that's a good sign

To break the bull market they’ll have to break NVDA and AAPL https://tinyurl.com/3342xss9 [tinyurl.com]

Futures

DOW +68

S&P +2

Nasdaq -4

Charts/Sentiment

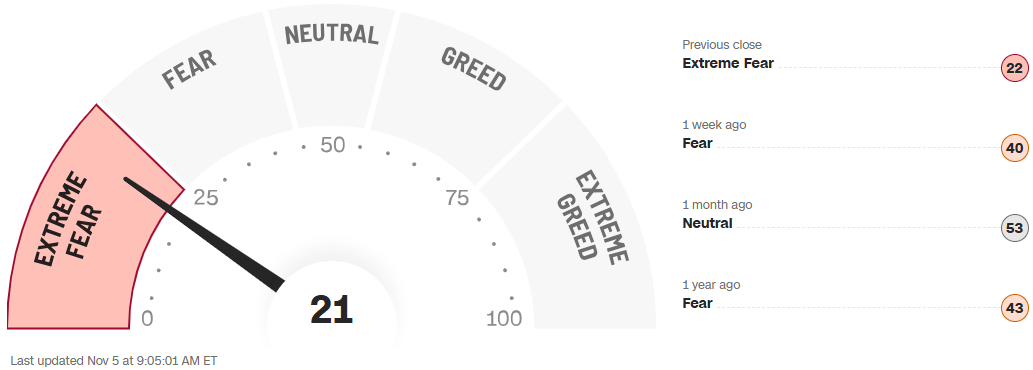

CNN Fear/Greed Index | U.S. 10 Year Treasury |

Gold | Bitcoin |

Financials / Consumer / Healthcare

UPST: -14% weaker rev guide / momentum; full-year outlook was lowered, likely a result of 3Q growth being lower than anticipated .... lower volumes but better profitability

BAC - Bank of America Corp. shares nudged about 1% lower premarket after the bank laid out a slew of new financial targets in its investor day presentation. It forecast that earnings per share will rise at least 12% annually over the next several years.

Clover Health (CLOV) shares sink 20% after the health insurer cut its adjusted Ebitda guidance for the full year, following third-quarter adjusted Ebitda results that fell short of expectations.

Humana (HUM) shares fall 4.6% after the health insurer reaffirmed its forecast for medical costs for the full year, with the outlook below the average analyst estimate.

MCD – Reversed and is higher after conference call. MCDONALD'S TARGETING 15% MINIMUM DISCOUNT FOR VALUE MENU

Technology

AI CHIPS (NVDA AMD): China bans the use of foreign AI chips in any data centers that receive state funds (Reuters)

ALAB: -4% margin concerns weighing / lofty expectations. continues to gain traction into larger and higher average sales prices scale-up connectivity markets across a broadening range of hyperscale customers

AMD: -5% not enough upside / slowing QoQ growth in its AI business. GMs inline/oper margins missed. 4Q Revs guided $2.3-2.4bn (up ~21% y/y at midpt) vs cons $2.33bn (+21% y/y) .. GMs guided 62-63% vs cons 63.2%

ANET: -12% not enough. 3Q revs decel ~3pts to ~27.5% y/y with 4Q Revs guided to low-20s y/ and GMs slightly below at midpt. Lackluster when viewed in the context of much stronger growth and upside exhibited by hardware suppliers levered to AI spending from hyperscalers

CRWD/CRWV: CROWDSTRIKE, COREWEAVE ENTER GLOBAL AI CLOUD PARTNERSHIP

GOOGL/AAPL: it looks like Apple will rely on Google’s Gemini AI technology to enhance the next-gen version of Siri (Digitimes)

GOOGL: reached a settlement w/Epic Games over how the internet giant’s app store deals with distribution and monetization (Bloomberg)

MTCH: -1.4% weaker-than-expected fourth-quarter revenue outlook and warned that product testing at its largest dating app, Tinder, will come at the expense of short-term gains ... dating apps both shorted/UW .. Co said it expects to generate savings in Q4 + 2026 as more of its apps adopt web payments and save on Apple's mobile payment fees

MU/Memory: MICRON apparently redesigning its HBM4 chip after facing yield and performance issues; could cede shr to Samsung/Hynix (Digitimes);

NVDA chain: supplier Hon Hai Precision Industry reports 11.3% revenue increase in October amid strong AI demand

PINS: -18% staying in penalty box. Hit on weaker rev outlook (guided Q4 revenue below the St at a range of 14-16% vs buyside @ 16%). Q3 Inline but Q4 revs and EBITDA lighter despite low expectations into the print ... fears: explosion of chatbot capabilities is meaningfully likely to move directly into Pinterest's space in coming years

QLYS shares are up 9.7% after the software company reported third-quarter results that beat expectations and raised its full-year forecast, prompting Piper Sandler to upgrade the stock.

SMCI: -9% margins poor; earnings/profit missed reduced expectations .... Co struggling with margins as it spends to win new customers and faces pressure to price its products lower to win AI server deals over rivals, with Chief Executive Officer Charles Liang saying "competition remains intense

TOST: +3.5% strong qrtr / raised outlook - recurring gross profit and adjusted Ebitda both especially strong. FY: Sees adj Ebitda $610M to $620M (prior $565M - $585M; est $589.6M)

U/Unity: +7% solid Q3 revs beat, adj EBTIDA ahead by 15%. Grow Solutions Rev $318M, est $302.1M. "In Create, we expect high-single digit year-over-year revenue growth"

Industrials

KTOS shares drop 8.0% in premarket trading after the defense contractor forecast revenue and adjusted Ebitda for the fourth quarter that missed the average analyst estimate. Bloomberg Intelligence wrote that the results “brought sentiment back to Earth.”

American Water (AWK) upgraded to hold at Jefferies

Archer-Daniels-Midland (ADM) downgraded to underweight at JP Morgan

Boise Cascade (BCC) upgraded to outperform from market perform at BMO Capital Markets

Kirby Corp (KEX) upgraded to buy from neutral at Citi

Lindsay Corporation (LNN) announces new $150M share repurchase program

Mosaic (MOS) upgraded to outperform at RBC

Trex Co. (TREX) downgraded at William Blair, Barclays, BofA, Vertical Research and Deutsche Bank

UL Solutions (ULS) downgraded to neutral from overweight at JPMorgan

Emerson Electric (EMR) shares are down 7.4% after the automation technology provider forecast adjusted earnings per share for 2026 of $6.35 to $6.55, a range with a midpoint below what analysts expected.

SolarEdge (SEDG) shares tumble 7.7% after the solar energy company forecasted revenue for the fourth quarter that fell short of the average analyst estimate.