- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Morning Note

presented by - |  |

Invest with us here: https://www.river1.us/invest.php

Trading Observations

Market getting a bounce as TSM higher on strong guidance (including AI) lifting semis and helping tech

Initial Jobless Claims were 198k vs estimates of 215k.

Healthcare M&A: BSX buying PEN

Oil continues to fall as US backing away from strikes for the time being

Trump saying no plans to fire Powell

Notable that despite the weakness, up volume was almost 2/1 positive and Adv/Decl was almost 2/1 as well https://tinyurl.com/hmjse2af [tinyurl.com]

Tech bore the brunt of the selling, TSM fueling snap back today

Closed near 6920 support, 7000 resistance

Oscillators starting to push into overbought, AAII Bulls up to 49.5%, highest since Nov 2024

For the bulls, earnings slope supportive https://tinyurl.com/5bepxm2s [tinyurl.com

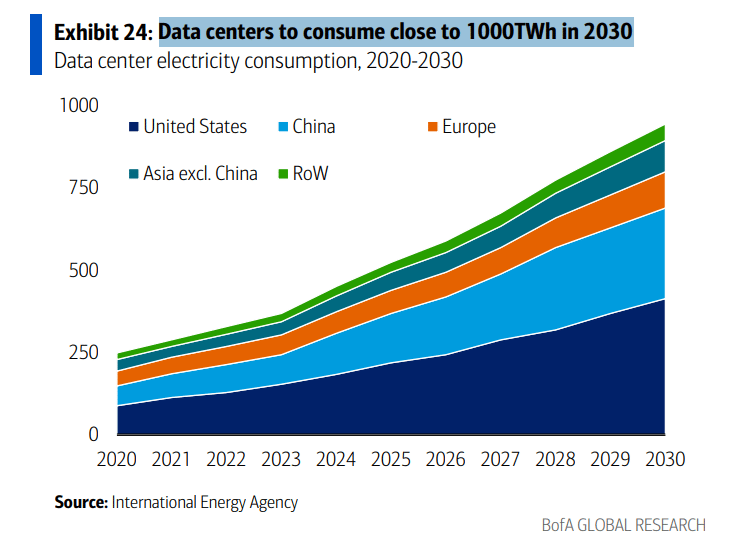

Capex boom starting https://tinyurl.com/3t9phssm [tinyurl.com]

AI sales ramping https://tinyurl.com/ysp27cem [tinyurl.com]

Hyperscalers spending continuing apace https://tinyurl.com/d3m6fhmy [tinyurl.com]

Silver... most $ ever traded in a day https://tinyurl.com/4vhc88sj [tinyurl.com]

Trump envoy says US and Greenland likely to reach some kind of beneficial agreement – Bloomey

Futures

DOW -11

S&P +35

Nasdaq +285

Financials / Consumer / Healthcare

GS – Down 2% - Quarter was great across the board, but trading was a driver (less helpful). We think 2.9x Book is just a hair expensive.

MS – Flat to down small – Small beats across the board except I Banking was solid. Similar expensive multiple to GS.

HLT – Adds $3.5B to its stock repurchase plan.

Baird Restaurant Survey Work – Softer industry comps in December due to weather with a limp to finish don’t look great. Jan and future comps likely saved by tax refunds.

GS Self Storage REIT checks look like growth of flat for 2026. Yawn unless housing turnover steps up.

BLK – Still printing money. Operating income was +22% y/y and a 3% beat. AUM is $14T, with a T.

ACI – Albertson’s downgraded at MS on competition.

M&A News

KDP – Said to launch an all cash $18B takeover for JDE Peet’s.

BSX, PEN – VSX to pay $14B for PEN, stock up 13%

OCUL – Up 17% on a higher bid from Sanofi.

SHCO – Soho House up 12% on $200MM funding commitment.

Bilt unveils new credit cards with interest capped at 10% after Trump threat, though rate to jump to ~35% in one year – Bloomey

SPOT increases premium subs price to $12.99/month from $11.99 – Bloomey

Keurig Dr Pepper launches $18B all-cash bid to acquire JDE Peet's, creating major global coffee rival – Reuters

IBRX (RVER name) - ImmunityBio Reports Continued Execution and Sales Momentum With $113 Million of Preliminary Net Product Revenue—a 700% increase year-over-year

Technology

CHIP STOCKS -- TSM up big following its beat, long-term guidance raise, higher capex outlook and upbeat AI commentary. The 2026 capex budget is significantly above the consensus at $52-56B (vs. the Street $46B), and mgmt. on the call talked about the need to continue spending heavily in the coming years. Mgmt. was asked on the call about whether AI is in an unsustainable bubble, and they refuted those fears, noting that they’ve spent a lot of time verifying that the demand is very real, and coming from financially healthy companies. • Positive for NVDA (#2 customer) and all equipment stocks with CAPEX spend.

AVGO, LRCX, ADI – Upgraded at WF

AMAT higher on Barclays upgrade; TSMC capex boost

ASML shares hit record, market value tops $500B after stronger-than-expected TSMC outlook – Bloomey

GOOGL – a few days after Anthropic stunned the software industry with its Claude Cowork, Google on Wed announced a series of personalization enhancements for Gemini, allowing users to connect other Google apps (like Gmail, Photos, Search, YouTube, etc.) into the model to enhance its utility

KLAC – Upgraded to Overweight at MS on memory exposure

ORCL was hit with a lawsuit by certain bondholders who are angry over the company’s elevated AI spending – Reuters

SNDK rises 4.1% after its price target was raised to $450 from $260 at Benchmark Co., which writes that even though the stock has soared, “the story continues to be compelling for several reasons.”

Industrials

FAST – Baird Adding Bullish Fresh Pick designation following strong Fastener survey data. Yesterday, we moved FAST to the top of our stack-ranking of Industrial Distributors.

BA named top 2026 A&D pick at Berstein

Parsons (PSN) Acquires Altamira Technologies Corporation for $330M cash plus potential $45M cash earn out

Silgan (SLGN) Cut to Sector Perform at RBC; PT $43

XPO, Inc (XPO) named short-term buy idea at Deutsche Bank

Latest Media

River1’s CIO on Schwab Network

Levered ETFs, market perspectives, etc.