- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Morning Note

presented by - |  |

Invest with us here: https://www.river1.us/invest.php

Calendar

This Week – Zero earnings in the S&P. Almost Zero economic Data, this only leaves positive Christmas vibes against a potentially snuck in negative news story

Tuesday – GDP Second Release, Core PCE, Durable Goods, Industrial Production

Wednesday – Friday – No Economic Releases

Trading Observations

The march to Xmas and New Years in on!

US 3Q GDP RISES ANNUALIZED 4.3% Q/Q; EST. +3.3%

Durable goods orders fell 2.2% m/m vs median est. -1.5%, US Census Bureau data show.

Nice rally ahead of Santa window, CLOSED above 6860 "should" negate any negative surprises into year end

6900 resistance, can we make a push to 7000 on a string?

Given markets thin, technicals not as relevant

Not sure much interest in anything other than buying gifts, but anyway... metals very stretched with DSIs of Platinum 88, Paldadium 88, Gold 83, and Silver 84... might be due a bit of a cool

NVO higher on FDA approval for oral GLP-1 (RVER Position)

Santa Claus rally/positive seasonality into year-end, key upside catalysts in 2026 (including OBBA, tax refunds, potential stimulus), ongoing expectations for double-digit earnings growth, M&A tailwinds, cleaner positioning, and vol compression (VIX hit YTD low Monday).

Futures

DOW -89

S&P -12

Nasdaq -60

Charts/Sentiment

CNN Fear/Greed Index | U.S. 10 Year Treasury |

Gold | Bitcoin |

Financials / Consumer / Healthcare

Gold, silver and copper mining and royalty stocks (AEM +1.6%, CDE +2.7%, FCX +1.4%) rose as the metals continued to hit record highs amid rising geopolitical tensions.

NVO - received FDA approval for oral version of its GLP-1, Wegovy.

V – Saying holiday spending up 4.2% higher than last year.

Technology

Investors flock to Chinese AI stocks, chasing next big winner amid bubble concerns and Beijing's tech push – Reuters

Meta Platforms Inc (META) – Baird Lower PT to $815/$820 as we review the current bull vs. Bear battleground, we acknowledge further NT risks to sentiment but believe embedded expectations are in better balance vs. three months ago, and encourage investors to be opportunistic buyers

ByteDance acquiring Nvidia H200 chips as part of $23B AI capex expansion.

Google (Yesterday) acquires energy generation and data center infrastructure firm Intersect https://www.techradar.com/pro/alphabet-secures-usd4-75-billion-intersect-deal-to-make-sure-its-data-centers-have-enough-energy [techradar.com]

NOW - ServiceNow to buy ARMIS for about $7.75b in cash.

ServiceNow expects to fund the transaction through a combination of cash on hand and debt

The transaction is expected to close in the second half of 2026

Industrials

Shares of space companies (FLY -5.2%, LUNR -7.9%, RKLB -6.3%) are lower after a three-day rally.

Trump to meet executives from defense contractors, aims to prod them to curb buybacks and invest more in weapons – Bloomey

Sable Offshore Corp. shares (SOC) rise 18% after the company said that the US Department of Transportation Pipeline and Hazardous Materials Safety Administration approved the firm’s Las Flores pipeline restart plan.

RTX - RTX’s Raytheon business secured a $1.7 billion contract to deliver four Patriot air and missile defense systems to Spain, marking the country’s largest-ever Patriot order

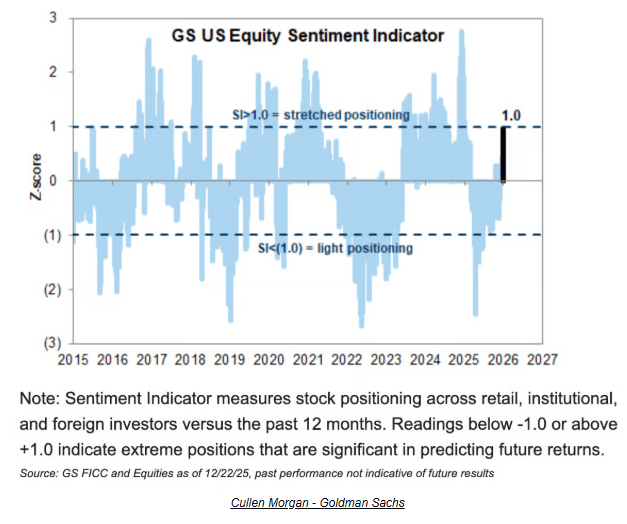

Goldman's US equity sentiment indicator—measures stock positioning across retail, institutional, and foreign investors vs. past 12 months—jumped to its highest level of the year. It has not been in "stretched" territory since Dec'24.

Latest Media

River1’s CIO on Schwab Network

Levered ETFs, market perspectives, etc.