- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Morning Note

presented by - |  |

Invest with us here: https://www.river1.us/invest.php

Trading Observations

Last day of qtr so may see some rebalance movement late

Govt shutdown seems likely, though apart from delayed econ data, irrelevant from a market perspective

JOLTS after the open and ADP pre-mkt tomorrow may be the only jobs data we get this week

Private sector job cuts remain steady https://tinyurl.com/yjd5btf4 [tinyurl.com]

Buyback window closing for the next 3 weeks, so if we are going to pullback, this would seemingly be the window

6700 resistance vs. 6650 (minor) and 6570 support

The question is are we in recessionary environment or not as Fed cuts https://tinyurl.com/k7jrjf9s [tinyurl.com]

Is tech about to go parabolic? https://tinyurl.com/u4hh7bxu [tinyurl.com]

Futures

DOW -66

S&P -7

Nasdaq -10

Charts/Sentiment

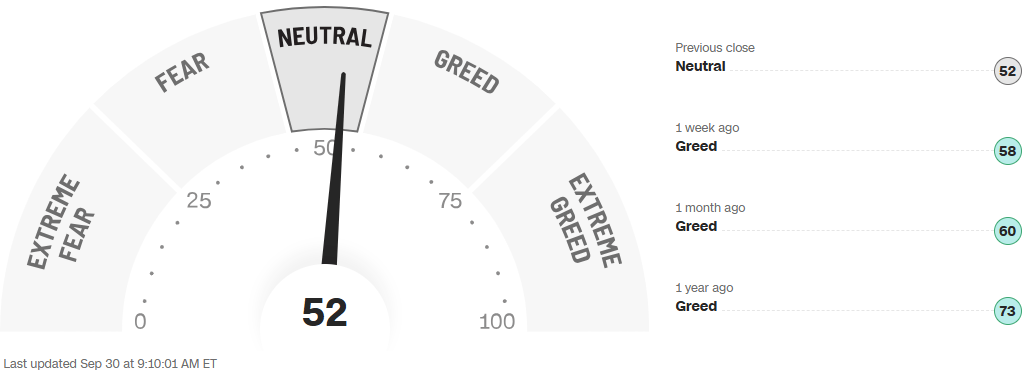

CNN Fear/Greed Index | U.S. 10 Year Treasury |

Gold | Bitcoin |

Financials / Consumer / Healthcare

Tariffs (W, WSM, RH) - Trump said the tariff on upholstered furniture will start at 25% and rise to 30% on Jan 1, with kitchen cabinets/bathroom vanities starting at 25% before rising to 50% (although imports from the EU and Japan will be capped at 15%, with the UK ceiling 10%) (NYT)

PEP - is being closely watched as the food and beverage giant considers new strategies, with activist investor Elliott Management calling for strategic changes such as refranchising to improve bottling inefficiencies, similar to what KO did…

V/Visa - to launch a stablecoin pilot through Visa Direct for cross-border payment

Novo Nordisk - requires some employees to accept demotions to keep jobs amid layoffs in weight-loss market - Bloomey

CELH - rise 4.2 in premarket trading after Morgan Stanley upgraded the energy drink maker to overweight from equal-weight, citing topline growth ahead.

Technology

OpenAI - CASH BURN, OpenAI generated ~$4.3B in rev in 1H 2025, ~16% more than it generated all of last year. The Co said it burned $2.5B, in large part due to its R&D costs for developing AI and for running ChatGPT. Some of its largest expenses were non-cash, incl stock payments to employees. Given the company was recently generating >$1B in revenue per month, it looks on track to meet its FY rev projection of $13B and $8.5B of cash burn

Memory/Storage - re-rating contd with SNDK+16%, WDC+9%, STX+5% ... inbounds more focused on magnitudes of moves being seen here. Have to think element of those who have missed/UW simply forced to chase at this pt to show being involved ... Definitely bullish for both memory/storage bull thesis: "OpenAI is preparing to launch a stand-alone app for its video generation AI model Sora 2"

CART: --2.5% catching downgrade @ BTIG - citing "ongoing negative competitive developments; notes that Instacart partners representing an estimated 25%-plus of Gross Order Volume have signed deals with Amazon, Doordash or Uber in the last two weeks

CRWV - +4% Evercore init outperform - CoreWeave Inks $14 Billion Meta Deal in Latest Sign of AI Demand Co is uniquely positioned to be the “Infrastructure-as-a-Service” provider; higher probability CRWV is able to sustain and scale their differentiation from training to inferencing as they benefit from running an “at scale AI-as-a service” for customers beyond the current cohort”. Co would not just provide for “AI-centric customers, but also for enterprises looking to build/run/deploy AI appls”

FLY - drops 13% premarket after a failed test of its Alpha Flight 7 rocket in Texas that ended in an explosion.

GOOGL - Google is rolling out visual seach in AI mode starting Tuesday, according to a statement.

PATH - UiPath collaborates with Nvidia to help enterprise customers strengthen their existing automated workflows with AI capabilities in sensitive cases, such as fraud detection or care management in healthcare.

ETSY - +16% post OpenAI headlines; narrative shift despite some uncertainty + comes post some improving 3P data (enough to create angst amongst the shorts)

META - underperformed the NDX on 8 of 9 days

NVDA - Citi positive - incrementally positive on Nvidia's product ramp and competitive positioning post Rubin CPX launch following a meeting with mgmt. Believes the GTC Washington event starting on Oct 27-29 could serve as a positive catalyst; cites higher AI Infrastructure forecasts for the target bump .. KeyBanc positive as well

SMTC - rise 2.9% in premarket trading after Oppenheimer raised the stock to outperform from market perform, saying the semiconductor firm’s active copper cable offerings can win market share among hyperscalers and drive sales growth.

SATS - rises 7.5% as Verizon Communications is said to be in discussions with the company about purchasing some of its wireless spectrum.

Industrials

Oklo Inc. shares (OKLO) fall 2.7% in premarket trading, while NuScale Power Corp. shares (SMR) drop 3.7% after Bank of America downgraded the nuclear companies as analyst Dimple Gosai sees the current valuations as unrealistic at this stage of small modular reactor development and sees near-term risk-reward as negative.

OKLO - NRC PDC REPORT ACCEPTED FOR REVIEW ON ACCELERATED TIMELINE

CWS - resumed buy at Stifel; $113 PT

DAR - to sell ~$125M in production tax credits to a corporate buyer

DORM - initiated overweight at Stephens; $185 PT

NXT - initiated buy at Deutsche Bank; $88 PT

RSG - resumed buy at Stifel; $257 PT

TDG - initiated outperform at BMO Capital Markets; $1,420 PT

WCN - resumed buy at Stifel; $221 PT

WM - resumed buy at Stifel; $252 PT