- River1 Morning Note

- Posts

- Market Snapshot

Market Snapshot

Morning Note

presented by - |  |

Invest with us (30sec to become shareholder): https://www.river1.us/invest.php

Calendar

Friday – 6 Fed Speakers.

Trading Observations

Trump just said "80% Tariffs on China seems right" and thus futures dip...

It's just Strategic Uncertainty as Bessent says

There is still is some need to position positively for talks with China in Geneva this weekend

When Trump says buy... well we should buy, right?

Seems tariffs under 60% and Rare Earth Relief is on the docket

It's been some move, S&P 500 up 14% last 21 days (1 month)

Nasdaq Comp $COMPQ up 17.4% last 21 trading days, is tariff relief priced in???

QQQ actually broke through the 200-day for a moment yday

MCHP, NET, TTD, PINS, and LYFT up big overnight helps the picture this morning for further gains in Tech

That said, we still have pretty strong resistance at the 200-day 5750 for S&P https://tinyurl.com/ycyffcbv [tinyurl.com]

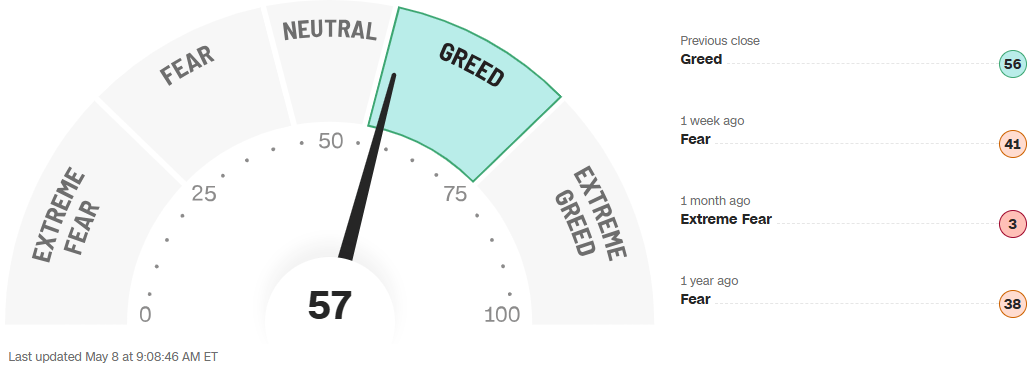

Animal Spirits rose yday, speculative themes like Quantum ripping https://tinyurl.com/yc8ekve9 [tinyurl.com]

Lyft says Q1 was strongest ever, similar UBER this week, both companies not seeing any signs of weakness in consumer demand.... Sure doesn't sound like a recession

Could we get Chinese ships moving immediately? They are moving already but just not to the US https://tinyurl.com/32upbcza [tinyurl.com]

Futures

DOW +135

S&P +24

Nasdaq +101

Charts/Sentiment

CNN Fear/Greed Index | U.S. 10 Year Treasury |

ICE Brent Crude | Bitcoin |

Financials / Retail / Healthcare

EXPE – Down 10% on US Travel demand diminishing. There are many signs the low to mid consumer needs to pull back or is, but our tech heavy stock market is only seeing this if consumer exposure to the low end is an important part of business.

AFRM – So much for risk on beta financials .Stock down 7% on lower revenue for buy now, pay later. Tariffs not helpful here. No sign of credit stress, which would have been much worse.

TOST - +8% on FY EBITDA positive guide. We see these adopted everywhere lately.

MNST – Monster Beverage down 4% on a small sales miss. Competition continues to get tougher and tougher.

AMG – GS taking numbers up the next three years as liquid alts continue to grow.

DKNG: +2% modest shortfall on Q1 EBITDA/sales ($102.6MM/$1.4B vs. the Street $114MM/$1.45B) and the full-year outlook is reduced .... qualitative commentary in the shareholder letter is bullish (“DraftKings is off to a strong start in 2025 - if not for customer-friendly sport outcomes in March, we would be raising our fiscal year 2025 revenue and Adjusted EBITDA guidance”)

CarGurus (CARG) rises 9% after the online car retailer reported first-quarter results that beat expectations on key metrics and gave an outlook that is seen as positive.

SG falls 5% after the salad chain lowered its annual forecasts for same-store sales and adjusted Ebitda.

Technology

ALGM: +4.4% trends are headed in the right direction after a broad-based beat in March and stronger June quarter ... mgmt highlighted Disti inventories were down 25%, direct customers are continuing to decline, bookings are up 20%, and orders within lead time are increasing

AKAM: -2% solid EPS upside (1.70 vs. the Street 1.57) w/the beat driven largely by higher margins (op. margins were more than 200bp ahead of plan) while overall sales were about inline (although Security and Compute revenue fell a bit short while Delivery wasn’t as bad as feared) and the low-end of the prior full-year guide is tweaked higher

COIN: -3% shortfall in Q1 sales/EBITDA ... Looking into Q2, mgmt. warns about soft macro conditions (“macro uncertainty, including around global trade policy, is impacting consumer sentiment and may contribute to softer crypto trading markets and lower asset prices as we enter the second quarter”).

LYFT: +7.7% strong growth in riders and engagement ..... Q1 rides solid / boost buyback. Q1 Gross Bookings: $4.162B vs est $4.156B; Q1 Active Riders: 24.2M vs est 24.07M; Q1 Adj. EBITDA: $106.5M vs est $93M; Q2 Gross Bookings Guide: $4.41B–$4.57B vs est $4.482B; Q2 Adj. EBITDA Guide: $115M–$130M vs est $124M ... Co has been making some significant moves, evolving its story with Canada, Europe and even some new domestic suburbs entering the fray

MCHP: +8% calling bottom / exiting an inventory correction and entering a restocking cycle. Mgmt sounded pretty bullish .... decent upside in FQ4/Mar on EPS/rev; Q1 guide is positive ... "in the March 2025 quarter, we achieved our first positive book-to-bill ratio in nearly three years" (follows TXN, STM similar commentary)

MTCH: announces planned 13% workforce reduction

NET: +4% Q1 landing ahead of expectations; Q2 guide inline; reit FY25 ... highest beat in five quarters. Expanding portfolio of cloud-based security and compute offerings is helping the company gain market share; continues to launch new security products, while its Workers AI developers platform is well suited to running inference tasks at the network edge, positioning it to tap rising demand for AI infrastructure

PINS: +16% Better than feared with +16% rev growth vs bogeys of 15.5% and better EBITDA. Q2 guided slightly above street - fears going in given CPG exposure; Q2 Revs guided to $960M - $980M or +12-15% vs street at $963M; Q2 EBITDA $217 - $237M below street at $237M ... reinforce that product initiatives, partnerships, and healthy engagement are creating micro-level tailwinds that alleviate macro pressure

YELP: very strong EBITDA upside in Q1 at $85MM (vs. the Street $69MM) w/the beat driven largely by margins (EBITDA margins were >400bp ahead of plan) as sales were just a few million ahead, but the full-year guide update is mixed

GOGO soars 25% after the in-flight broadband company reaffirmed its adjusted Ebitda guidance for the full year.

Industrials

Autoliv (ALV) Raised to Outperform at BNPP Exane; PT $123

Carrier Global (CARR) Raised to Buy at Northcoast; PT $85

International Paper (IP) Cut to Underweight at Wells Fargo; PT $40

Owens Corning (OC) Raised to Outperform at Wolfe; PT $178

Packaging Corp (PKG) Cut to Equal-Weight at Wells Fargo; PT $180

Rockwell Automation (ROK) Raised to Hold at TD Cowen; PT $275